Option trading can be a great way to make money, offering strategies for traders from beginner level to the most advanced.

Before we can begin to make it work, though, there a few basic things that we need to understand.

What You Need to Understand About Options Trading

A listed stock option must be one of only two things:

-

Call option – A right to buy 100 shares of a stock at a fixed price, good through a definite future date

-

Put option – A right to sell 100 shares of a stock at a fixed price, good through a definite future date

It sounds simple with only two elements, but then so do the numbers 0 and 1. And with just those two digits, in different combinations, anything and everything in the universe can be represented (that’s what digital data is).

The possibilities with options are not quite that limitless, but close enough.

What Is a Listed Stock Option?

The “listed” part of listed options means that they trade (are “listed”) on centralized option exchanges. The exchanges specify the standardized terms of every option contract. There are several exchanges, and all are coordinated through a central clearing house. The clearing house arrangement provides a guarantee that every option buyer’s right to buy or sell is absolute.

Here is the breakdown of the elements of an option:

For both puts and calls, there is an underlying asset. That asset is almost always 100 shares of the stock of a given company, or of an exchange-traded fund. (There are options on things other than stocks and ETFs, but we’ll stick to those for now). For example, the underlying asset might be 100 shares of Apple stock.

For each underlying asset, there are many different options available. The two things that differentiate one Apple call from another Apple call, or one Apple put from another Apple put, are the price at which they give the right to buy or sell (called the strike price); and the duration of that right, indicated by the option’s expiration date, or expiry date if you like.

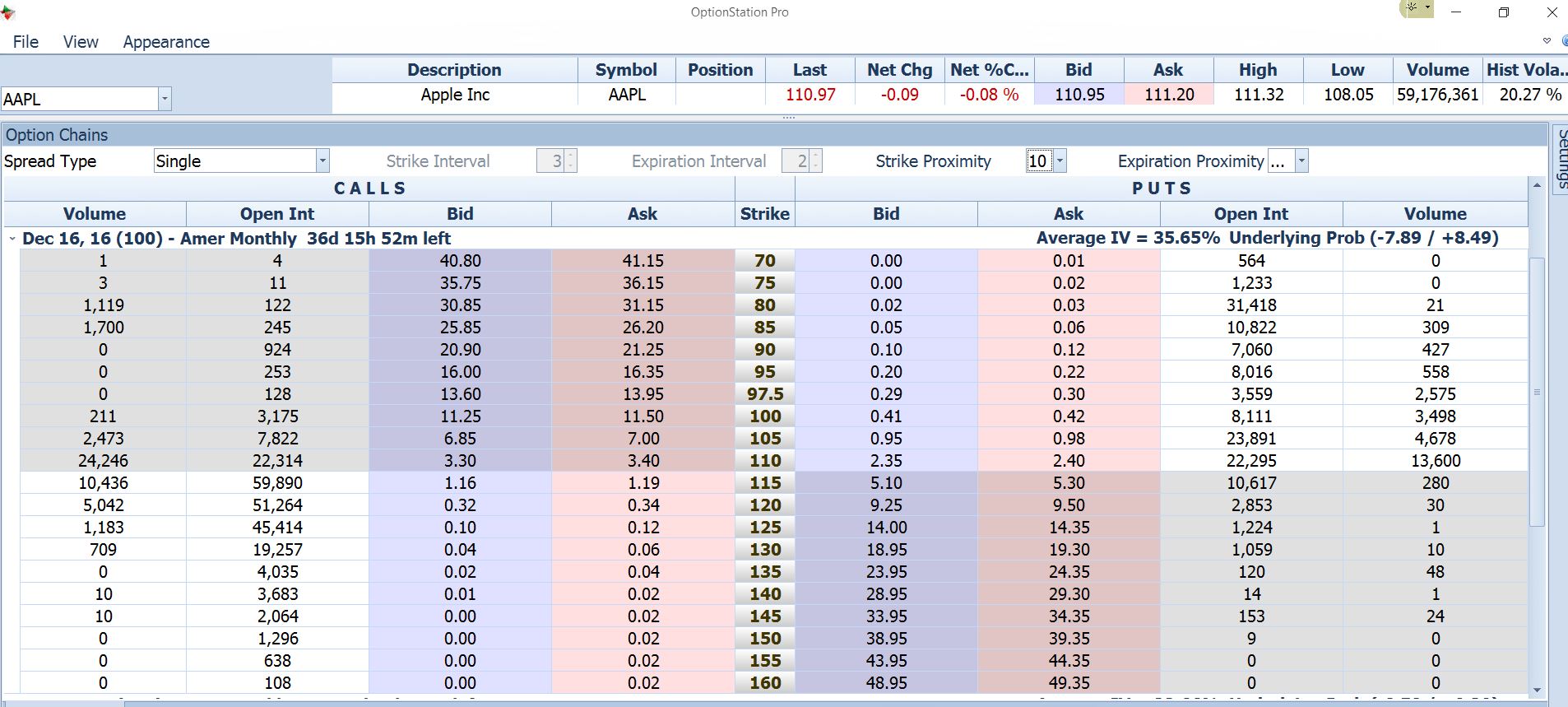

The list of available options is called an option chain, a picture of which is shown below:

A Simple Explanation of Options Calls and Puts

Above is a small sample of the options for Apple stock for just one expiration date, December 16, 2016. The Strike column in the center of the chain lists the strike prices that are available. The columns to the left of the Strike column refer to call options, while those on the right refer to puts.

On this page, there are strikes listed from $70 per share to $160 per share. A call option with a Strike of 110 gives the right to buy 100 shares of Apple stock at $110 per share. In this list that right is good through December 16. A call at the 115 strike gives the right to buy the stock at $115 a share, and so on.

People buy call options if they believe that Apple stock will go up in price. Once you have paid for a call option (you can buy one for the price shown in the Ask column, times 100), you then have the right buy the stock at that price no matter what the market price of Apple stock is at some future date between now and expiration. You are not obligated to buy the stock, but you may whenever you want, at any time through the expiration date. This will allow you to make money if Apple stock goes up while risking only a small fraction of the stock price.

People buy put options if they believe that the price of a stock will go down. A put at the 110 strike, for example, would give you the right to sell Apple stock for $110 per share, even if the stock went down to a much lower price, or even to zero. If you own the stock, this is like a guaranteed stop-loss. If you don’t own the stock, but just believe that the stock will go down and want to make money if it does, you can also buy puts. If you bought these puts and then Apple went down to $100, you could make money by buying the Apple stock at $100, then exercising your option and thereby selling the stock at $110.

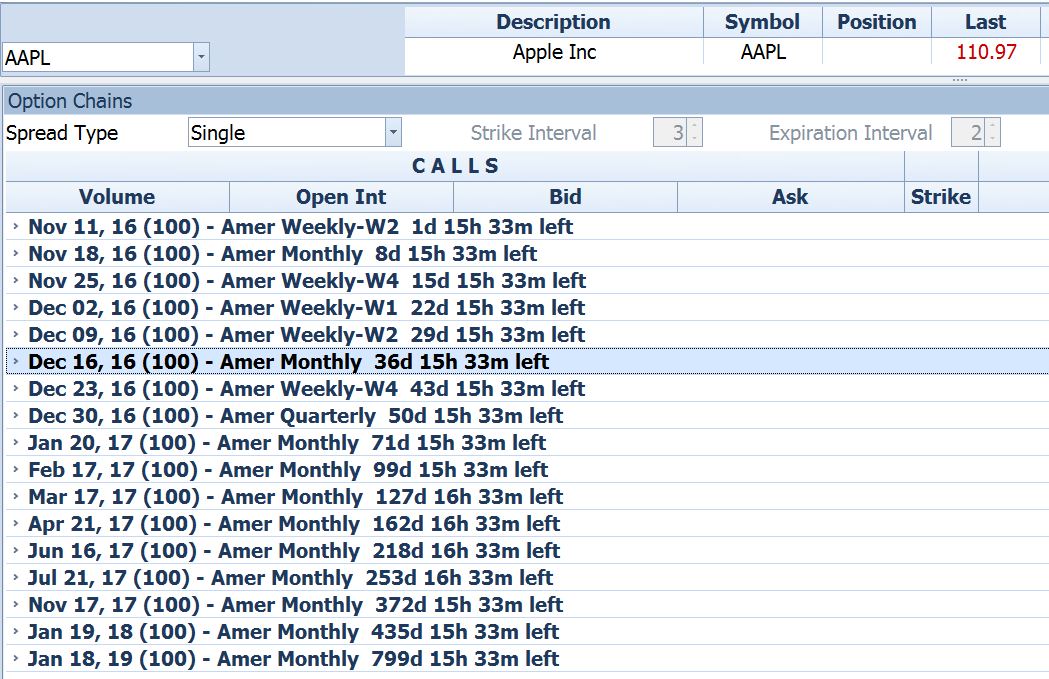

Besides the options listed above that expire in December, there are other expiration dates available as shown below:

The expiration dates above range from November 11, 2016, which was just 2 days away when this article was written; to January 18, 2019, more than two years away. For every one of those expiration dates there is a list of available option strike prices that is similar to the one in the first diagram above, altogether there are over 1200 options for Apple stock.

By choosing the right options for your market outlook and current market conditions, you can construct option positions to protect stock that you have; or to make money from movement in a stock that you don’t have (up or down – as long as you are right about that direction) , or even to make money from a lack of movement. Once you understand the world of options, all these possibilities are open.

Stay tuned for future articles. If this piques your interest, check with your local center on option classes offered in your area.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates

Unimpressive European Central Bank left monetary policy unchanged for the fifth consecutive meeting. The United States first-tier employment and inflation data is scheduled for the second week of February. EUR/USD battles to remain afloat above 1.1800, sellers moving to the sidelines.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.