When trading Forex, one can either choose to follow the myriad rules that other traders have put in place or go their own way. The path chosen will depend on several factors, such as experience, technical knowledge and risk appetite. As the saying goes, smooth seas never made a skilled sailor - and the same can be said for traders.

While everyone is free to forget their own path to becoming a successful trader, others may prefer to adopt a tried-and-tested strategy that has helped many traders before them. One of these strategies is based on breakout situations – how to prepare for them, how to spot them and how to react, quickly.

What are Breakouts in Forex?

Put simply, a breakout is a sudden sharp movement in the price of an asset, which moves away from the established support and resistance areas. A rise in price indicates a bullish breakout trend, whereas a decrease in price indicates a bearish market.

Think back to the first time you tried to interpret a chart and you most likely felt it was impossible to draw patterns between price movements. While markets can be highly unpredictable, breakout patterns can help a trader see the charts in a whole new light. Once breakouts start to be identified, a trader begins to view the marketplace as one large puzzle, waiting to be solved.

Types of Breakouts

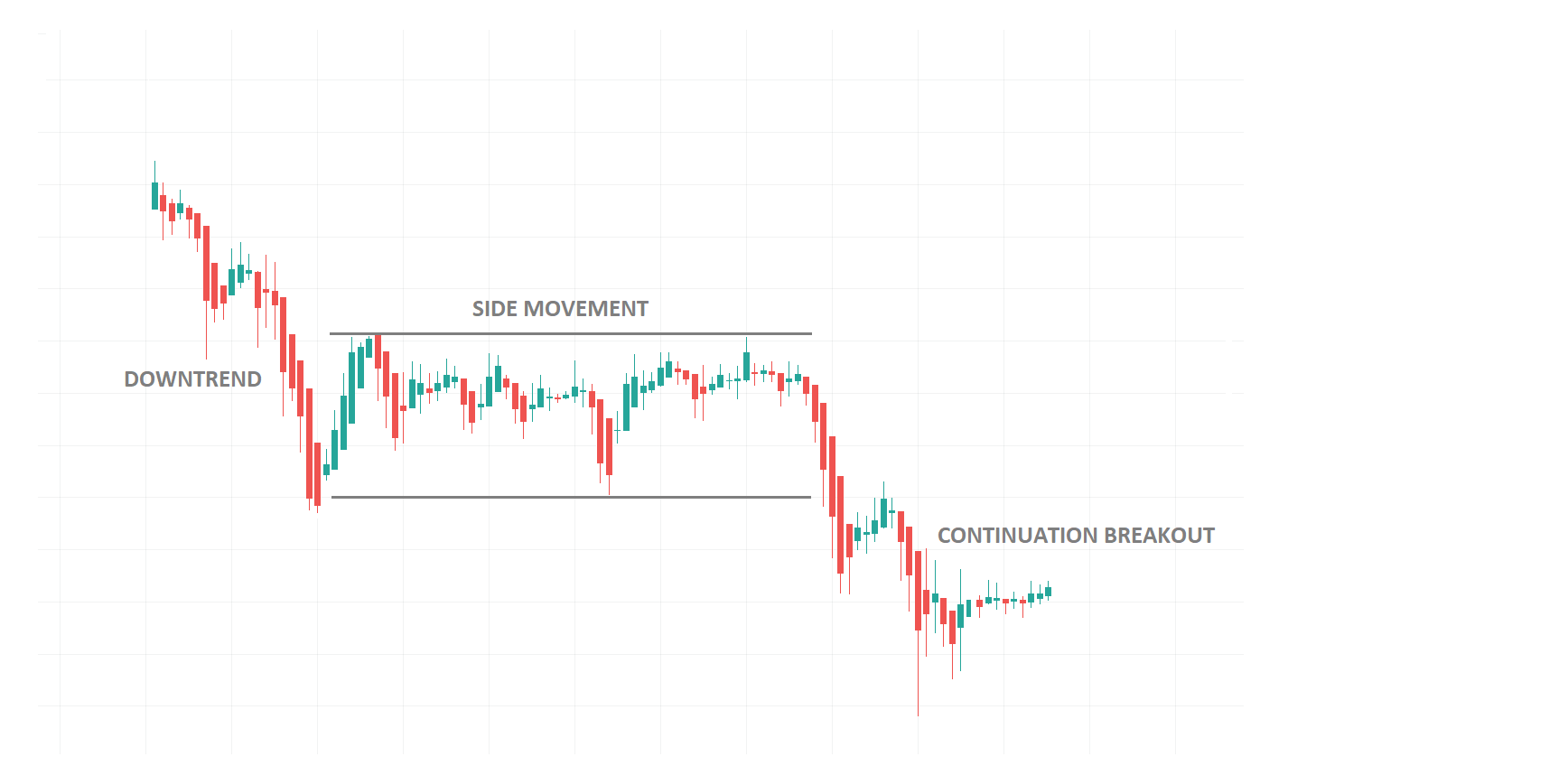

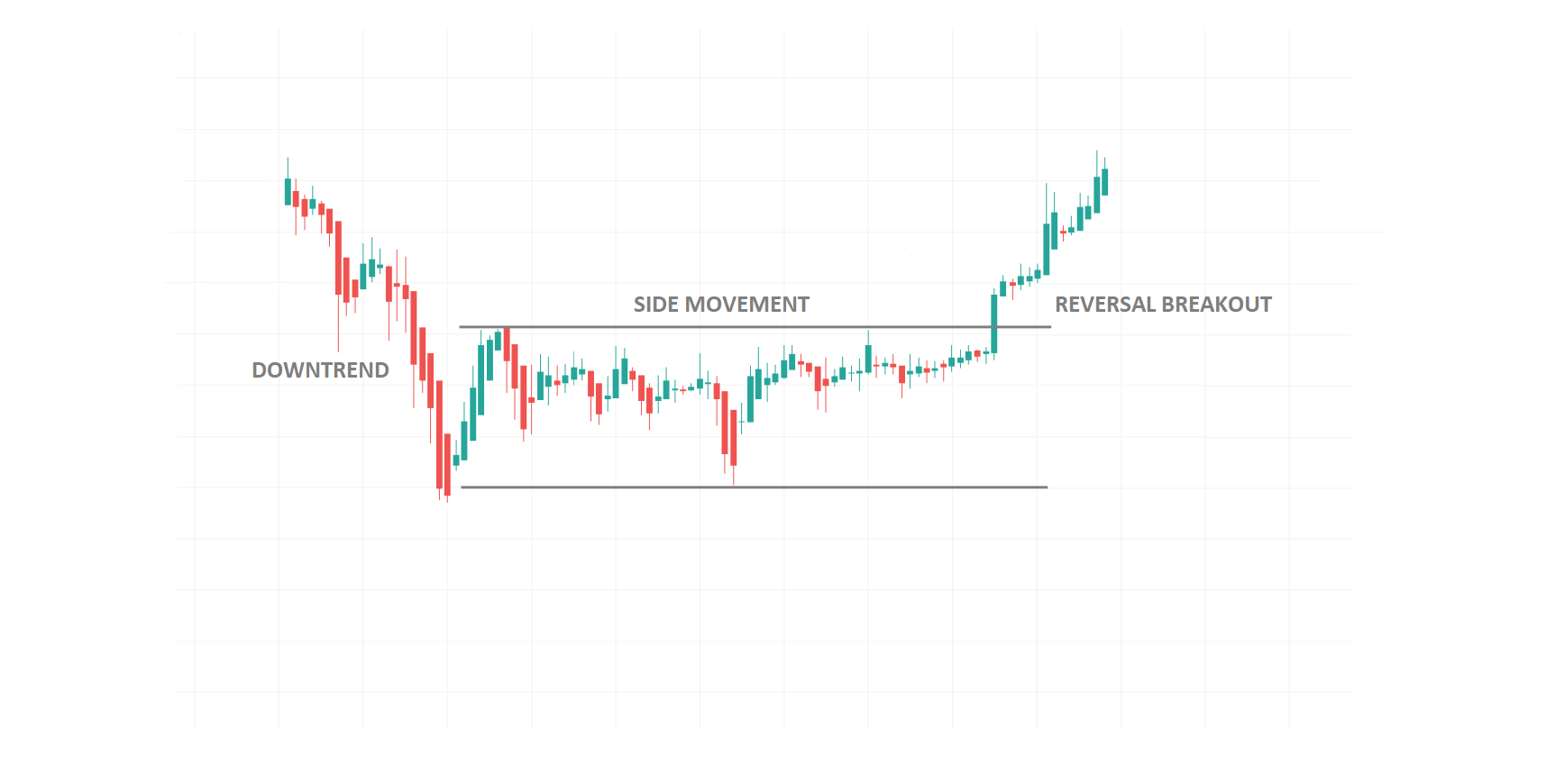

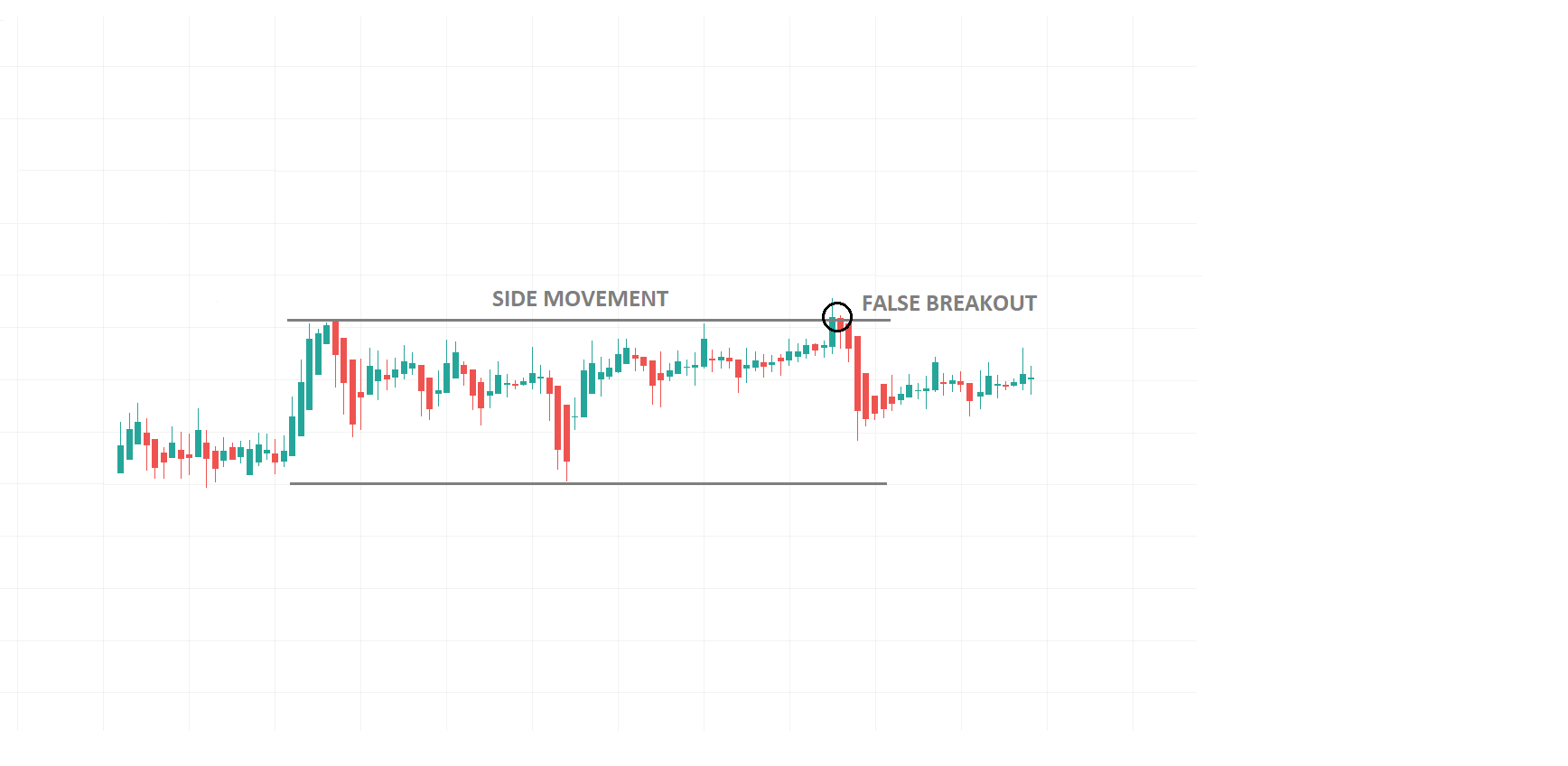

Breakouts can be categorised further into continuous, reversal or false breakouts. Something that all breakouts usually have in common is they occur after a period of consolidation, during which traders pause to consider their next actions. If traders decide that the trend is moving in the right direction, a continuation breakout could occur. If they believe the asset has been overbought, however, a reversal breakout could take place instead. Alternatively, a false breakout could result in a shortterm spike beyond the support or resistance level, only to return to the established areas.

Continuation Breakouts

Reversal Breakouts

False Breakouts

How to Identify Breakouts

At first, looking for breakouts can be a time-consuming process for traders who are new to the business. However, there are a few methods that have been designed to catch breakout points.

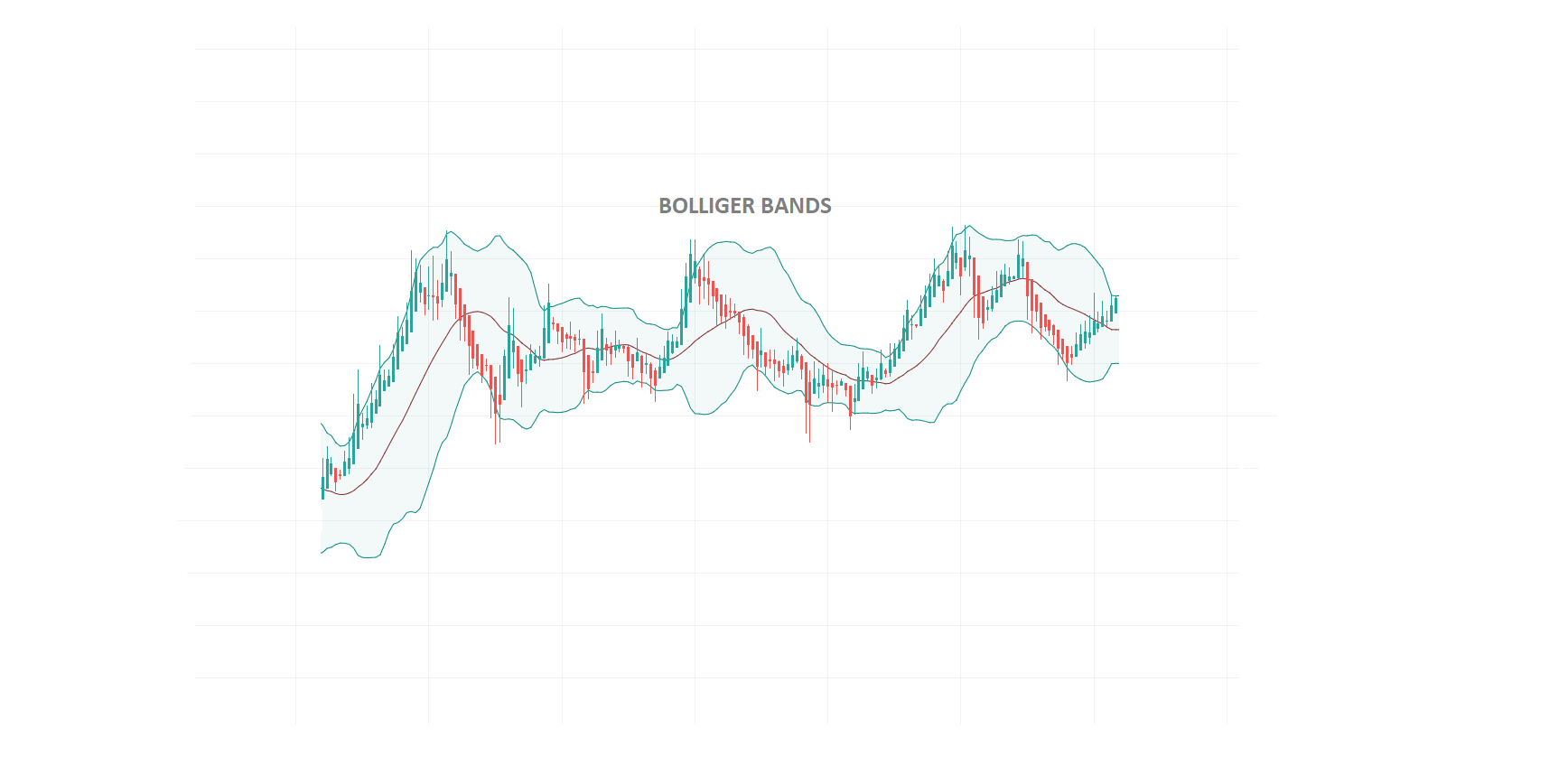

Bollinger Bands

Bollinger Bands are a technical indicator used to display areas of support and resistance on a price chart. They provide a visual representation of a breakout, as when prices reach the outer lines of the bands they often continue moving in the same direction, beyond the resistance or support lines. Traders can benefit from using Bollinger Band indicators by waiting for prices to move past the lines. As a general rule, the narrower the range, the tighter the period of consolidation. This means that once the breakout occurs, it will usually run with greater momentum.

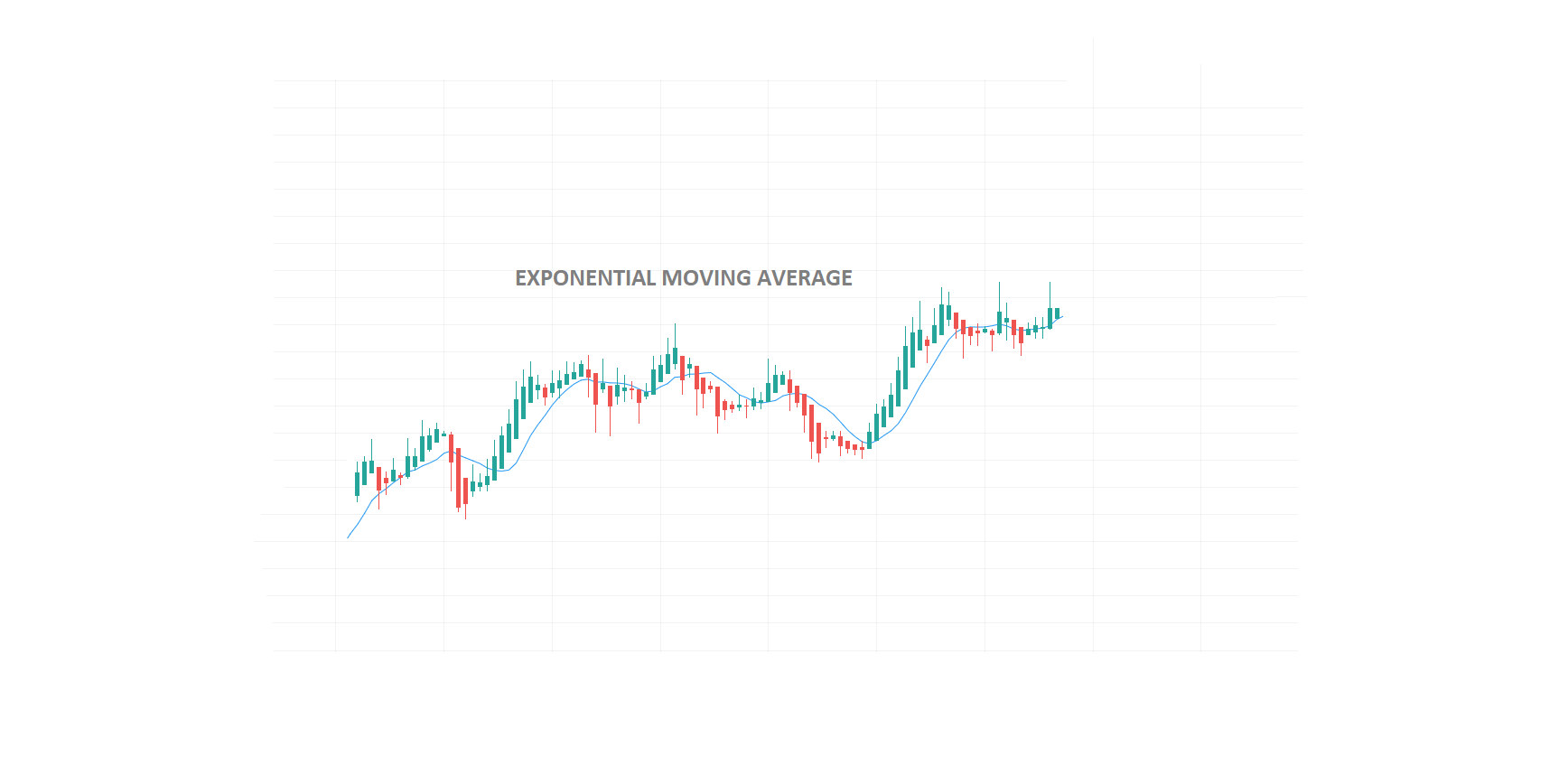

Exponential Moving Averages

Exponential Moving Averages (EMAs) are another indicator that can be used to trade Forex breakouts. By combining the 5, 30 and 50 period EMAs, you can pinpoint an upcoming breakout when the indicators flatten out. Once the shorter-term EMA breakout out from the established narrow range, it’s likely that an overall breakout will occur in the same direction.

Profit from Forex Breakouts

While no one strategy can guarantee high profits in every market, learning to understand how to trade Forex breakouts is a great skill to have. Practice trading Forex breakouts through a CedarFX demo account, or go live with a 0% Commission account or Eco Account.

Dedicated to bringing positive change to the environment, Eco Account holders can support CedarFX’s tree-planting mission, one trade at a time. Open an account with the world’s first Ecofriendly broker at www.cedarfx.com.

Trading leveraged products such as Forex and Cryptos may not be suitable for all investors as they carry a degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates

Unimpressive European Central Bank left monetary policy unchanged for the fifth consecutive meeting. The United States first-tier employment and inflation data is scheduled for the second week of February. EUR/USD battles to remain afloat above 1.1800, sellers moving to the sidelines.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.