A few years ago, I met with a new coaching client at a hedge fund. This individual defied every stereotype of how one might assume a hedge fund portfolio manager may be. Despite a 20-year history in the markets and a stellar track record, he was a very nervous and anxious individual. Unlike many of his colleagues at the fund, who mostly took medium- term relative-value type trades, this individual day-traded FX, something generally assumed the domain of the home retail trader. What was all the more remarkable was his incredible track record. In a typical year he made around USD 40-50 mio of profit, this year he had made around USD 100 mio, a large chunk of it in the space of a few moments when the Swiss pulled their peg against the Euro. What really stood out for me though, was that he never traded after 1 pm.

I asked him, “What if you have a strong signal in the afternoon which suggests taking action, wouldn’t it mean that you will be leaving a lot of money on the table by not doing anything?” He replied that that was often the case, however he was still better not to act, he said overall he believes that historically his afternoon trading provides him with a net loss, even if you included these trades.

This fascinated me because it was a live example of a theory that I had about afternoon trading. This theory was formed from research I had read about our how our ability to make effective decisions and to exert self-control in our actions diminished the longer the day went on. In a trading sense, this could mean that whilst a trader may have an edge in early in the day, as the day wore on, that edge was eroded to the point where it became a negative edge.

Decision fatigue, mental bandwidth and trading

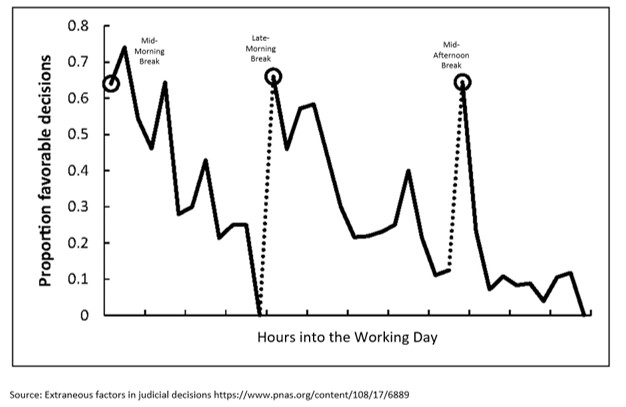

The research which led me to this belief was produced by a group of psychologists who had analysed the decision-making performance of judges. The research analysed the decision-making capabilities of a group of parole board judges when it came to granting or denying parole of over 1000 cases over a period of nearly a year. Their decisions were aggregated and placed into a single time of day chart. This chart can be seen below:

A positive or good choice was given a score of 1, a sub-par choice ‘denying parole’ was given a score of 0. The quality of the choices can be seen to deteriorate as the day wears on, only improving for a short period after intraday breaks.

This chart and their research highlight the role of ‘Decision Fatigue’ in people’s decision-making. The mental work of ruling on case after case, whatever the individual merits, wore the judges down leading to lower quality decisions as the day moved on. This sort of decision fatigue makes people involved in repetitive high stakes decision-making prone to dubious choices as the day progresses.

This sort of fatigue differs from ordinary physical fatigue where you are conscious of your tiredness. With decision-fatigue, your mental bandwidth is stretched, but you are not conscious of it and do not feel it. Thus, you carry you carry on making decisions and choices regardless, though you do become more irritable, and do make progressively lower quality choices.

Decision fatigue usually manifests in one of two ways.

The first of these is poor quality or even reckless decisions where one acts impulsively instead of expending the energy to first think through the consequences. We see these in knee-jerk trading responses, and unplanned reactive trades. The other manifestation is ‘Decision Avoidance’, not taking an action but procrastinating or hesitating.

Time of day quality in FX trading markets

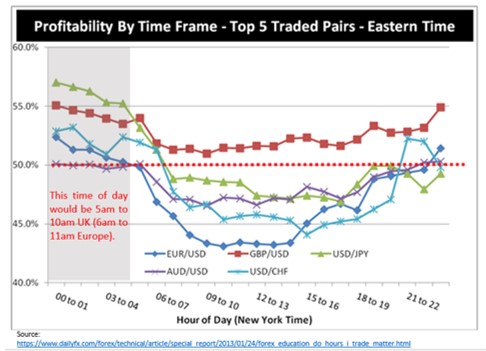

The following chart looks at the percentage of trades in five currency pairs that closed with a profit at broker FXCM from 10/01/2009 to 09/30/2010. I have assumed that most of these trades refer to day trading clients.

The most profitable period of the day was from midnight to around 5am NY Time. This is around 6am to 11am Central European Time. Since by far the highest proportion of Forex trading occurs in the European time-zone, this suggests that most Forex traders were profitable in the first few hours of their trading day. However, as the day goes progressed the trader’s profitability levels drop.

Levels of profitability appear to return to balance late in the evening, which one presumes coincides with much lower activity levels post-US markets and into the Asian/Pacific time-zone.

We cannot know the reason for this with any certainty, but this does seem to lend some credence to the possibility that ‘Decision-Fatigue’ could be at play.

Returning to the story of the Fund trader. Seen in this light, his practice of not trading into the afternoon seems a wise one. He is a seasoned trader; he knows when he is strong and when he is compromised. He knows he has no edge in the afternoon, why play when you have no edge, for him it is just playing to lose.

AlphaMind do not offer trading or investment advice and do not take responsibility for any investment or trading actions or decisions taken by clients or any observers of our material in any form of media, either now or in future.

Editors’ Picks

EUR/USD stays below 1.1850 after dismal German sentiment data

EUR/USD stays in negative territory below 1.1850 in the second half of the day on Tuesday. Renewed US Dollar strength, combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD falls toward 1.3550, pressured by weak UK jobs report

GBP/USD remains under bearish pressure and extends its decline below 1.3600 on Tuesday. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold recovers modestly, stays deep in red below $4,950

Gold (XAU/USD) stages a rebound but remains deep in negative territory below $4,950 after touching its weakest level in over a week near $4,850 earlier in the day. Renewed US Dollar strength makes it difficult for XAU/USD to gather recovery momentum despite the risk-averse market atmosphere.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.