Fortunately, there are enthusiast who have done most of the hard work already, hence showing what each trader should expect from its MT4.

Not to go into too much technicalities - standard MT4 platform could be upgraded in order to enhance trading performance and simplify day to day routines, all by incorporating key functionalities traders desire. After all what traders need is time to formulate and fine-tune trading strategy instead of navigating cumbersome online resources for much-needed functionality.

Below you will find a description of the most stand-out features (out of over 60 enhancements) of the handy MT4 build - MetaTrader 4 Supreme Edition, a version assembled with the help of few bright IT specialists and several demanding day-traders.

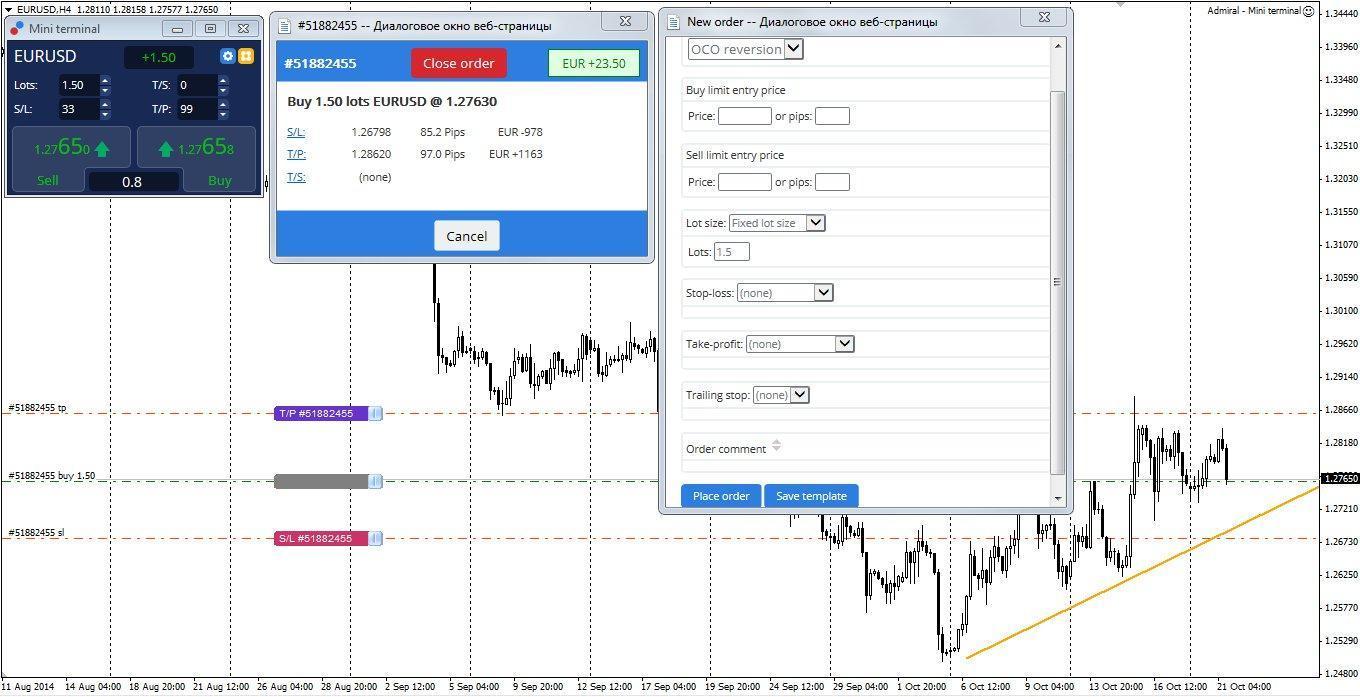

Mini Terminal

The Mini Terminal is an advanced version of the standard MetaTrader 4 one click trading feature, a compact window which enables you to do all the important trading tasks in a blink of an eye. Order and risk management has never been as straight-forward and flexible: setting stop-loss, take-profit and trailing stop, observing current spread - all in a single panel; chart trading; saving preferred trading conditions as a template; advanced order types and settings and many more!

For instance, chart trading allows you to amend order levels directly on charts in a fraction of a second. This feature comes really handy during fast market when your reaction has to be quick (yes scalping). Moreover, you can draw diagonal trend line which could be turned into stop loss and more features each trader would enjoy playing with.

Trade Terminal

The Trade Terminal enables you to monitor and place orders on multiple instruments at a glance. When it comes to managing several simultaneously opened positions and pending orders, this add-on is a do-everything tool, allowing you to multitask within a single frame, highlighting core idea of MT4SE - bridging convenience and effectiveness.Have you even tried to put yourself in the shoes of a professional trader or money manager? Now you are able to create your own Multi-Monitor experience undocking charts, news feeds, analysis tools or the Trade Terminal.

In case you don’t have multiple monitors, undocking feature comes handy to safely minimise the platform and perform other tasks while still keeping an eye on price movements.

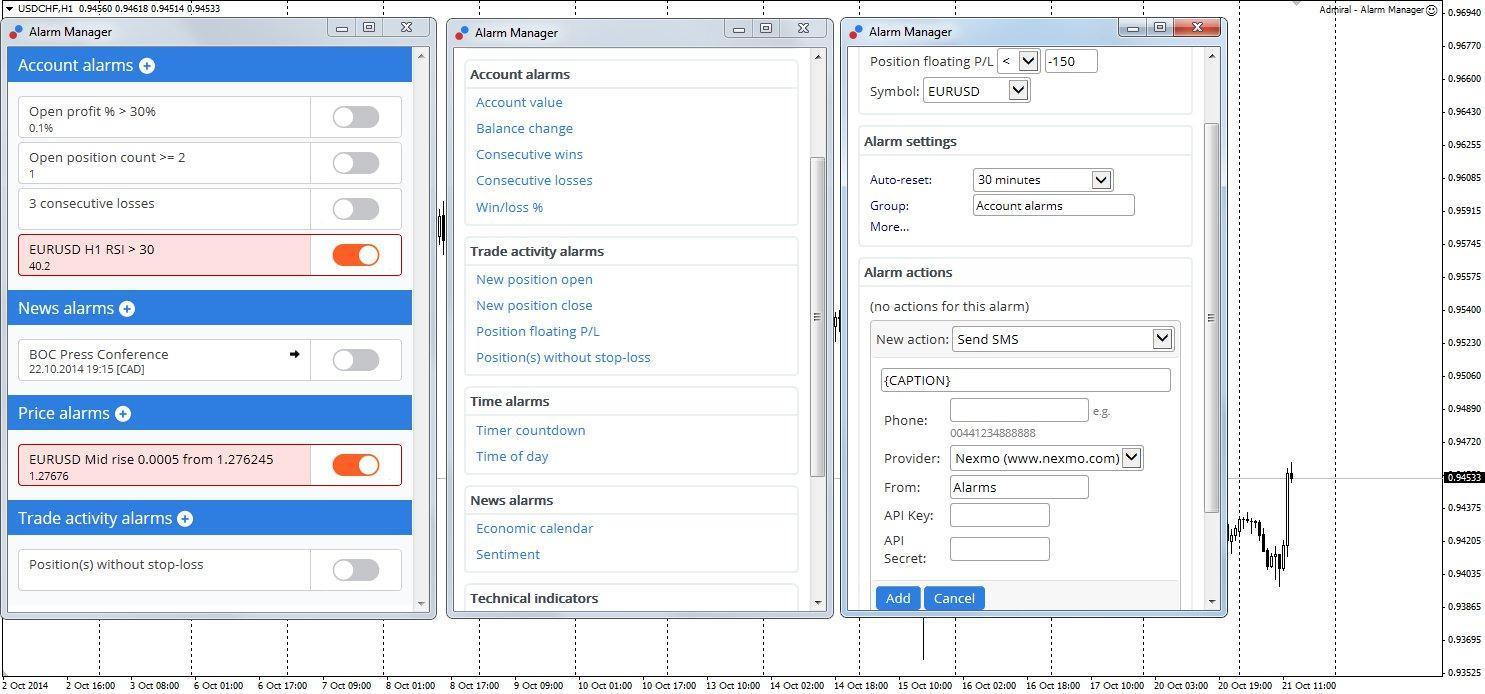

Alarm manager

The Alarm Manager lets you get all account & market notifications and construct an automatic actions when such events occur, automatically updating you via SMS, email or Twitter. Alerts can be set via the alarm tool which enables you to set triggers for multiple events concerning account criteria (margin, balance, profit, loss, etc.), news and sentiment, indicators, price movements, time and more.

Overall, Alarm Manager saves a lot of time and efforts so you can work with your strategy or take this well-required lunch break for once!

Correlation Matrix

This powerful add-on shows (in grid form) the correlation between symbols over a configurable time-frame and number of bars, e.g. the last 300 H4 bars. It brings a solid backup for your trading strategies and is an absolute necessity, given you trade 2+ instruments. Soon after launching MT4SE the Correlation Matrix will prove invaluable for you to plan trades and minimise risks.

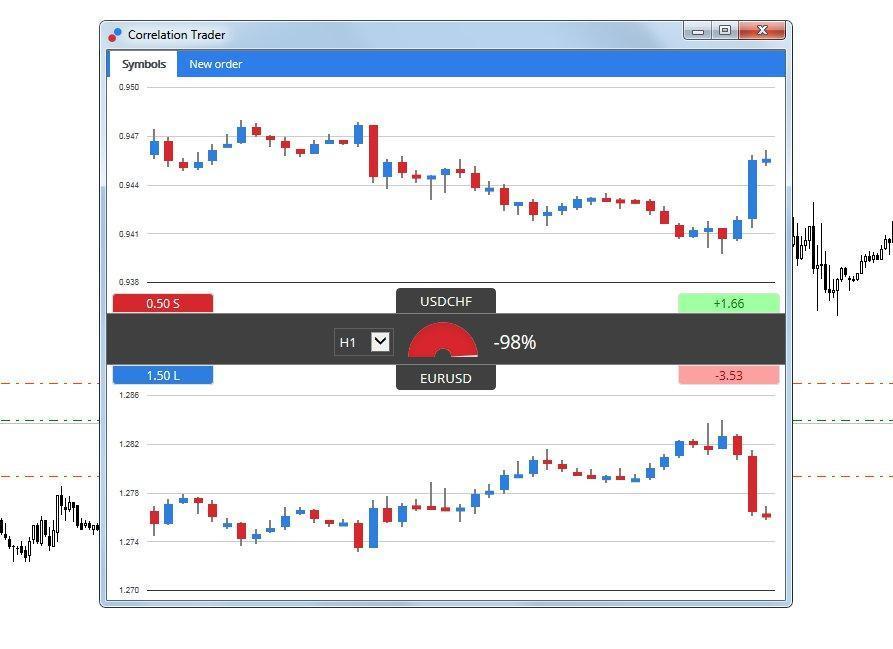

Correlation Trader

Shouldn’t come as a surprise, some pairs correlate better than others, so when currency pair moves in the same or opposite direction compared to another, it means they are strongly correlated; otherwise, correlation is weak or there is even no correlation at all.The Correlation Trader shows correlation between instruments in a form of charts. It helps you identify symbols with strong or weak, positive or negative correlations and fine-tune your trading strategies according to emerging differences in the analysed instruments.

Is there more to it? Of course!

There are more features to MT4SE, but only so much of an attention span the reader can handle - so we will leave you the liberty of discovering the rest of MT4SE.

Meanwhile, Let us know what is your favorite MT4 build and what is the feature(s) you value the most in MT4SE?

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1870 during the Asian hours on Friday. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming steady momentum. RSI has eased but remains above 50, indicating momentum remains constructive for the bulls.

Gold recovers swiftly from weekly low, climbs back closer to $5,000 ahead of US CPI

Gold regains positive traction during the Asian session on Friday and recovers a part of the previous day's heavy losses to the $4,878-4,877 region, or the weekly low. The commodity has now moved back closer to the $5,000 psychological mark as traders keenly await the release of the US consumer inflation figures for more cues about the Federal Reserve's policy path.

GBP/USD consolidates around 1.3600 vs. USD; looks to US CPI for fresh impetus

The GBP/USD pair remains on the defensive through the Asian session on Friday, though it lacks bearish conviction and holds above the 1.3600 mark as traders await the release of the US consumer inflation figures before placing directional bets.

Solana: Mixed market sentiment caps recovery

Solana is trading at $79 as of Friday, following a correction of over 9% so far this week. On-chain and derivatives data indicates mixed sentiment among traders, further limiting the chances of a price recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.