I have already written a lengthy report with plenty of examples on how to manage your risk when in a trade in THIS article. But I wanted to provide a template here to give you an idea of exactly when I normally adjust the stop loss.

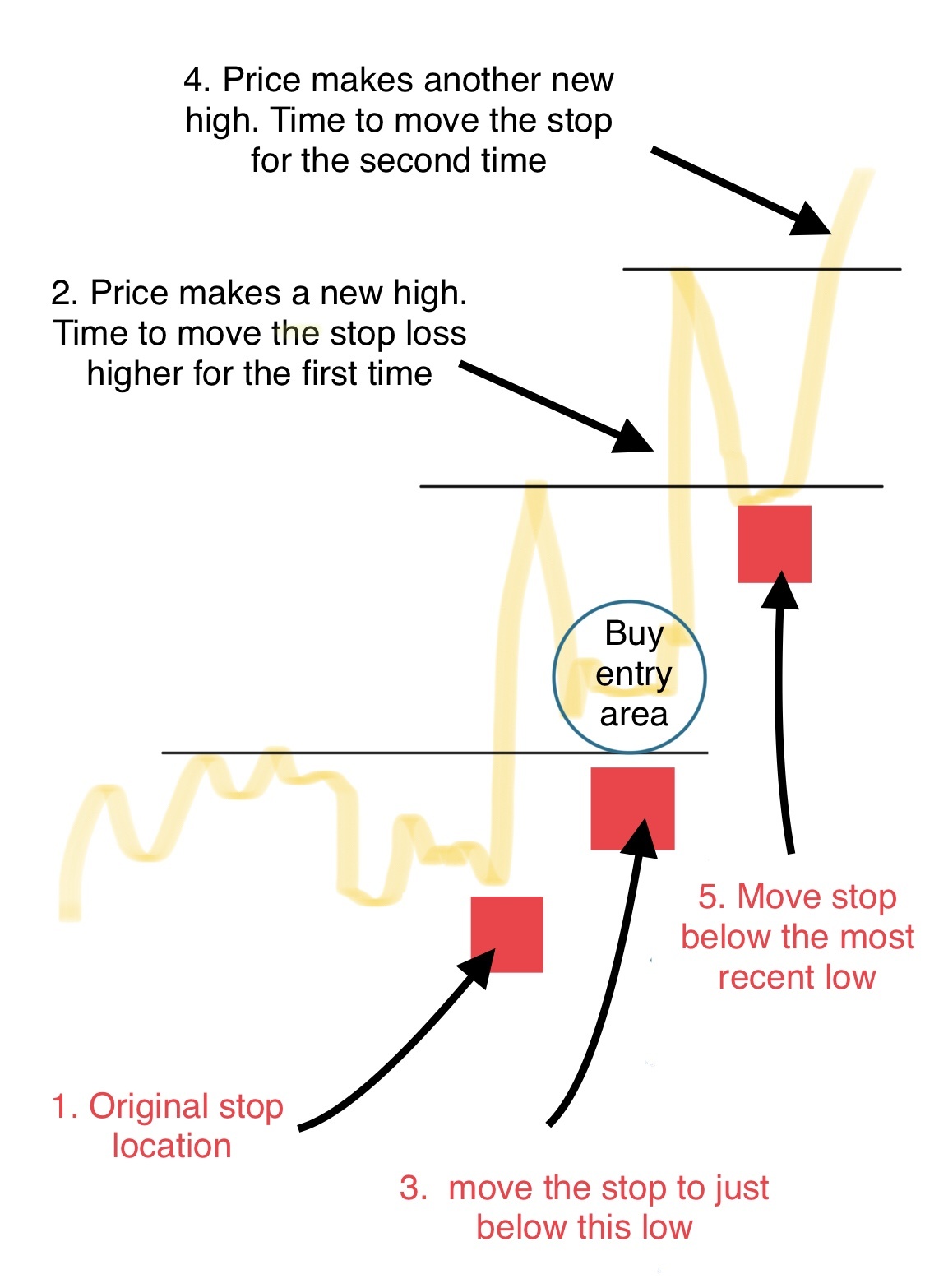

Let's get straight to the point. The diagram below describes how I normally adjust the stop loss for a long trade and the opposite of this for a sell trade:

To show you how I use the above template to manage the stop in some of my most recent trade signals for the private group, here are a couple of real world examples:

Example 1: USD/CAD

The USD/CAD was one of my recent trade signals. The idea was to sell the rallies into resistance in a downtrend. So, after a two- or three-day rebound into the bearish trend line, I thought it was the right time to issue a sell trade idea:

Source: TradingCandles.com and TradingView.com

In addition to the above chart, I posted the below hourly chart showing the specifics of the trade entry, as well a short rationale behind the idea:

"USD/CAD daily sows price reaching a potential resistance area (trend line and 21-day eMA) after a counter trend rebound off the lows. The long-term trend is bearish. So we will look for a sell setup here."

"USD/CAD short trade idea on H1 chart – the idea is based off the daily and the fact that on this timeframe rates have rallied to and stalled at the 61.8% Fibo. The invalidation level is above the most recent high on H1 and also the trend line above the daily. The main target is the liquidity below the recent low "

Source: TradingCandles.com and TradingView.com

After providing the above trade signal, rates started to go down as we had envisaged, prompting me to provide the following update, as my focus now was on reducing the risk (as we always do after entering a trade):

"USD/CAD update – lower the stop on this so we can lock in some profit as price has now created some structure below our entry range. It is important to continually monitor your positions, especially at times like now when the markets are all over the place. "

Source: TradingCandles.com and TradingView.com

As can be seen from the above 4-hour chart, the reason why I moved the stop lower was because of the fact price had created a structure of interim lower highs and lower lows. I did not take into account the entry range and didn't just move the stop loss just for the sake of moving it to breakeven or better. But there was good reason for us to do so, and price action told us when it was the right time.

As it happened, the USD/CAD stalled just ahead of our intended target, which, together with the fact the US dollar was weakening against some other currencies, meant it was probably the best time to close it manually. So I provided the following rationale and chart for the subscribers behind my decision to close it ahead of the target:

"USD/CAD closing it manually here for at least +125 pips profit. Oil prices have stalled and the US dollar has shown signs of life against some currencies already e.g. against euro and gold. So let's not take any chances and close this for a very good profit."

Source: TradingCandles.com and TradingView.com

Example 2: GBP/JPY

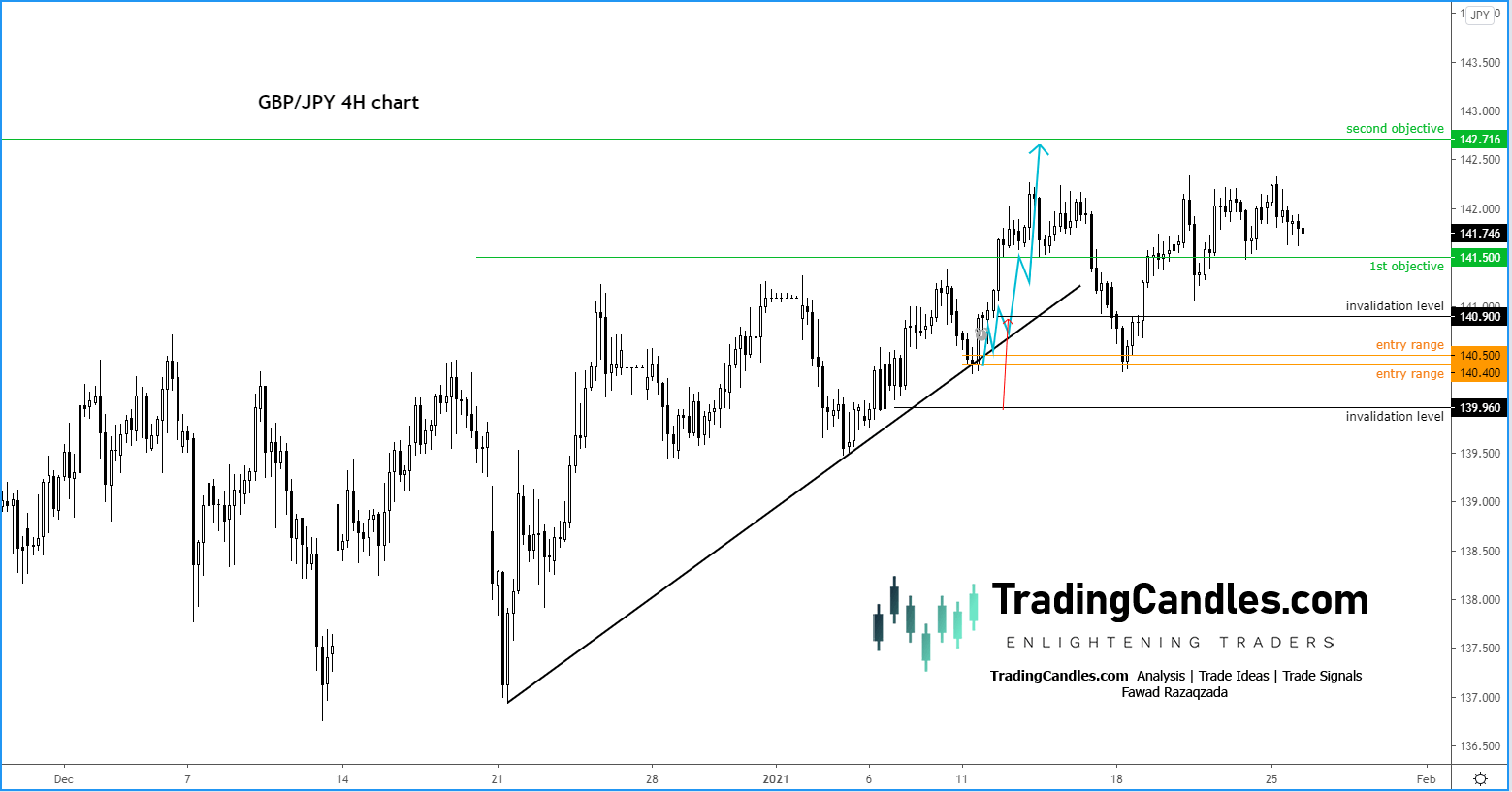

Another of our trade ideas which required management of the stop was the long GBP/JPY setup, which was issued on 11th January 2021. This is what I wrote to the group:

"GBP/JPY is looking quite bullish and think more gains are likely in my view as ongoing risk rally keeps the pressure on the safe haven yen and I think the pound will bounce back because no-deal Brexit has been avoided. The next key objective is the long-term bear trend and previous high around 142.71ish "

Source: TradingCandles.com and TradingView.com

I then issued the specifics of the GBP/JPY long trade idea on the 4-hour chart as rates were testing the bullish trend line. The stop low below the most recent lows on 4H candles and thus the trend line:

Source: TradingCandles.com and TradingView.com

The GBP/JPY hit our first target for at least +100 pips and by now I had tightened the stop on the small portion still left open as shown on the updated chart to lock in some profit in case price reversed:

As it turned out, this trade reversed and stopped us out of the second portion (for a small profit). But on reflection, perhaps I shouldn't have adjusted the the stop too tightly as price subsequently rebounded again after re-testing our entry area:

Source: TradingCandles.com and TradingView.com

Final words

It is impossible to know ahead of time whether adjusting the stop loss is better than not doing anything at all. The way I see it is that you should adjust the stop loss as price action evolves and the market makes new price structures. On occasions, you might regret adjusting the stop loss. But essentially, what you want to do is reduce risk and remain in control of the trade. A small win is, after all, a win, and certainly not a loss. I would rather make a small win than lose a full 1R on any given trade.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Editors’ Picks

USD/JPY drops back below 157.00 on Japan's verbal intervention

USD/JPY has come under moderate selling pressure below 157.00 in the Asian session on Monday. The Japanese Yen lost ground to near 157.70 following Japan’s ruling Liberal Democratic Party's outright majority win in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi. However, JPY buyers jumped back and dragged the pair southward on FX verbal intervention by Japan’s Finance Minister Katayama.

Gold eyes acceptance above $5,000, kicking off a big week

Gold is consolidating the latest uptick at around the $5,000 mark, with buyers gathering pace for a sustained uptrend as a critical week kicks off. All eyes remain on the delayed Nonfarm Payrolls and Consumer Price Index data from the United States due on Wednesday and Friday, respectively.

AUD/USD: Buyers eyes 0.7050 amid upbeat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Top Crypto Gainers: Aster, Decred, and Kaspa rise as selling pressure wanes

Altcoins such as Aster, Decred, and Kaspa are leading the broader cryptocurrency market recovery over the last 24 hours, as Bitcoin holds above $70,000 on Monday, up from the $60,000 dip on Thursday.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.