What is the Consumer Confidence Report?

The consumer confidence report is a survey conducted by the Conference Board that measures consumer attitudes about both the present and future situation of the U.S. economy. Each month, five thousand consumers across the U.S. are interviewed and survey about their thoughts of economy. Their answers are then graded under different, weighted components and later compiled to give us one number that makes up the Consumer Confidence reading.Why Should I Pay Attention to this report?

Consumer confidence is basically a measure of how good (or bad) consumers think the economy is performing. The more confident consumers are about the economy and their personal financial situations, the more likely they will be willing to shell out their hard earned cash. On the other hand, if consumers are concerned about the state of the economy, chances are they'll hold back on spending right now, and instead save their cash for a rainy day. Keep in mind that the consumer consumption accounts for about two-thirds of U.S. GDP. That said, having an idea what consumers feel and how it could affect their spending habits could provide valuable insight with regards to predicting which way the economy may be headed in.Is there really a correlation between Consumer Confidence and Spending?

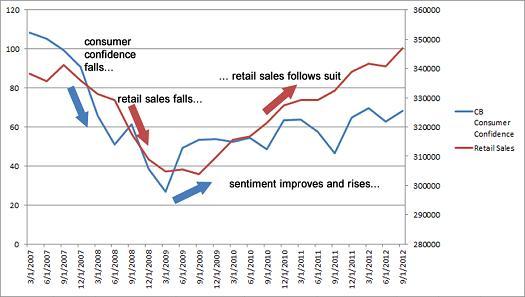

I decided to do a little digging of my own to see whether consumer confidence does affect spending. Below is a chart showing the monthly releases of the consumer confidence and retail sales reports:

As it turns out, there appears to be a positive correlation between retail sales and the consumer confidence report. In 2007-2008, consumer confidence dropped as the Great Recession was taking place. During this time, retail sales also stumbled, falling from 340 billion USD to 305 billion USD.

Then, once the Conference Board index bottomed out at 25.0 in early 2009, we saw retail sales start to pick up as well. Over the past few years, both consumer sentiment and retail sales have seen steady growth.

No, the correlation isn't pitch perfect, but at the very least it provides support for the argument that consumer sentiment does have predictive qualities in terms of predicting the direction of retail sales growth.

That said, we should continue to measures this relationship, as it could give us hints as to how well the rest of the U.S. economy may perform this 2013. Should confidence continue to rise, retail sales may follow suit. This could have a ripple effect on the rest of the economy, as more spending will allow businesses to expand, which could in turn lead to them hiring. Before you know it, NFP figures are starting to hit the 200,000 mark, while GDP growth is steadily climbing each month!

Make sure you check out your calendars every last Tuesday of the month to find out the results of the Conference Board Consumer Confidence report!

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD climbs to two-week highs beyond 1.1900

EUR/USD is keeping its foot on the gas at the start of the week, reclaiming the 1.1900 barrier and above on Monday. The US Dollar remains on the back foot, with traders reluctant to step in ahead of Wednesday’s key January jobs report, allowing the pair to extend its upward grind for now.

USD/JPY plummets to 156.00 amid rising intervention jitters

USD/JPY retreats markedly and revisits the 156.00 neighbourhod at the beginning of the week amid growing speculation that authorities could step in to curb further currency weakness. That chatter picked up after PM S. Takaichi secured a landslide victory in Sunday’s election, fuelling expectations of a firmer stance on the Yen.

Gold treads water around $5,000

Gold is trading in an inconclusive fashion around the key $5,000 mark on Monday week. Support is coming from fresh signs of further buying from the PBoC, while expectations that the Fed could turn more dovish, alongside concerns over its independence, keep the demand for the precious metal running.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.