Interest rates remain the main driver of the Forex (foreign exchange) market. More than any other factor, it is the decisions of central banks that drive currency values.

In recent weeks, investor attention has focused on Jackson Hole, where Federal Reserve (Fed) Chair Jerome Powell opened the door to a first rate cut in 2025 as early as September. A strong signal that is already shaking up the US Dollar (USD) and the major Forex pairs.

Why interest rates dictate Forex

The mechanisms are relatively simple: higher interest rates attract foreign capital, as they offer a more attractive return on Bonds and deposits denominated in the currency concerned.

Conversely, lower interest rates make the currency less attractive. In this way, interest rate differentials explain why one currency strengthens or weakens against another.

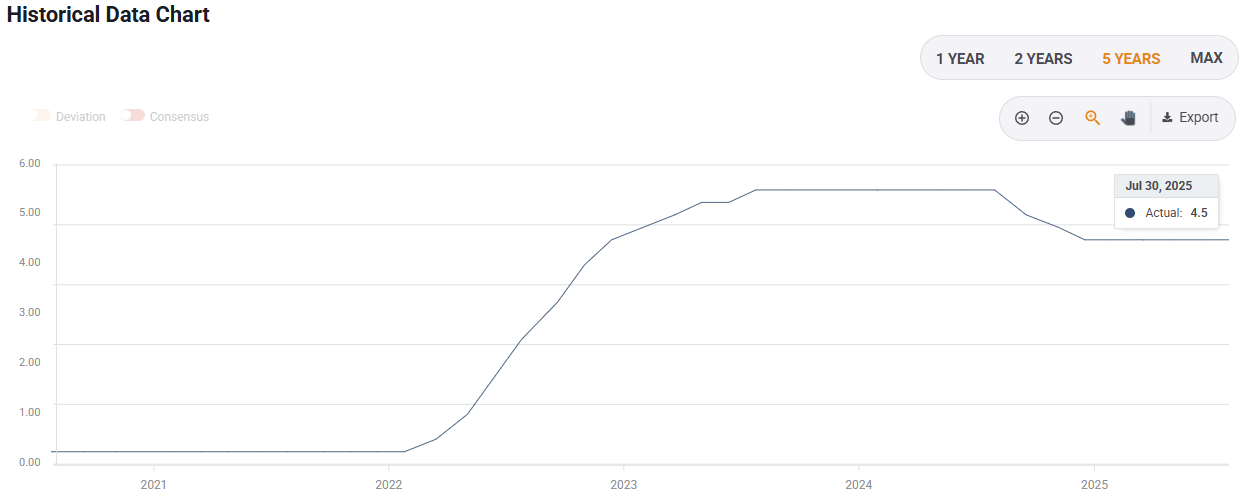

In the case of the United States, the Fed's rate hikes in 2022 and 2023 propelled the Greenback, with the US Dollar Index (DXY) even reaching a twenty-year high.

But today, the cycle is reversing: inflation is falling, growth is showing signs of fatigue, and employment, the mainstay of the US economy, is weakening.

United States Fed interest rate. Source: FXStreet

Powell prepares markets for monetary easing

In his Jackson Hole speech, Jerome Powell acknowledged that US monetary policy remained "restrictive" and that the balance of risks was now shifting towards the labor market.

He mentioned the possibility of an adjustment as early as the September 17 meeting, confirming the expectations of many traders.

Markets were quick to react. Bond yields fell, and the US Dollar retreated against the Euro (EUR) and Japanese Yen (JPY).

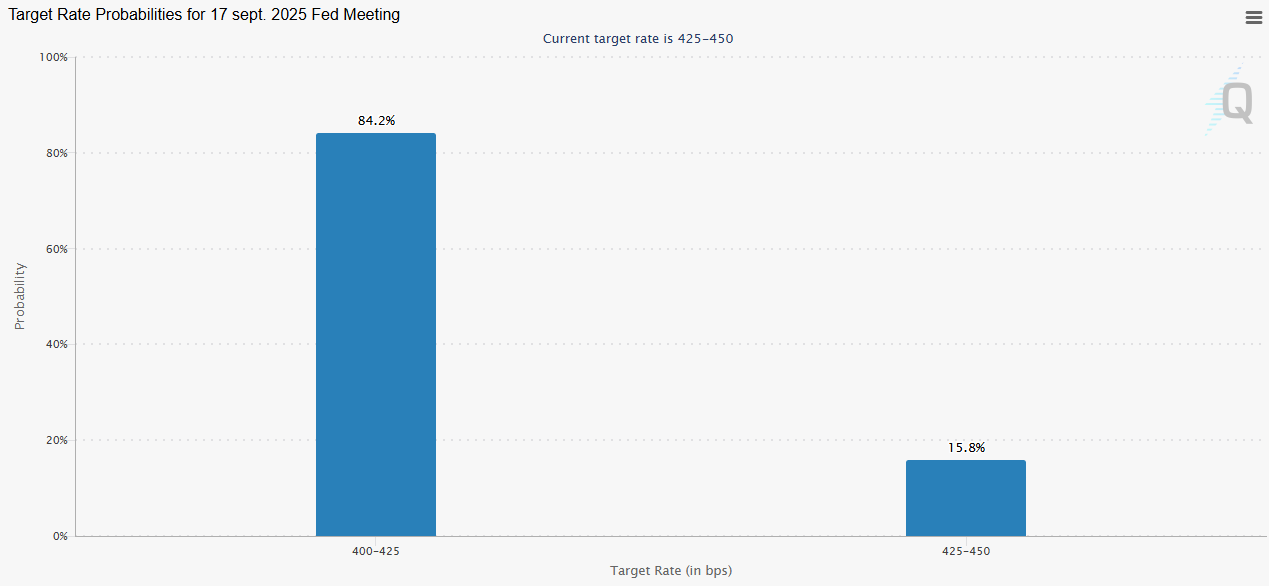

According to the CME FedWatch Tool, the probability of a 25 basis point cut in September now exceeds 84%. Investors are even anticipating two further interest rate cuts between now and the end of the year.

CME FedWatch Tool. Source: CME Group

A direct impact on the US Dollar and Forex

In practical terms, a fall in US interest rates reduces the yield differential with other currencies. If the Fed eases its policy faster than the European Central Bank (ECB) or the Bank of England (BoE), the Greenback will lose its appeal and could weaken against the Euro or the British Pound (GBP). This is what we have seen in recent weeks, with the EUR/USD back above 1.15.

EUR/USD price daily chart. Source: FXStreet.

But the future remains uncertain. If inflation were to rise again, notably as a result of the US President Donald Trump administration's tariffs, the Fed could slow down its cuts, thereby supporting the US Dollar.

Conversely, a marked weakening in the labor market would prompt Jerome Powell to accelerate easing, to the detriment of the Greenback.

The role of expectations

It's important to remember that in Forex, it's not just the decisions themselves that count, but above all, expectations.

Forex traders adjust their positions even before the Fed announces a move. Thus, a speech by Powell that is deemed "dovish" (accommodating) may immediately weaken the US Dollar, even if interest rates remain unchanged for the time being.

Conversely, a hawkish tone may strengthen the Greenback, despite a status quo decision.

A strategic turning point for traders

For market operators, this autumn could mark a turning point. The prospect of Federal Reserve rate cuts is reshuffling the deck, creating new opportunities for major pairs.

If the US Dollar weakens, emerging currencies and those of higher-rate countries, such as the Canadian Dollar (CAD) and Australian Dollar (AUD), could benefit.

Beyond the immediate news, this sequence reminds us of a fundamental truth: interest rates, by dictating global capital flows, are Forex's number-one barometer.

For any investor, following Jerome Powell's and the Federal Reserve's announcements is not an option, but a necessity.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains around 1.1800 amid renewed USD selling

EUR/USD regains positive traction and holds around 1.1800 in the European session, reversing the previous day's modest losses. The pair's uptick is sponsored by the emergence of fresh US Dollar selling, which remains induced by persistent trade-related uncertainties.

GBP/USD strengthens above 1.3500 on softer US Dollar

GBP/USD is posting moderate gains above 1.3500 in European trading on Wednesday. The pair appreciates as the US Dollar meets fresh supply following US President Donald Trump’s first State of the Union address and amid looming tariff uncertainty.

Gold eyes monthly top above $5,200 amid geopolitics, trade jitters

Gold buyers are back in the game, eyeing $5,200 and beyonf on Wednesday after seeing a correction from monthly highs on Tuesday. The US Dollar slips after Trump’s SOTU fails to impress and as AI-driven worries ease. Dovish Fed bets also weigh. Gold looks north so long as the key 61.8% Fibo resistance at $5,142 holds on the daily chart.

Bitcoin, Ethereum and Ripple post cautious recovery amid downside risks

Bitcoin, Ethereum, and Ripple are posting a cautious recovery on Wednesday following a market correction earlier this week. BTC is approaching a key breakdown level, while ETH and XRP are rebounding from crucial support levels.

Nvidia remains at the heart of the AI boom

Nvidia remains at the heart of the AI boom, with Q4 revenue projected near $65.6–66.1 billion, nearly 70% higher year-over-year. But investors are watching cash flow, leverage, and broader AI adoption. Growth is strong, but the AI stress isn’t over.

Why SPX dropped — And why it still looks like noise

Yesterday’s drop in the S&P 500 (SPX) caught attention fast. Futures softened early, sellers pressed throughout the session, and by the close the tone felt heavy. Financial media framed it as a warning shot. Traders felt the tension.