Use more than one approach

For continued and long term success in trading it is important to understand the conditions that best suit your strategy and then look to only implement your strategy in the most favourable market conditions. With this logic in mind it is also beneficial to develop more than one core strategy, a strategy that performs better in the conditions seen as unfavourable for the first strategy. Adopting this approach allows you to diversify your efforts and ensure that you are mainly operating strategies suitable for the conditions present during each trading period, which depending on your time frame may be a day or a month.

When markets are trending and prone to sustained directional moves in price, it is best to employ breakout methods or to look to catch retracements in price which offer the opportunity to join a resumption of the trend, however, during range-bound periods of consolidation mean reversion tactics work best whereby you look to catch price as it moves out to extremes, targeting a reversion to the mean.

The power of VWAP

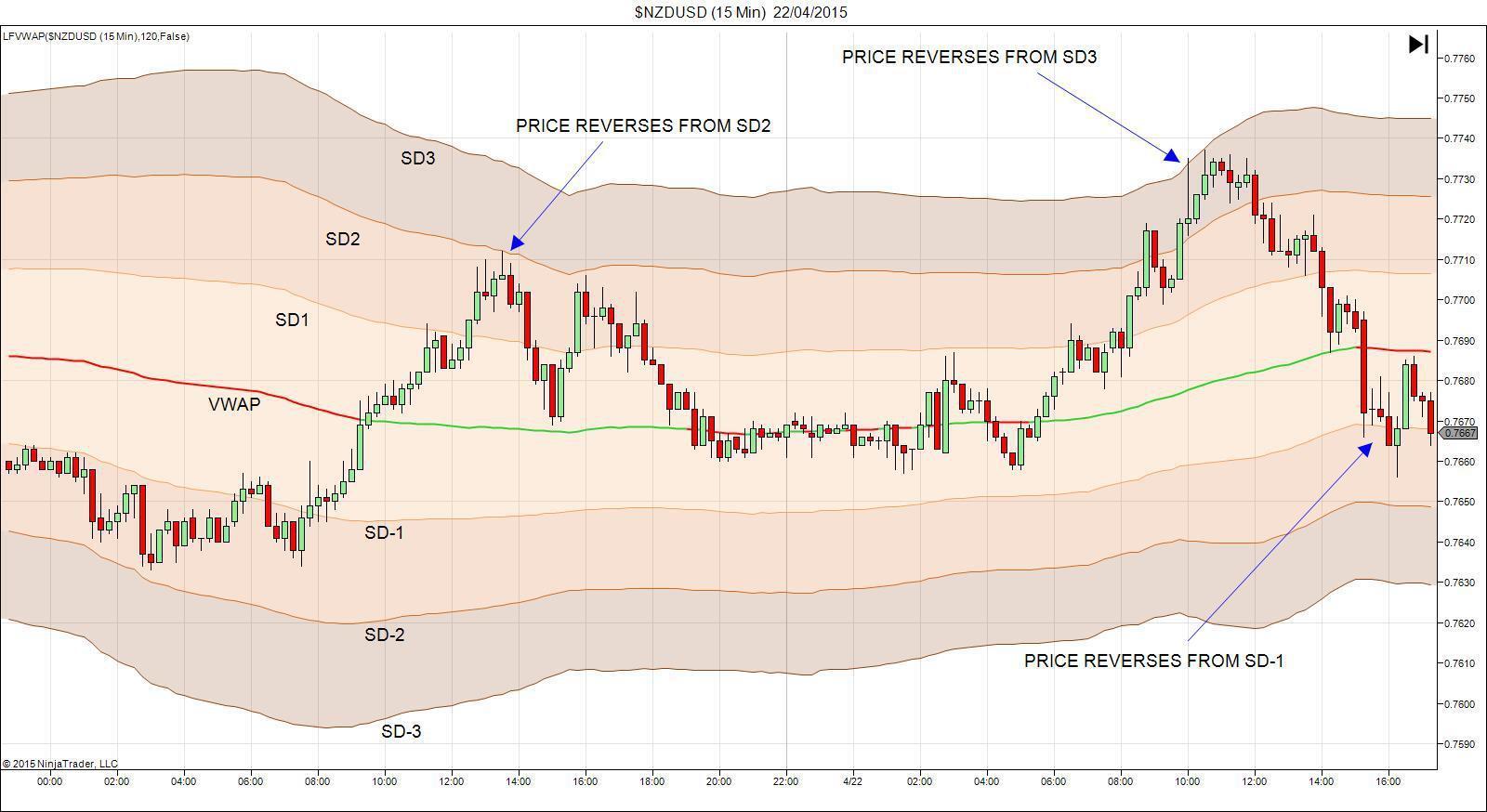

One of the best tools for trading a mean reversion strategy is VWAP. Typically we can use VWAP a lot like a moving average whereby we look to trend in the direction of price relative to the average e.g bullish when price is above and bearish when price is below. Once the market moves into consolidation and VWAP flattens out, it can be used to highlight really powerful support and resistance areas by tracking price against the standard deviations of VWAP. These levels offer really reversal opportunity as price becomes over extended from its VWAP and trades back into it.

The chart above shows NZDUSD 15min in a typical range-bound market. You can see VWAP is flat (indicating range trading) and price is simply rotating between the negative standard deviations as support and the positive standard deviations as resistance.

VWAP alone gives us the areas we are looking to trade and we can trade the levels effectively just using basic price action but if we want to be more conservative with our approach we can looki to use an added filter to confirm our trades.

VWAP & Delta

Delta (Book pressure) is a highly sophisticated indicator that measures the net difference between buying and selling strength in the market and also the difference between the volume traded at the bid price and volume traded at the ask price. Delta is brilliant for illuminating the strength of order flow in the market and can be used alongside VWAP to identify when order flow looks set to reverse as the indicator begins to diverge from price.

Where we can identify Delta divergence at the outer standard deviations of VWAP we know we have a high probability mean-reversion setup. If we focus solely on the 3rd standard deviation only, the probability becomes even more favourable.

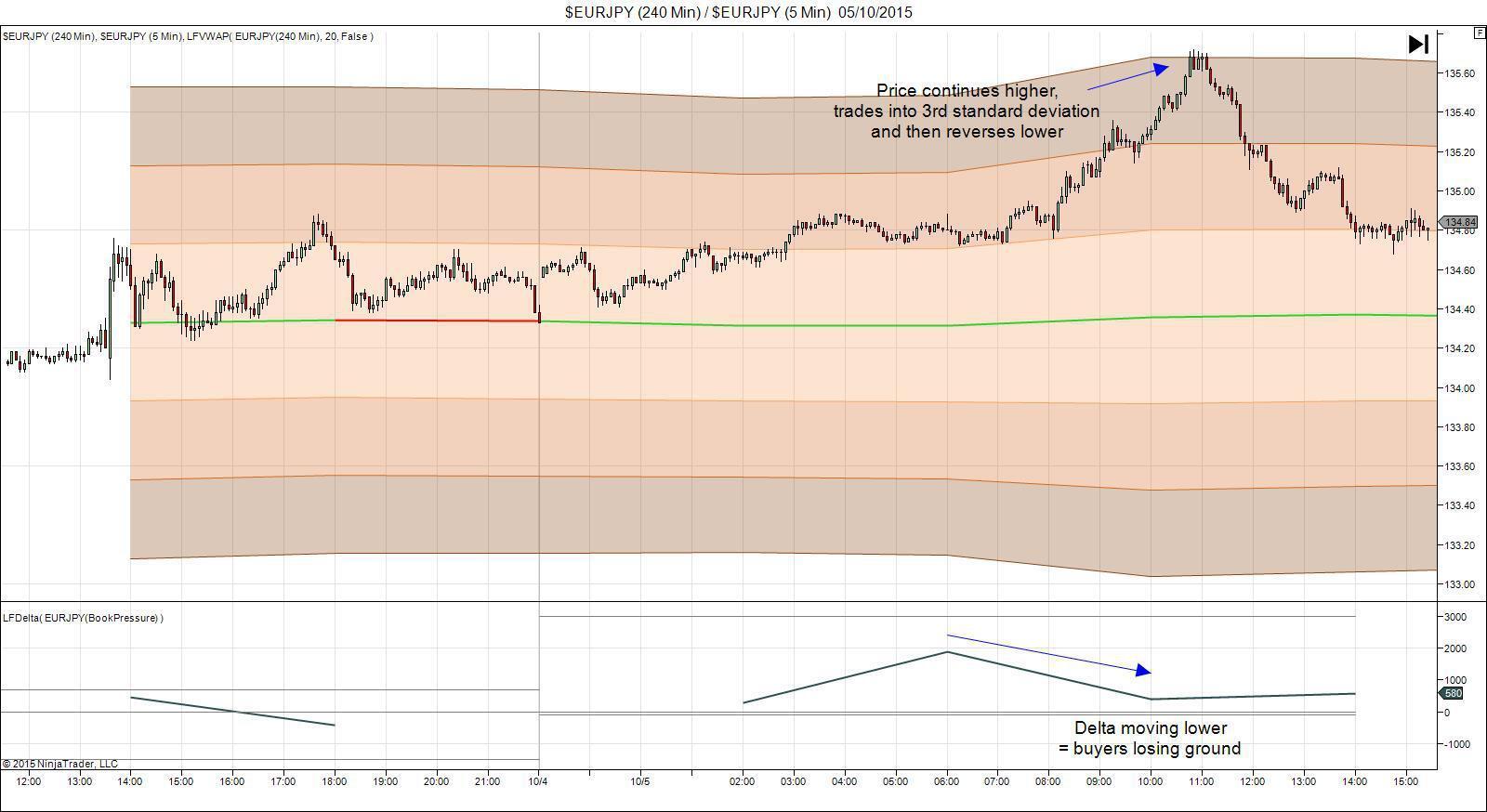

In the chart above we have the EURJPY 4hour VWAP overlaid onto 5-minute price action. The 5 minute price action allows us to see the most initial reaction that price displays when it tests the H4 VWAP offering fantastic scalping opportunities.

Delta is most powerful on an intra-day basis where it is highly sensitive to order flow, however, when used on higher time-frames ,although less sensitive it still gives fantastic insight into the general order flow make-up of the session.

We can see that price is trading in firmly range-bound conditions with VWAP flat. As price begins to travel higher from VWAP we can see that Delta is trending upward highlighting the strength of buyers in the market. Notice however that by the time we reach the second standard deviation, Delta has started to diverge with price, indicating weakening demand. By the time price has pushed up into the third standard deviation (our potential trade zone) we can see that Delta is showing strong bearish divergence and we can see that price stalls out at the third standard deviation level, where we can initiate shorts looking for price to rebound to the second standard deviation as an initial target and a return to VWAP as a final target.

As you can see, price sold off from the reversal at the the third standard deviation and hit the initial target at which point we could move stops to break-even. Price then continued to sell off and eventually made our final target at a retest of VWAP.

These extensions of price into the outer standard deviations of VWAP during range-bound conditions, using Delta to highlight divergence, are fantastic mean-reversion setups that you should definitely look to build into your strategy portfolio.

In the EURJPY example above, the range is very easy to spot because VWAP is totally flat. However, once you get good at identifying range-bound conditions you can begin to use VWAP in more advanced ranges such as channels and wedges.

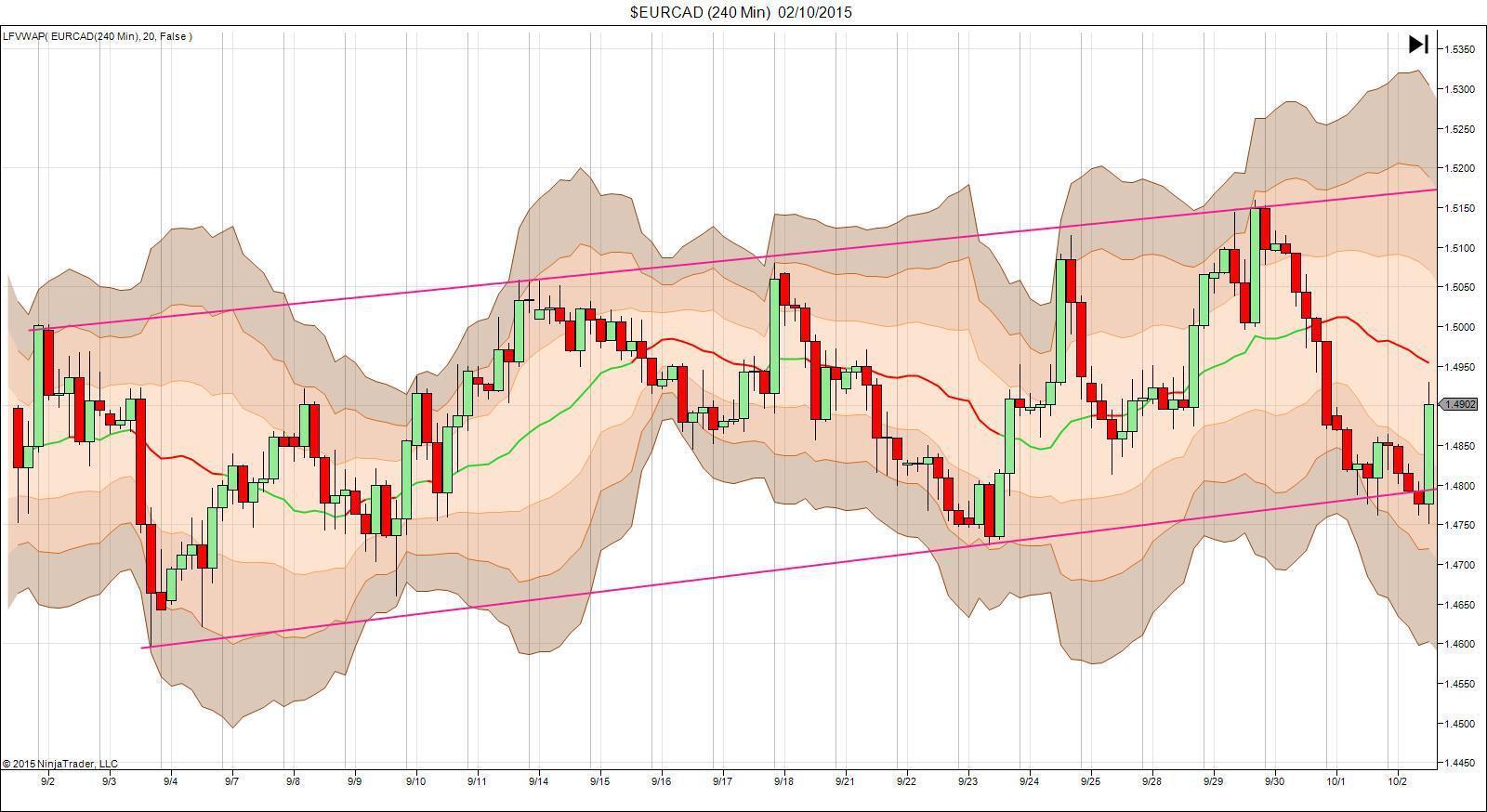

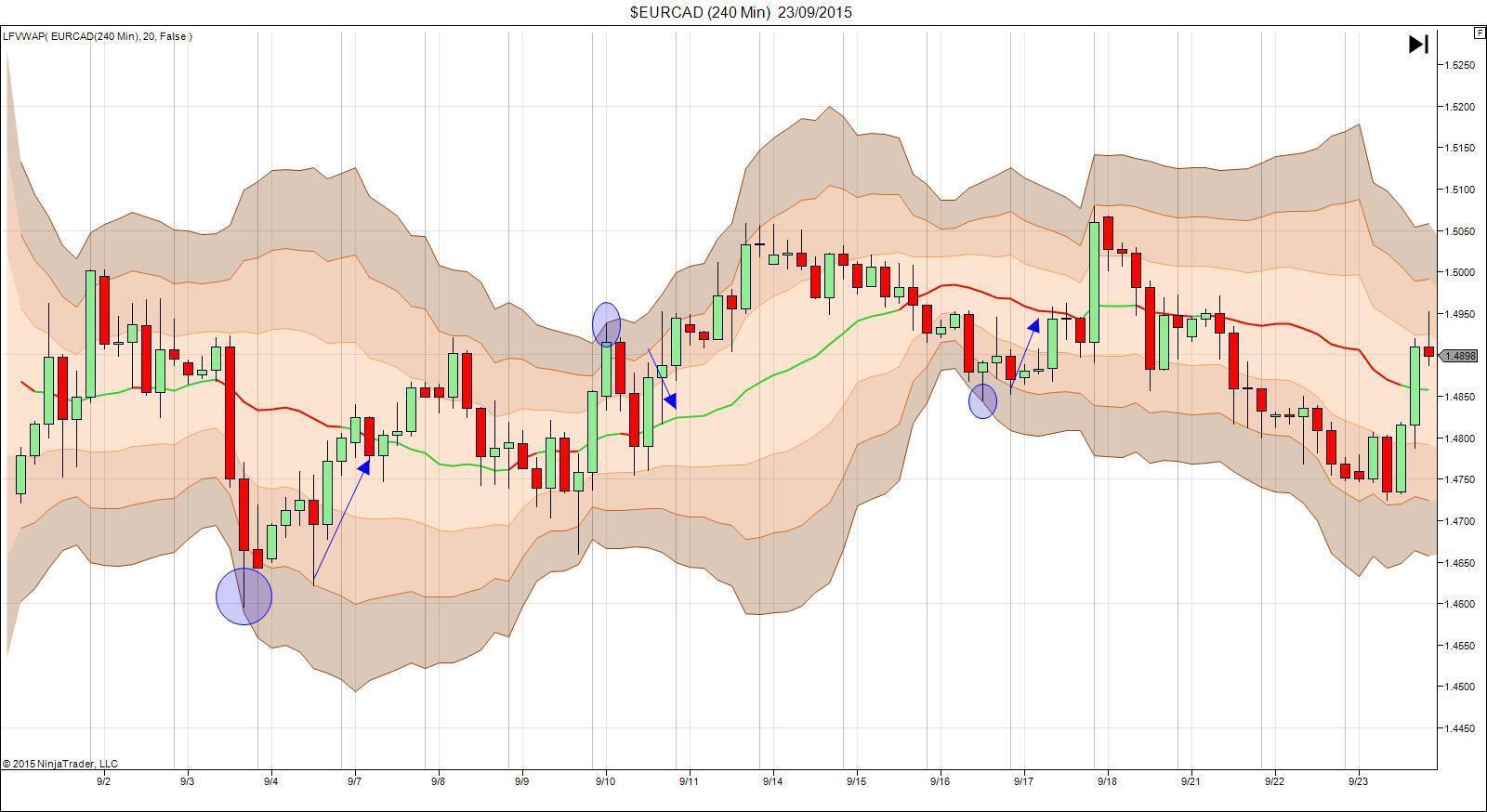

The chart above shows EURCAD on the 4 Hour charts and we can see that price is stuck within pretty confined consolidation. Although VWAP is not totally flat it does remain fairly direction-less showing only a very slight curve in either direction as price rotates between the initial high and low points of the range.

Notably, each of the three occasions that price moved out into the 3rd standard deviation of VWAP we saw price sharply retreat back into VWAP with between 100 – 300 pips worth of movement, highlighting the potential profit to be made from fading these moves.

The chart above shows that price is simply rotating within a very clear channel formation and whilst the channel holds, we can continue to use VWAP to fade moves into the outer standard deviation levels to play for a reversal back to VWAP.

Once price breaks out of this channel and VWAP starts to follow a steeper curve (indicating a strong directional move) we know that the market is likely moving into an expansion phase (a trending period) and we then cease looking to fade these moves and change tactics to looking to sell a retest of VWAP as price retraces, to join the bearish trend.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.