The US Dollar (USD) continues to slide, posting its worst first-semester performance in nearly forty years, according to Bloomberg data reported by SMM.

While US President Donald Trump's re-election was initially seen as a supportive factor for the Greenback, recent developments reflect a very different reality: unstable trade policy, worsening fiscal imbalances and declining foreign demand for assets denominated in US Dollars are now weighing heavily on the US currency.

Is this recent weakness a short-term blip or an indication of the end of an era for King Dollar?

A historic downturn for the US Dollar

The current sequence of a falling US Dollar is unprecedented in its scale and speed. The US Dollar Index (DXY), which measures the currency against a basket of six foreign peers, has fallen by more than 10% since the start of the year, dropping towards 97 points for the first time since February 2022. This is the worst first half-year for the DXY in decades.

US Dollar Index H1 performance. Source: FXStreet

The movement is not confined to the currency markets. It reflects a broader recomposition of global capital flows in the face of persistent political and economic uncertainty in the United States.

"The dynamics observed in the foreign exchange market are a direct reflection of a crisis of confidence in US fundamentals and the stability of its economic governance," Barry Eichengreen, professor of economics at UC Berkeley, told CNN.

The paradoxical effect of Trump's policies

Initial expectations of a strengthening US Dollar were based on two pillars of US President Donald Trump's policies: fiscal stimulus via tax cuts, and tariff barriers supposed to boost the balance of trade. But these measures have had the opposite effect.

Variable-geometry announcements on tariffs – whether imposed, suspended or extended – have increased volatility and worsened the investment climate. The uncertainties generated by US trade policy have also diminished the appeal of the US Dollar as a safe-haven asset.

"We're seeing a significant drop in the safety premium traditionally associated with Dollar-denominated assets," notes Francesco Pesole, FX strategist at ING, according to CNN.

"The Dollar's status as a safe-haven currency is now being called into question", he adds.

Reallocation of capital flows

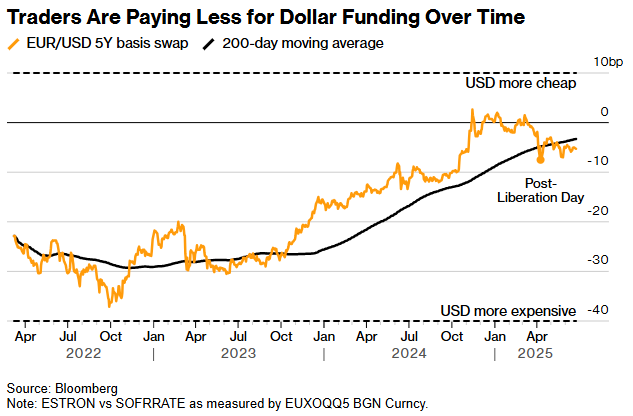

One of the most notable developments concerns cross-border capital flows. Several indicators, notably the cross-currency basis swap – a financial contract where two entities exchange an equivalent amount of principal in different currencies – point to a decline in demand for US Dollars on international markets, in favor of the Euro (EUR) and the Japanese Yen (JPY).

According to Goldman Sachs and BNP Paribas, European institutional investors, notably pension funds and insurers, have reduced their exposure to the US Dollar to historically low levels, notes SMM. At the same time, China has stepped up its sales of US Treasuries, reinforcing its strategy of reserve diversification.

"We are witnessing a systemic reallocation towards markets considered more predictable from a macroeconomic point of view. This reflects a paradigm shift in sovereign risk perception", notes Richard Chambers, Global Head at Goldman Sachs.

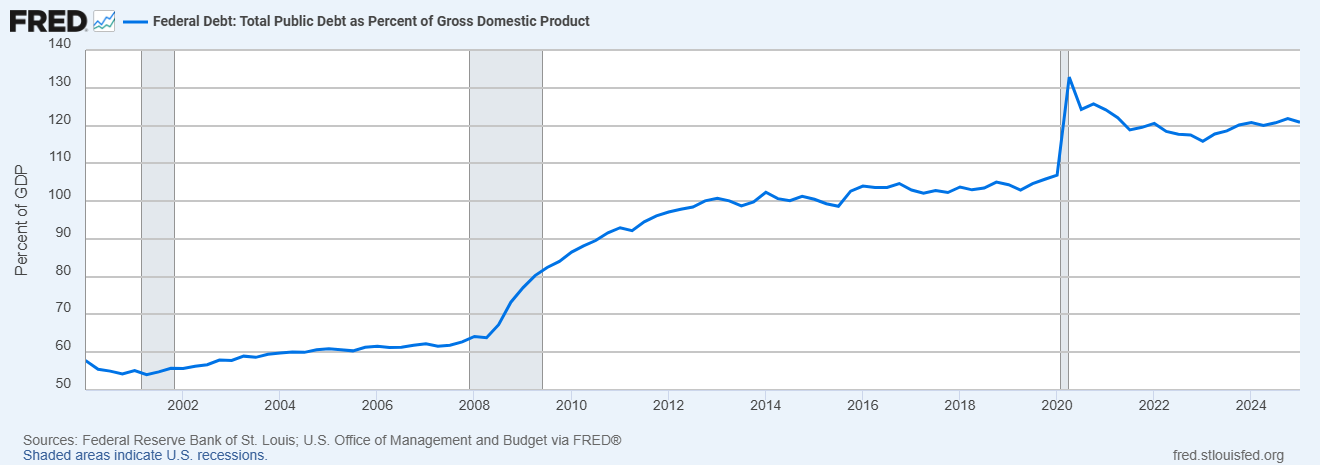

Increased vulnerability to structural imbalances

This phenomenon is amplified by concerns about the United States' fiscal trajectory. The public deficit exceeds 6.8% of GDP, and federal debt is now approaching $36,200 billion, or over 120% of GDP, according to Fed data.

Against this backdrop, Moody's downgraded the US sovereign rating to AA1 in May, citing structurally worsening deficits and rising interest costs.

Many investors are now demanding higher yields to finance US debt, mechanically increasing the cost of government and private-sector financing.

Global rebalancing accelerates

The fall in the DXY has benefited several currencies:

- The Euro has risen by 13% since January, reaching its highest level since 2021.

- The Japanese Yen, the Swedish Krona (SEK) and the Swiss Franc (CHF) also recorded significant gains over the period.

- In Asia, the Taiwanese Dollar (TWD), the Korean Won (KRW) and the Thai Baht (THB) posted gains of between 6% and 12%.

EUR, CHF, JPY and SEK performances against USD. Source: FXStreet

These movements reflect a change in perception regarding the relative economic stability of regional blocs, but also a heightened anticipation of future currency divergences.

What can we expect for the second half of the year?

The decline in the US Dollar during the first half of the year came despite the Federal Reserve’s decisions to keep interest rates high. But it doesn’t look like this will last much more: The Fed could make up to three rate cuts between now and the end of the year, according to market expectations, while the inflation, measured by the PCE index (2.3% in May), is closer to the Fed’s target of 2%.

If this monetary easing is not offset by credible deficit reduction or trade stabilization policies, the US Dollar could continue to depreciate in an orderly but sustained fashion.

According to Arun Sai, multi-asset strategist at Pictet AM, "Current conditions argue in favor of a further weakening of the US Dollar, barring a major overhaul of US fiscal policy", according to CNN.

A strategic turning point for the US Dollar

The US Dollar's decline in 2025 goes beyond a simple market correction. It reflects a structural repositioning of global investors and a rethinking of the fundamentals that have historically supported the central role of the Greenback.

The US currency remains dominant, but its systemic role could gradually be scaled back if the current risk factors, political instability, fiscal imbalances and loss of monetary credibility are not rapidly brought under control.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD extends the bounce, focus back to 0.7100

AUD/USD adds to Monday’s optimism and approaches the key 0.7100 barrier ahead of the opening bell in Asia. The pair’s positive performance comes as investors keep assessing the hawkish tilt from the RBA Minutes and despite humble gains in the Greenback. Next in Oz will be the Westpac Leading Index and the Wage Price Index.

EUR/USD meets initial support around 1.1800

EUR/USD remains on the back foot, although it has managed to reverse the initial strong pullback toward the 1.1800 region and regain some balance, hovering around the 1.1850 zone as the NA session draws to a close on Tuesday. Moving forward, market participants will now shift their attention to the release of the FOMC Minutes and US hard data on Wednesday.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

RBNZ set to pause interest-rate easing cycle as new Governor Breman faces firm inflation

The Reserve Bank of New Zealand remains on track to maintain the Official Cash Rate at 2.25% after concluding its first monetary policy meeting of this year on Wednesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

FedEx (FDX) outpaces stock market gains: What you should know

FedEx (FDX) ended the recent trading session at $374.72, demonstrating a +1.42% change from the preceding day's closing price. The stock outpaced the S&P 500's daily gain of 0.05%. On the other hand, the Dow registered a gain of 0.1%, and the technology-centric Nasdaq decreased by 0.22%.