By Jeff Greenblatt

The best way to predict the future is to have an understanding of the past, noted master trader W.D. Gann who had more than 50 years of experience in financial markets and did research dating back hundreds of years. What he found to his satisfaction was that history repeats, and the past is the best predictor of future prices. His forecasts of time cycles over a half century proved to be accurate because those cycles are based on human nature, which does not change.

Gann was a complex individual. He sold his master course during the Great Depression for $5,000 — a small fortune in today’s dollars. People paid the price, but found a lot was left to interpretation, perhaps akin to Gann dropping a 1,000-piece jigsaw puzzle on your coffee table and leaving you to assemble it without a picture. Needless to say, today’s generation of traders would expect more out of an expensive trading course, so it’s understandable why so many find his work mysterious and confusing.

We can’t conquer Gann’s mysteries in one article, but we can put a few practical pieces of that puzzle together.

According to Gann himself, one of his most important and valuable discoveries was that price squares with time. This means that it’s possible to forecast important changes in a trend with greater accuracy because an equal number of price points balance an equal number of time periods. There are variations, though. We’ll look at some macro examples and then one that is applicable to everyday trading.

Crash matters

The high in the Dow Jones Industrial Average before the 1987 crash came in at 2,746.6 and bottomed out at 1,638.3, for a range of 1,108.3 points (see "Crashed out"). When we take the time from Aug. 25, 1987, to Nov. 21, 2008, it comes out to 1,108.4 weeks. We must overlook that we are working with a Dow top (the Nasdaq 100 topped in October 1987, two months later than the Dow) and an ultimate Nasdaq 100 bottom on that date. This market evolution is one of the complex adjustments we must make because Gann dealt mostly with the Dow and S&P 500.

It is beyond doubt that the range from the 1987 sequence has squared time to the point where the market traced out one of its bear market bottoms on Nov. 21, 2008. With all the bearish sentiment the past couple of years, each sell-off demonstrates how much the cyclical importance of the bear market bottom is misunderstood — as well as its ties to the cycle top of a generation earlier.

The 1987 high was recognized as an important top for the entire decade, until it was taken out in 1989 on the recovery that led to the bull market of the 1990s. The 1,108 number also appears to be critical because 1108.49 is also the low for the Nasdaq Composite in the bear market in 2002.

The 2008 Nasdaq 100 low is not just some random pivot, but a point in history tied into long-term market cycles. It should be put into context with current investment and trading decisions. Every market sell-off will not lead to new bear market lows. However, given that low is so important, it would take a powerful leg to violate and invalidate it.

The next example is of a smaller degree but no less significant. The S&P 500 bear market had a range of 1576.09 to 666.79 for 909.30 points, which topped on Oct. 11, 2007. If we take the number of calendar days from Oct. 11, 2007 to the April 26, 2010 high we get 928 days, so apparently it doesn’t work.

However, the market is never easy and it makes you dig as it attempts to conceal its true hand. When we take the Nasdaq top from Oct. 31, 2007 to April 26, 2010, we get 908 calendar days, which puts us off by one. (A margin of error of plus or minus one is acceptable.) The relationship marked an important trading leg down.

Much of Gann’s material is a mystery to modern day traders. One reason is that not all of Gann’s principles are clear. Perhaps the master wanted his students to do their own due diligence. There are several variations to this concept. The range will square over a long period of time. In the case of the Dow and Nasdaq 100, time squared with the range from the extreme high back in 1987 to a market bottom. In other instances, the trader might have to calculate from the extreme low. It also is possible a range such as 1,108 could have squared from either the top or bottom and terminated to create the top. It’s important to be open to all of the possibilities.

Granted, this can be confusing, and Gann never envisioned his methods to be used in a fast-paced Internet world. Given that, it is no doubt more challenging for modern traders to exploit these techniques.

21st century Gann

Shorter-term trading requires an adjustment and the manipulation of the decimal point. The Dow bear market of 2007-09 had a high of 14,198 to a low of 6,470, for a range of 7,728 points. From the bottom on March 6, 2009 to Aug. 27, 2010, when the Dow made an important turn after the August sell off at 9,937, few people realized that it was 77 weeks off the bottom.

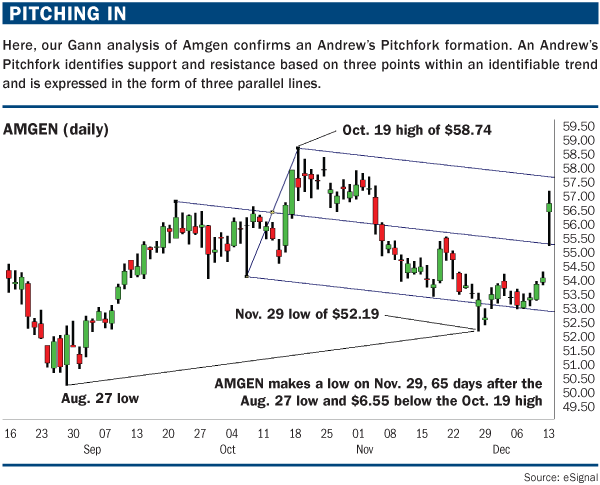

Amgen had a low on that August turn and found another low 65 trading days later (see "Pitching in"). With a high on Oct. 19 at 58.74 and a low at 52.19, there was a range of 6.55. In a world with a five-digit Dow, four-digit SPX and either two to four digits to the right of the decimal on futures or forex, traders must adapt.

In the case of 7700/77 or 65/6.55, the meaning is the same. This can be used as a standalone technique or in combination with another tool. As we have seen, it would be hard to combine a long-term range calculation with any other method. However, shorter-term trading is about developing conviction about a move and the more evidence the trader can stack, the greater the probability he or she will get to the point of allowing a winner to run.

For example, the Amgen move is combined with an Andrew’s pitchfork. This particular pattern reversed right on the lower pitchfork line to give the trader more confidence in the overall technical condition. There was good evidence to take the initial trade, but with early congestion, it may have challenged the trader’s faith. Eventually, this move gapped through the midline right to the upper channel, making it a good swing trade.

Another variation is where time and price square in the same place. A great example of this was the April top in the KBW Bank Index (see "Banking on it"). The high since the March 2009 bottom came in at price point 58.81 in roughly 59 weeks. (From March 6, 2009 to April 21, 2010 it is exactly 58.71 weeks.) This method gives the trader a high degree of timing precision. If a square relationship can be identified on a key sector or important market leader, it can be a huge edge because the trader can leverage this information into many kinds of trading opportunities.

Gann’s techniques are so new to most of us that it is necessary to have an open mind as we approach them. For those practicing these methods for the first time, it will require practice and patience to learn to trust the pattern. Gann called the squaring the range with time method his most important discovery, and it is still as valuable today as it was in his era.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.