Extrapolating current trends into the future leave many people unprepared for major societal shifts

The one thing you can count on in financial markets, and society at large, is change.

I was reminded of this when I read this May 18 New York Times' headline and subheadline:

The Last Days of Time Inc.

... how the pre-eminent media organization of the 20th century ended up on the scrap heap.

Time Inc. has been purchased by the Meredith Corporation, which plans to spin off Time magazine, Sports Illustrated, Fortune and Money. All four magazines have suffered from declining ad revenue and declining circulation. There are other details, but the bottom line is that an established media empire, which had a long history of reporting on change, has now been swept up by change.

A generation ago, many observers would not have imagined that a company as iconic as Time Inc. would find itself "on the scrap heap."

But linear trend extrapolation has always had its pitfalls, and on changes that have been on a much bigger scale than one media company, which brings to mind what the 2017 book, The Socionomic Theory of Finance, said:

(1) It is 1975. Project the future of China.

(2) It is 1963. Project the cost of medical care in the U.S.

(3) It is 100 A.D. Project the future of Roman civilization.

In 1975, the Communist party was entrenched in China. ... Would anyone have imagined that China's economic production, in just over a single generation, would rival that of the United States?

In 1963, medical care was cheap and accessible. ... Would anyone have guessed that [today] pills would sell for $2, $20, $200 and even $1,000 apiece?

In 100 A.D., would you have predicted that the most powerful state in the world--the Roman Empire--would be reduced to rubble in a bit over three centuries? Few people of the day imagined that outcome.

Let me add: It's June 13, 2005 -- what were many people projecting for home prices?

Well, here's a Time magazine cover which published on that date:

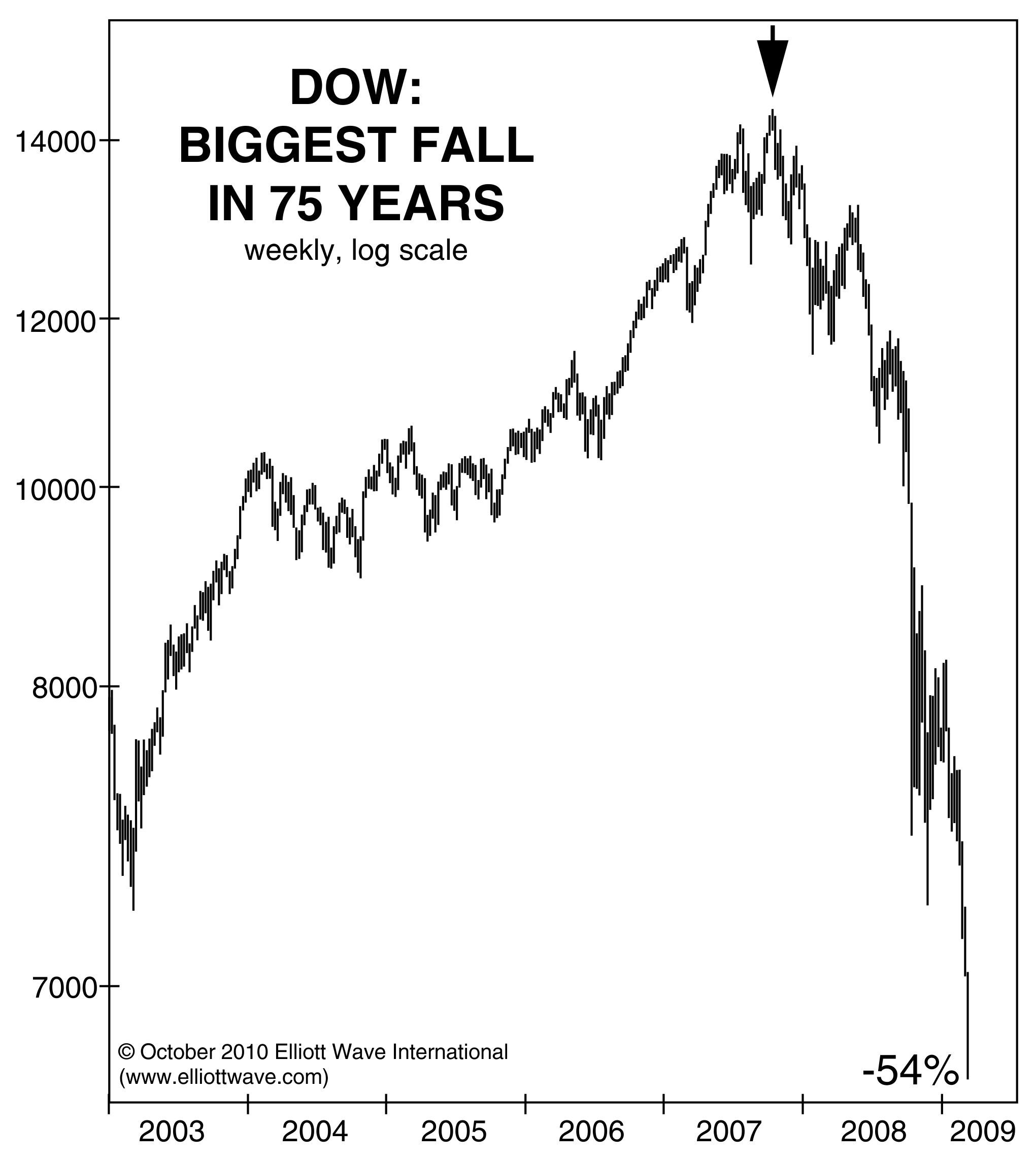

If that cover was an indicator, most people expected home prices to keep rising. But, we know what happened: Housing stocks topped that very year and the "subprime mortgage crisis" hit about two years later. Eventually, home prices plummeted by more than 50% in some of the nation's high-flying real estate markets. Moreover, the Dow topped in 2007 and then suffered its worst decline in 75 years:

Yes, this dramatic trend change in the Dow also took many observers by surprise.

The reason you should brace yourself for more big financial and economic changes is that EWI's analysis suggests that the next financial change will again surprise the unprepared.

Get more financial insights like these -- 100% free. Just follow this link

Elliott Wave International does not provide investment advice. All rights reserved.

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

EUR/USD eases to near 1.1900 in Tuesday's European trading hours, snapping the two-day winning streak. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD stays in the red below 1.3700 on renewed USD demand

GBP/USD trades on a weaker note below 1.3700 in the European session on Tuesday. The pair faces challenges due to renewed US Dollar demand, UK political risks and rising expectations of a March Bank of England rate cut. The immediate focus is now on the US Retail Sales data.

Gold sticks to modest losses above $5,000 ahead of US data

Gold sticks to modest intraday losses through the first half of the European session, though it holds comfortably above the $5,000 psychological mark and the daily swing low. The outcome of Japan's snap election on Sunday removes political uncertainty, which along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood. This turns out to be a key factor exerting downward pressure on the safe-haven precious metal.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Follow the money, what USD/JPY in Tokyo is really telling you

Over the past two Tokyo sessions, this has not been a rate story. Not even close. Interest rate differentials have been spectators, not drivers. What has moved USD/JPY in local hours has been flow and flow alone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.