Natural Gas consumption in the United States (US) will reach a new peak in 2025, according to the latest forecasts from the US Energy Information Administration (EIA). Behind this increase lies a complex dynamic that illustrates both the structural dependence of the US economy on Natural Gas and the resulting tensions on energy markets.

An icy winter boosts demand

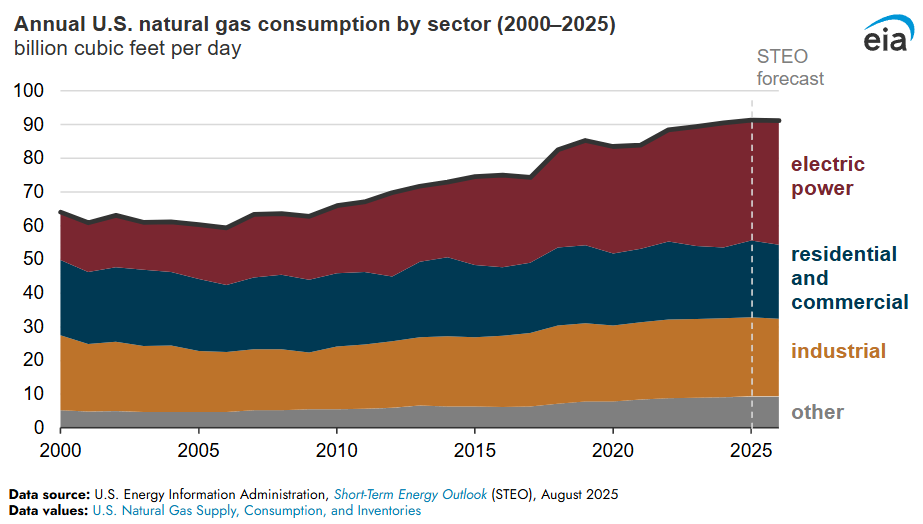

Natural Gas demand is set to rise by 1% to 91.4 billion cubic feet per day (Bcf/d) in 2025, according to the EIA.

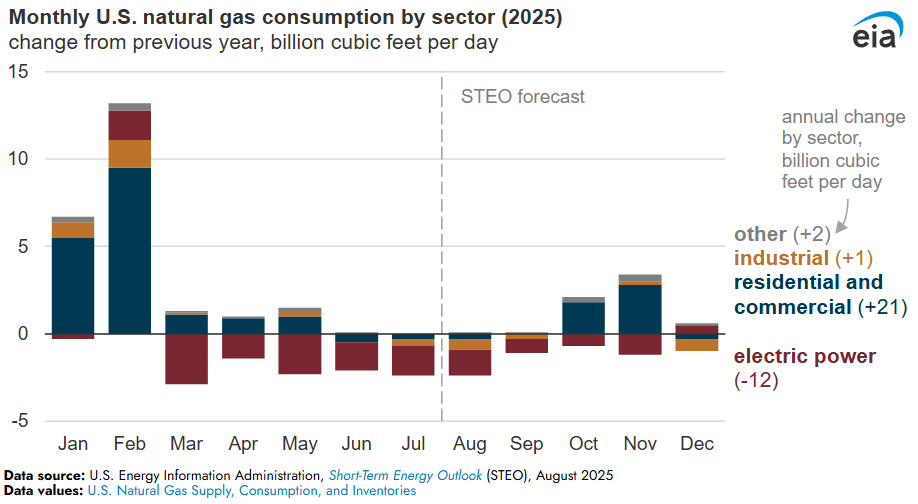

Most of the increase was due to an exceptional start to the year. In January 2025, Gas consumption reached a record 126.8 Bcf/d, 5% higher than the previous record set a year earlier. February followed the same trend, with 115.9 Bcf/d consumed.

These levels are largely explained by a particularly harsh winter marked by a polar vortex. Remember that around 45% of American households use Gas as their main source of heating. A factor that makes demand highly sensitive to weather conditions.

Changing sectors: Less electricity, more heating and industry

Unlike the previous decade, when the electricity sector drove demand, benefiting from the boom in Gas-fired power plants, 2025 marks a turning point.

The share of Gas in electricity production is declining, in favor of Coal and, above all, renewable energies (solar and wind).

On the other hand, consumption remains steady in the residential and commercial sectors, boosted by the harsh winter, and continues to grow in industry, which remains a structural driver of demand.

Natural Gas market under pressure

This rise in consumption comes against a backdrop of heightened volatility in world Gas markets.

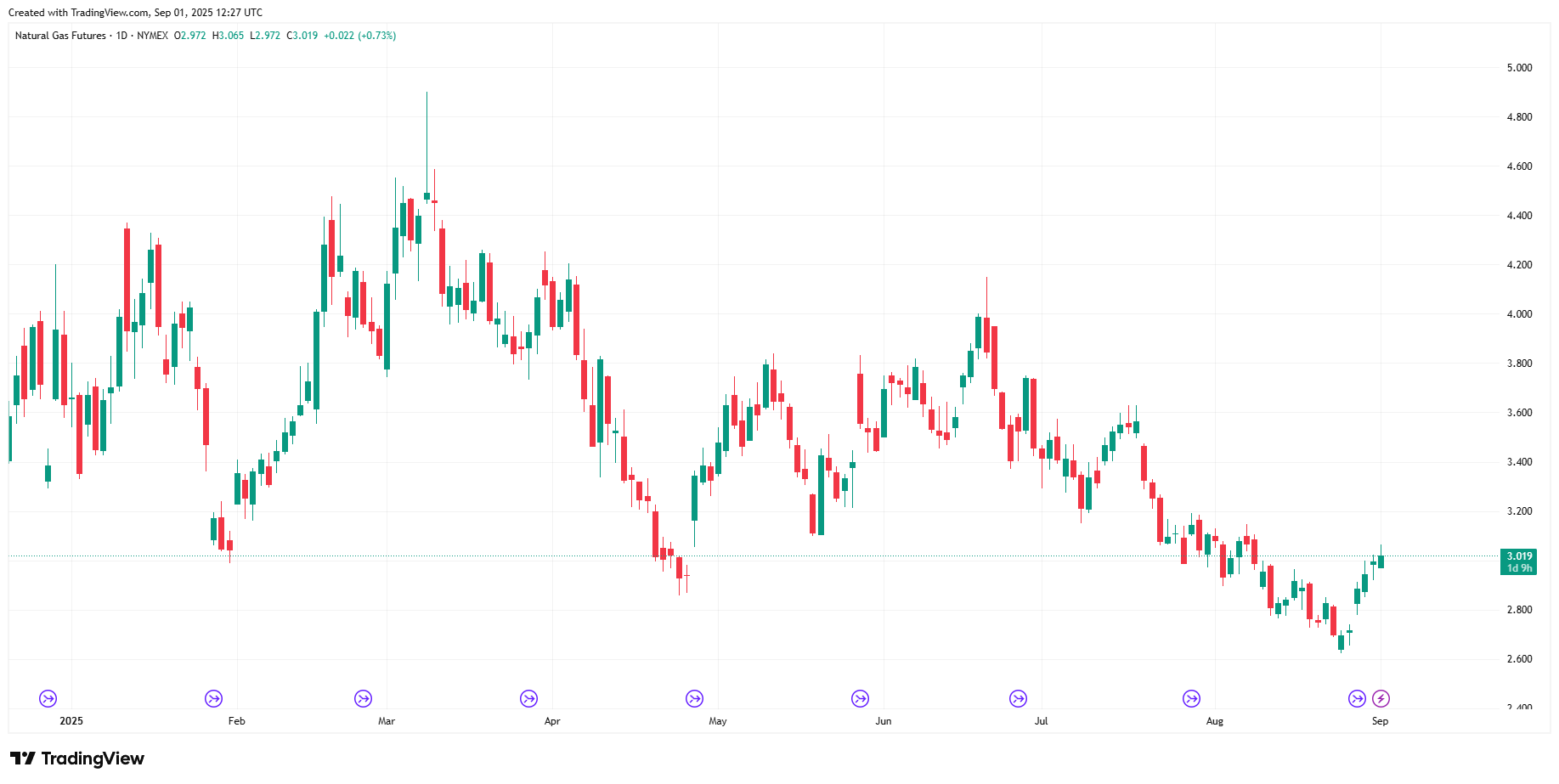

US prices, which had surged by nearly 14% in the first quarter, subsequently corrected, reflecting the precarious balance between record production and cyclical demand.

Natural Gas daily chart. Source: TradingView

Gas inventories, meanwhile, are slightly below 2024 levels, according to the EIA report, keeping investors on their toes as winter approaches.

An impact beyond US borders

The United States' position as the world's leading exporter of Liquefied Natural Gas (LNG) lends an international dimension to this rise in domestic consumption.

When US demand intensifies, the availability of cargoes for Europe and Asia can be reduced, fuelling global price volatility.

The winter of 2024-2025 illustrated this phenomenon, with increased competition between Asian and European buyers to secure deliveries.

What's next?

According to the EIA, US Natural Gas consumption is set to decline slightly in 2026, under the expected impact of milder winters and the continued rise of renewable energies.

But the underlying trend remains clear: Gas continues to play a central role in the US energy mix, for heating, industry and exports.

Ultimately, the increase in Natural Gas consumption in the United States underlines a dual reality: the resilience of this energy in the face of the energy transition and its ability to remain a pillar of the global economy, while exposing markets to volatility that is unlikely to abate anytime soon.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

Vertiv Holdings explodes higher, but can bulls break through this resistance ceiling?

Vertiv Holdings, LLC (VRT) is a provider of critical digital infrastructure and continuity solutions. The stock just delivered one of those rare trading days that gets everyone's attention. VRT rocketed 24.49% higher yesterday, closing at $248.5, so what's the technical picture telling us here?