You don’t expect it to be ‘easy’.

But getting beyond ambiguity, frustration and the never-ending one step forward, one step back to achieve ever-green consistency—in exchange for acquiring skills—is a fair trade.

And that skill acquisition starts with a sophisticated approach:

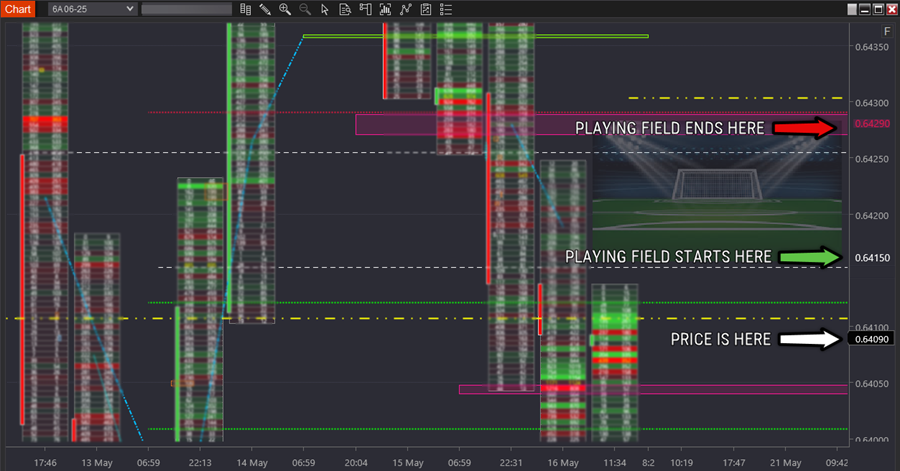

The playing field: where to trade—and just as crucially, where not to

The playing field is a solution to:

-

Getting out of trades too soon.

-

Staying in trades too long.

-

Avoiding non-directional price movement which 'chops' traders up.

In addition:

- It’s accurate. And has been reliable for two decades.

- It isn’t widely known.

- And in a competitive environment, where trading is about taking money—knowing what most don’t is how you achieve it.

Below is an excerpt from Friday’s game plan showing a playing field—where to trade, and just as crucially, where not to.

Widely accepted: trading is counterintuitive.

The playing field is no different.

Like the playing field above, ‘getting long’ is often when price moves higher from the current level (and the reverse for entering short).

Signature trades: Aligning your buys and sells with how price is travelling ‘now’

Price travels in different ways between two points, often differing vastly from each other.

These differences are often what makes trading messy.

What could have been a winning trade is a mess of over-trading, unnecessary losses and trades that go from underwhelming to outright losing.

But recognising signature characteristics of how price travels gives you a clean, dependable solution.

When each trade has specific actions you take—there are no shades of grey—only clarity on what to do.

Actions you know by heart, having repeated them in a risk-free environment to reach competence.

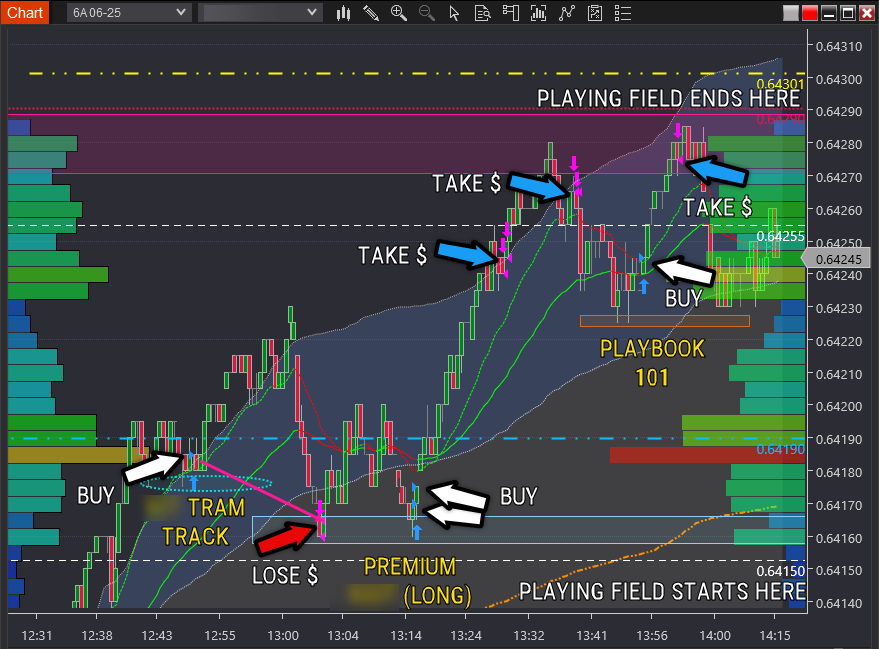

Below you can see three different signature trades executed within the previously identified playing field.

It’s not as ‘easy’ as pointing to a chart and spotting a setup. Each signature trade is identified by multiple points of evidence.

But it’s worth noting—once you can identify them—they show up frequently.

Notice how the chart includes numerous simple shapes and coloured lines?

Each represents descriptions of market information you commit to memory.

It’s a sophisticated approach to developing a deep understanding of what the market is doing ‘now’—because your brain processes shapes and colours 60,000 times faster than if you were to read descriptions meaning the same thing.

Playing fields combined with signature trades produce efficient, consistent and reliable trading outcomes that last a trading career.

Skill acquisition is a small price to pay for this.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD stabilizes near 1.1800 as markets focus on geopolitics

EUR/USD stays defensive around 1.1800 in the second half of the day on Thursday. The US Dollar stabilizes, following the recent decline led by tariff uncertainty, capping the pair's upside. All eyes now remain on the US-Iran nuclear talks after ECB President Lagarde's testimony failed to impress Euro bulls.

GBP/USD holds above 1.3500, struggles to gain traction

GBP/USD rebound from session lows but stays below 1.3550 on Thursday. The cautious market stance helps the US Dollar stay resilient against its rivals and makes it difficult for the pair gather recovery momentum. Investors await headlines that will come out of the US-Iran nuclear talks.

Gold clings to small gains near $5,200 ahead of US-Iran talks

Gold trades marginally higher on the day above $5,150 on Thursday as investors refrain from taking large positions. The US and Iran will hold the next round of nuclear talks in Geneva on Thursday, outcome of which could have significant implications for risk perception.

Stellar: Relief bounce fades as bearish undertone persists

Stellar is trading around $0.16 at the time of writing on Thursday after rebounding more than 8% in the previous day. Derivatives data paints a negative picture as XLM’s short bets hit a monthly high while Open Interest continues to decline.

The one thing everyone is on the lookout for is US action of some sort against Iran

The FX market is minestrone soup these days. It is befuddled by conflicting data, rumors and small stories exaggerated out of proportion, and Trump-generated uncertainty.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.