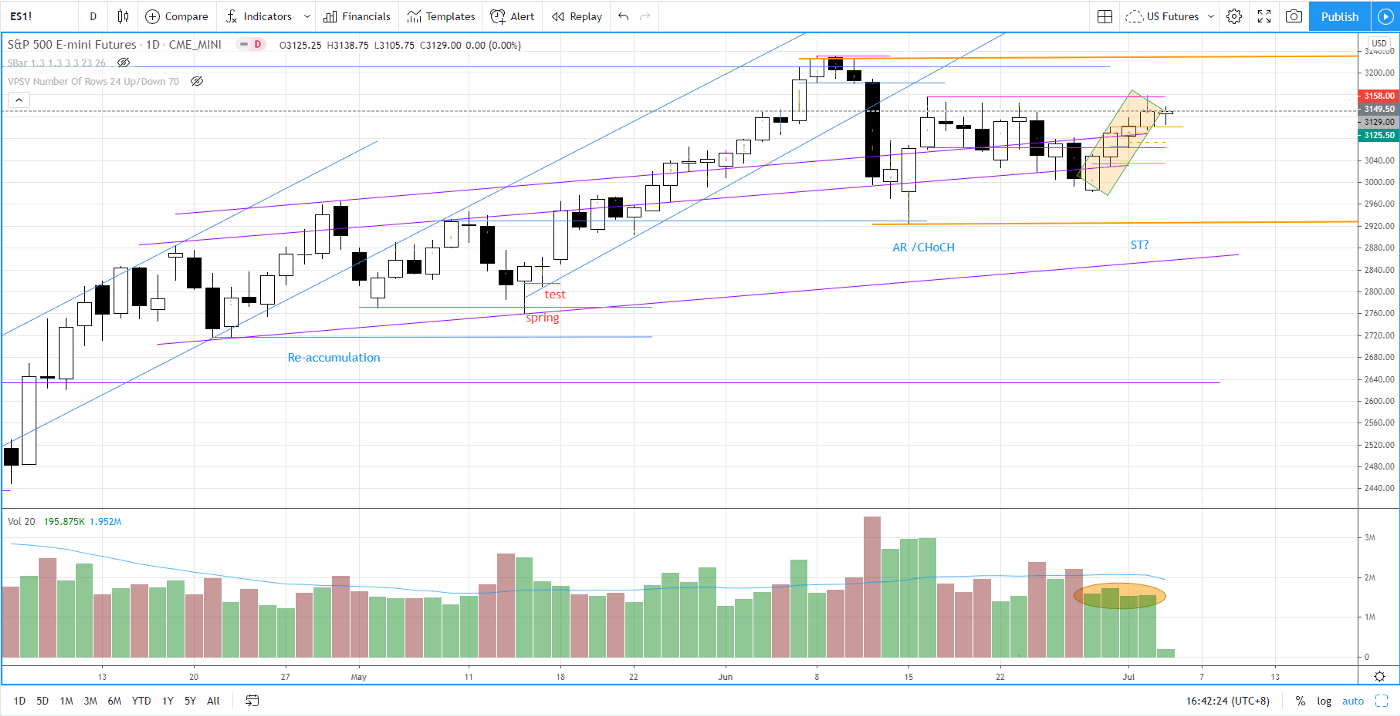

Last week in my Week 26 Market Round up, I stated the grinding down move is a bullish character with possible shortening of the downward thrust as a bullish scenario. This bullish scenario did play out as per what I mentioned.

The reversal up swing from last week accompanied by consistent demand signature, as shown below. S&P 500 is likely to see a breakout of this immediate resistance at 3156 to test the buying climax high at 3230 formed on 8 Jun 2020. The big trading range between 2925–3230 is still well in play.

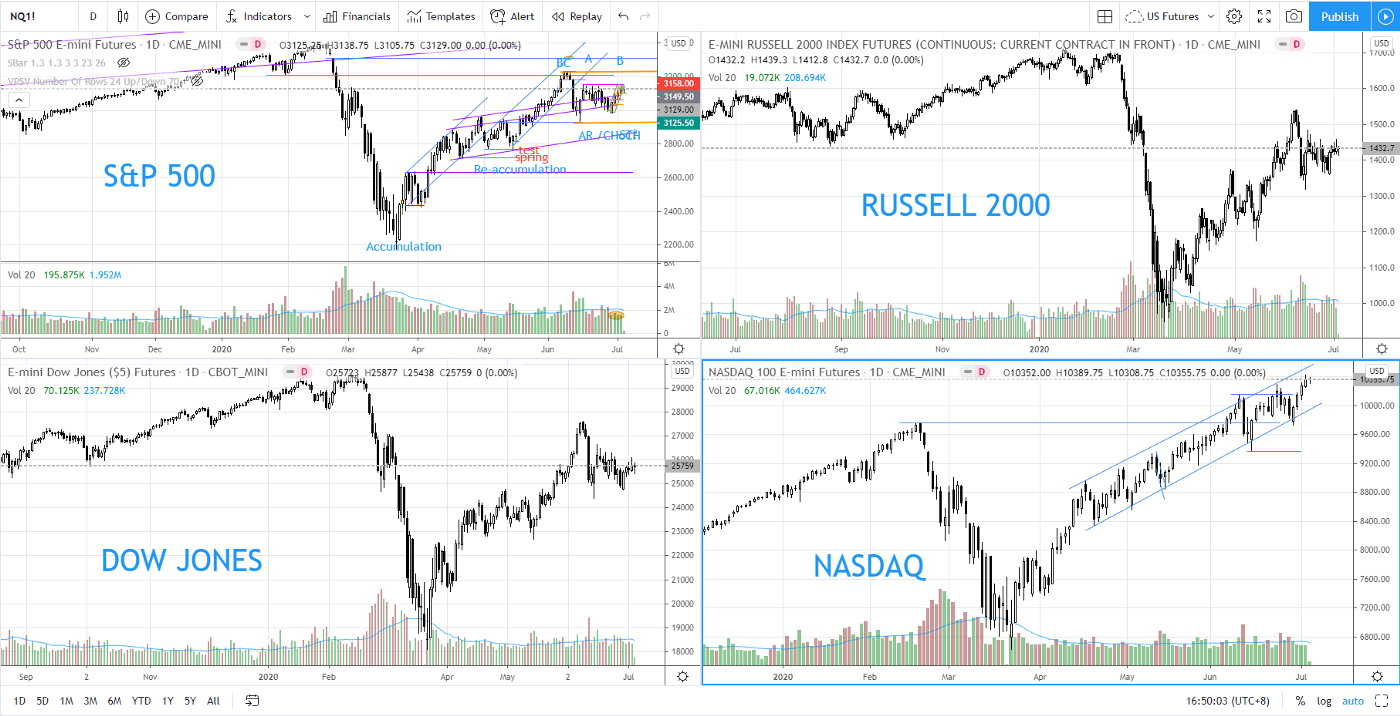

It is worth to note that so far NASDAQ has been the leader, followed by S&P 500, RUSSELL 2000 while DOW is the weakest among these 4 major indices. I pay close attention to the NASDAQ in case it become the one to lead the way down. Also, RUSSELL (small cap) is showing decent strength and we can expect rotation into small cap in focus too.

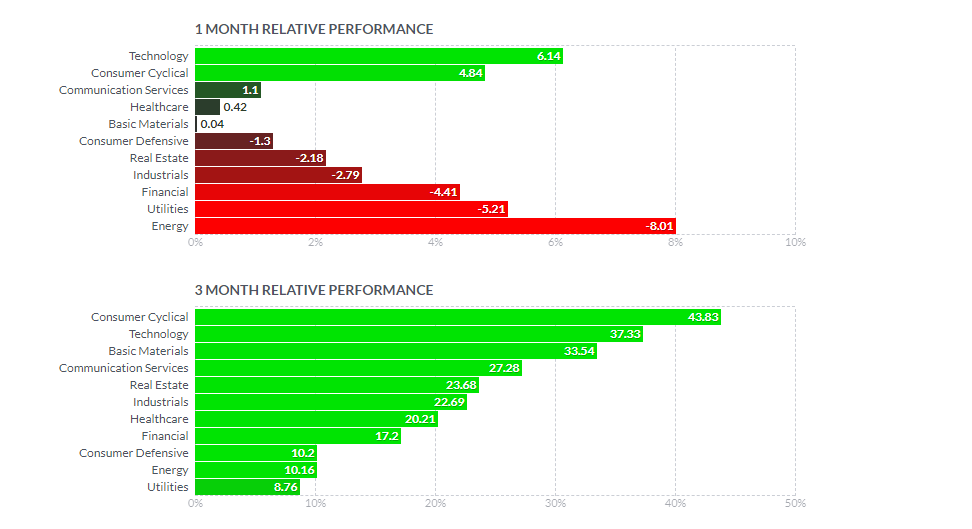

Based on the relative performance from Finviz, Technology and consumer cyclical are still leading the rest.

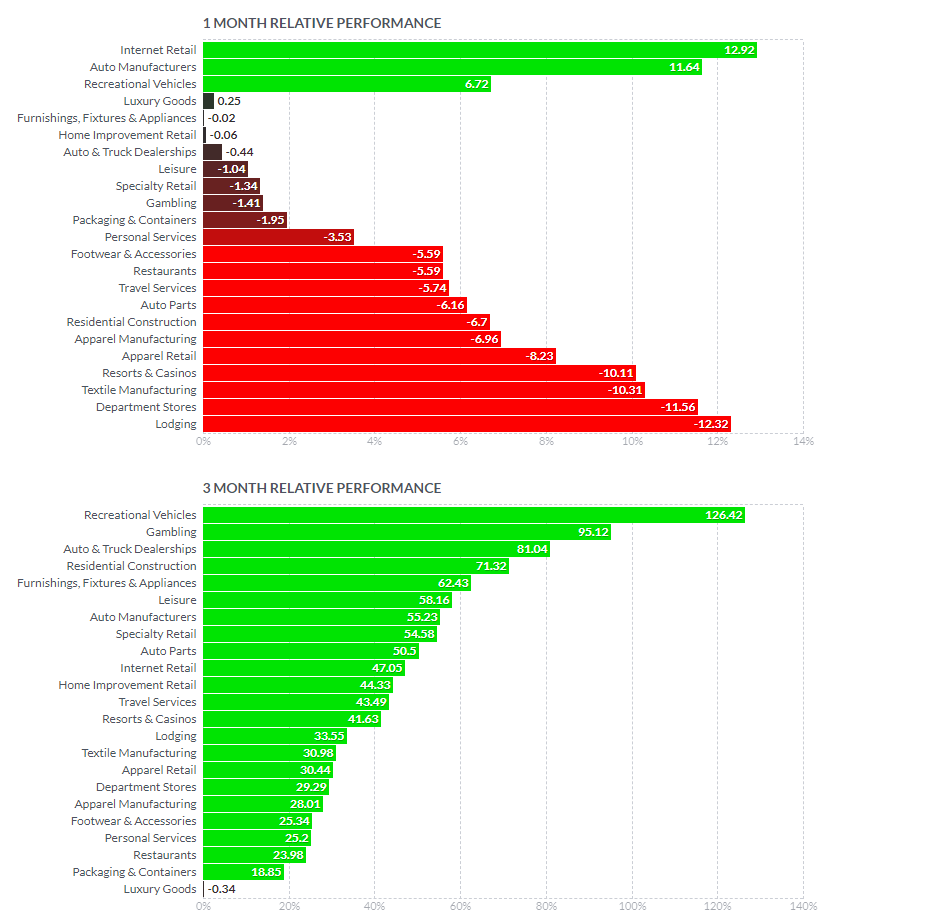

By zooming in Consumer cyclical, it is interesting to notice some of the hard hitting industries due to COVID-19 had a strong recover from extreme oversold condition while internet retail is still showing leadership.

Check out last week market analysis video series below if you haven’t or would like to reflect how last week unfold together with your preparation and analysis:

Stock Watchlist — Malaysia

Quality demand is required to propel up AIRASIA, MASTER, KNM, ARMADA, FGV and ANNJOO, which are all in re-accumulation bullish bias.

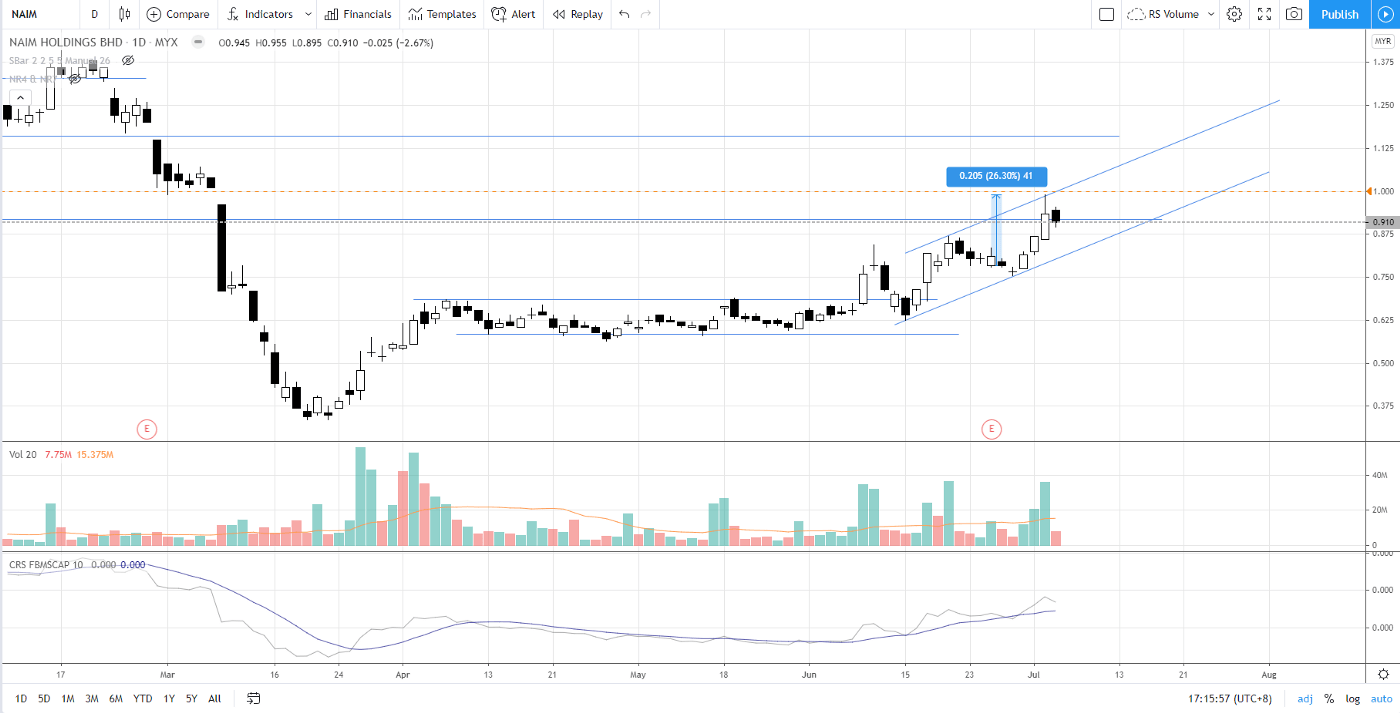

Stock A as mentioned in Week 26 Market Round up, is NAIM, rallied up 26% to test 0.99, touching the overbought channel followed by a mild profit taking reaction. It is likely to break above 1 to test higher targets.

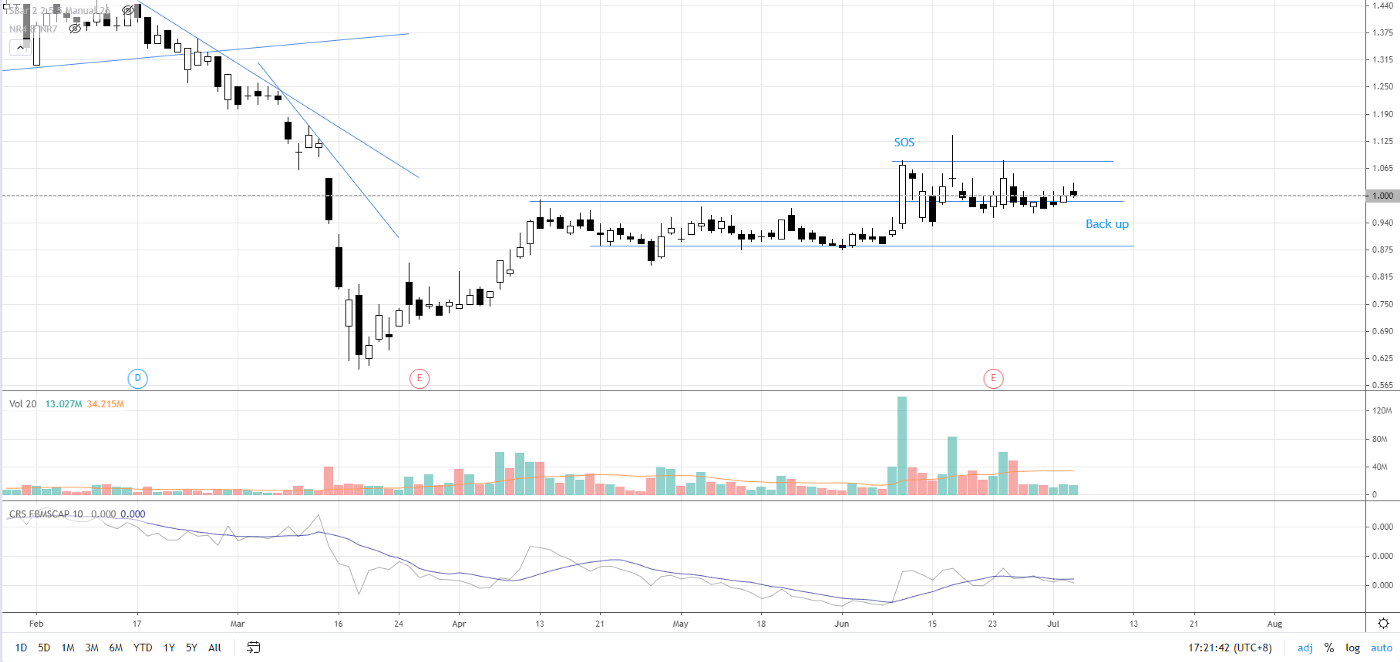

Stock AA, a Malaysia stock (Electronic Manufacturing Service provider) with a nice re-accumulation structure, currently under backup action range pending to scale higher. Commitment above 1.05 is needed to kick start the rally.

Stock Watchlist — US

MSFT (MICROSOFT) broke all time high and closed at 206.26 in the markup phase E.

BYND (BEYOND MEAT) — tested the support level at 127 and bounced up to 140.7. A trading range between 127–163.

FB (FACEBOOK) — Instead of having a sign of weakness (SOW), FB had a shakeout with quick recovery above 230, which is still bullish. The commitment last week violated the distribution scenario.

IBB — A reversal from the backup action happened last week. It is likely to break above 140 to test the uncharted zone. This ETF containing 5-years cause built with huge upside potential.

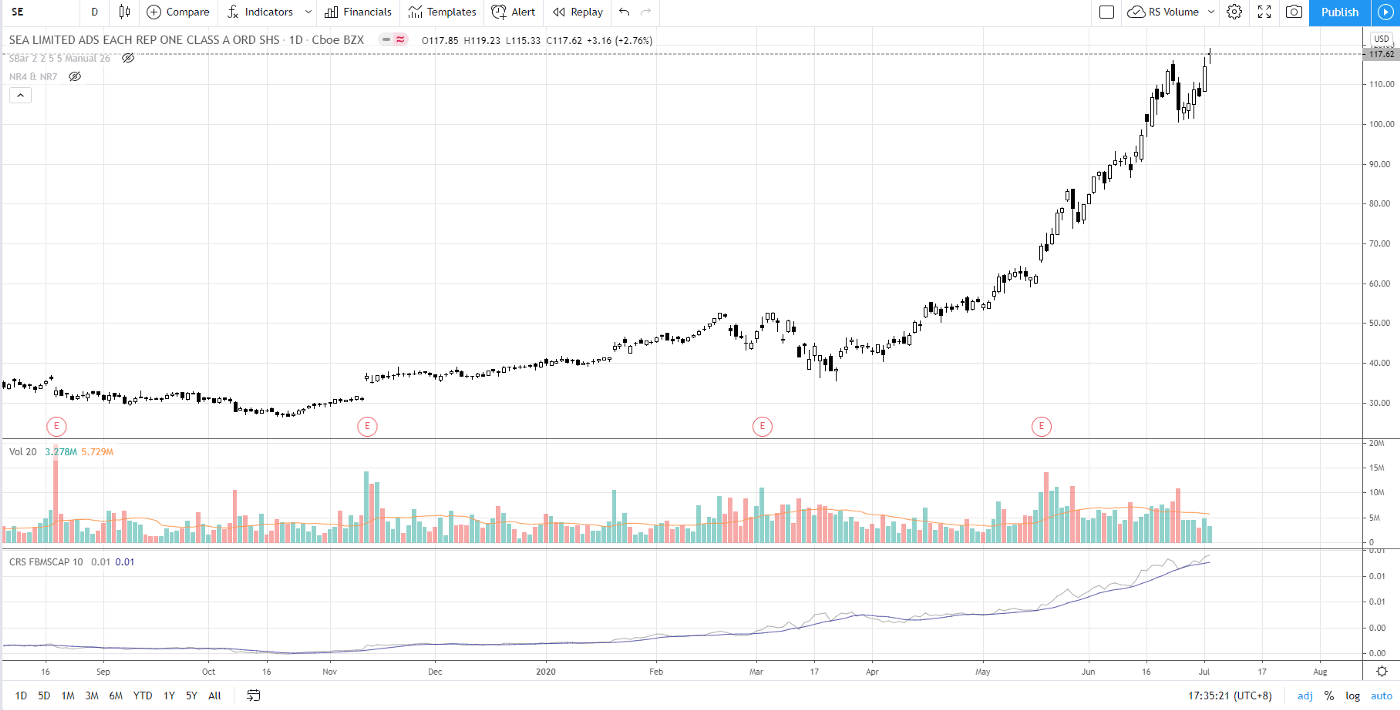

Stock X, as mentioned in Week 26 Market Roundup, is SEA Limited. This is the company behind SHOPEE platform, a popular online shopping platform in South East Asia. It broke all time high after a reversal from the reaction.

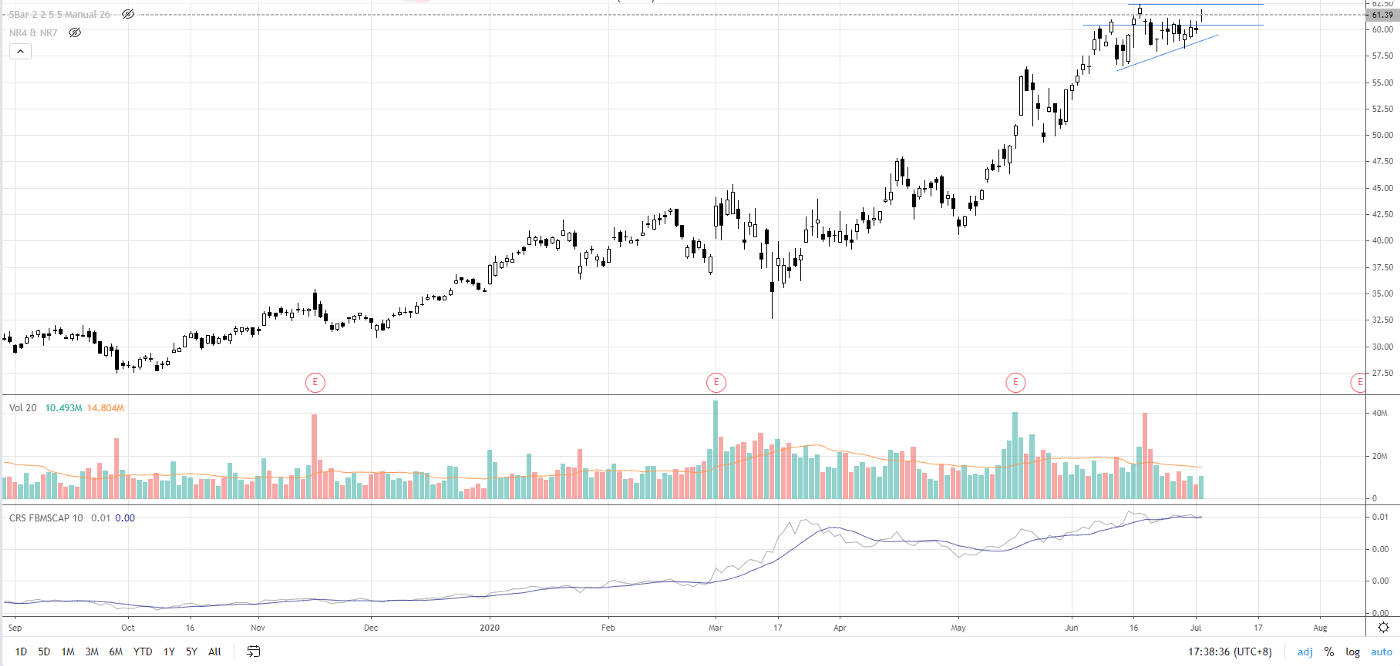

Stock Y, a popular e-commerce platform in China, listed in NASDAQ, is about to break all time high out from the small re-accumulation structure.

Study their charts and you should find them interesting in terms of price structure and volume signature.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD gathers traction, approaches 1.1800

EUR/USD manages to reverse Tuesday’s pullback, advancing to two-day highs near the 1.1800 hurdle in the latter part of Wednesday’s session. The pair’s decent uptick comes on the back of the modest retracement in the US Dollar, as investors continue to closely follow developments on the trade front and news from the White House in the wake of President Trump’s SOTU speech.

GBP/USD challenges multi-day highs near 1.3530

GBP/USD leaves behind the previous day’s decline and regains fresh upside traction on Wednesday, surpassing the 1.3500 barrier in a context of a modest decline in the Greenback and a generalised improved mood in the risk-linked space. Meanwhile, the US tariff narrative continues to dictate the mood among market participants after Presidet Trump’s SOTU speech failed to surprise markets.

Gold remains bid and close to $5,200

Gold buyers are returning to the fold on Wednesday, targeting the $5,200 area and possibly beyond, after Tuesday’s corrective dip from monthly highs. The rebound in the precious metal comes as the US Dollar loses traction, with Trump’s SOTU speech offering little fresh direction and AI-related nerves continuing to ease.

Crypto Today: Bitcoin, Ethereum, XRP test rebound strength as ETF inflows return

Bitcoin, Ethereum and Ripple are gaining traction at the time of writing on Wednesday, amid persistent market doldrums. The Crypto King is up over 2% intraday, trading above $65,000 from the day’s opening of $64,058.

Nvidia earnings to influence AI trade and broader market sentiment Premium

For the last three years, Nvidia has been the engine of the AI boom, and now Wall Street is watching to see whether that momentum can keep going. High-growth stocks have been struggling to maintain their bullish trend in 2026.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.