So read on as we pick out our four must-have Forex indicators for 2015, and explain just why you should be using them every day of your trading life. In no particular order, we start with…

1. Psych Indicator

What It Does

- Displays neat visual aid on your charts

- Tracks market psychology to give clear trading signals

- Measures percentages longs/shorts in a given period

- Seeks to align with dominant market trend

Best Thing About It

- Trades against retail sentiment and trades in line with Banks and smart-money flow.

- Fantastic trend trading system

- Can be used on all timeframes

- Easy to understand, clear signals

- Works extremely well with other indicators to improve entries or even with basic candlestick patterns

What It Looks Like

Above we can see an example of the Psych Indicator applied to a candlestick price chart.

The indicator has two key elements to it:

- Firstly, the oscillator in the bottom panel, this oscillator is a pictorial representation of the extremes and mid points of the market psychology. Readings above 80 and below 20 suggest extremes in market participants psychology and suggest the potential for a turning point in the price action.

- Secondly, the arrow alerts that appear on the chart, these arrows suggest a psychological pattern that gives a high probability of price action to follow the candle that the arrow prints above or below. So when a green arrow prints we anticipate bullish price action to follow and when a red arrow prints we anticipate a bearish price action to follow.

Video – More Info

2. LFX Order Flow Trader

What It Does

- Tracks orders in the market to anticipate price movements

- Combines Order Flow techniques with trend following

- Displays neat visual aid on your charts

Best Thing About It

- Made OVER 39,000 Pips in 2014 across six pairs

- Extremely easy to use and very powerful

- Works on all timeframes

- With minor tweaks and optimising per underlying asset, it can make 20% per underlying per year on low to moderate risk

- Could be the only trading product you ever need

What It Looks Like

In the chart example above we can see how the Order Flow Trader indicator is represented on our price charts.

The indicator has two key elements to it:

- The indicator creates a pictorial representation of the order flow positioning of the larger market participants It does this in two ways primarily it creates an arrow alert that alerts us to a change in flow green represents buying pressure and red represents selling pressure.

- The second aspect of the indicator which serves as a continuous confirmation or filter is the shading and dot representation on the charts. Once a green/buying pressure arrow appears the next candle if it confirms the continuation of the current order flow will print a dot under the candle and a shaded area around the candle of the same colour as the order flow direction.

Video – More Info

3. Pin Bar Indicator

What It Does

- Automatically highlights Pin Bar on your charts

- Neat, clear visual aid

- Marks entries, stop loss and reward targets on your charts automatically

Best Thing About It

- Scans markets for pin bars so you don’t have to spend hours scouring the screens and ensures you don’t miss any trades

- Fully customisable so you can find and set the parameters for your optimum pin bars

- Works brilliantly with other indicators for high-probability trade setups.

- Extremely effective on all timeframes

What It Looks Like

There Are Two Key Elements To This Indicator:

- In the first chart above you can see the Pin Bar detector highlighting Pin Bars with Red arrows for bearish pin bars and green arrows for bullish pin bars.

- In the second chart above you can see the Pin Bar detector markers highlighting the Entry, Stop Loss and reward levels for the Pin Bar.

Video – More Info

4. COT Indicator

What It Does

- Automatically downloads weekly COT data from C.F.T.C report

- Displays clear and easy-to-read measure of positioning both current and historical

- Maps the direction of market participants

Best Thing About It

- Used within many funds and hedge funds to generate consistent annual returns

- If used on 4 or 5 key underlying assets on basic 182 day settings, you can easily return 10% per underlying on low to moderate risk per year. As a retail trader you can use leverage and easily multiply this.

- Means you don’t have to spend time deciphering the weekly data which can be daunting

- Gives you a clear directional guide of where Banks & Institutions are trading

- Allows you to track historical positioning against historical price movement to build profitable trading strategies easily.

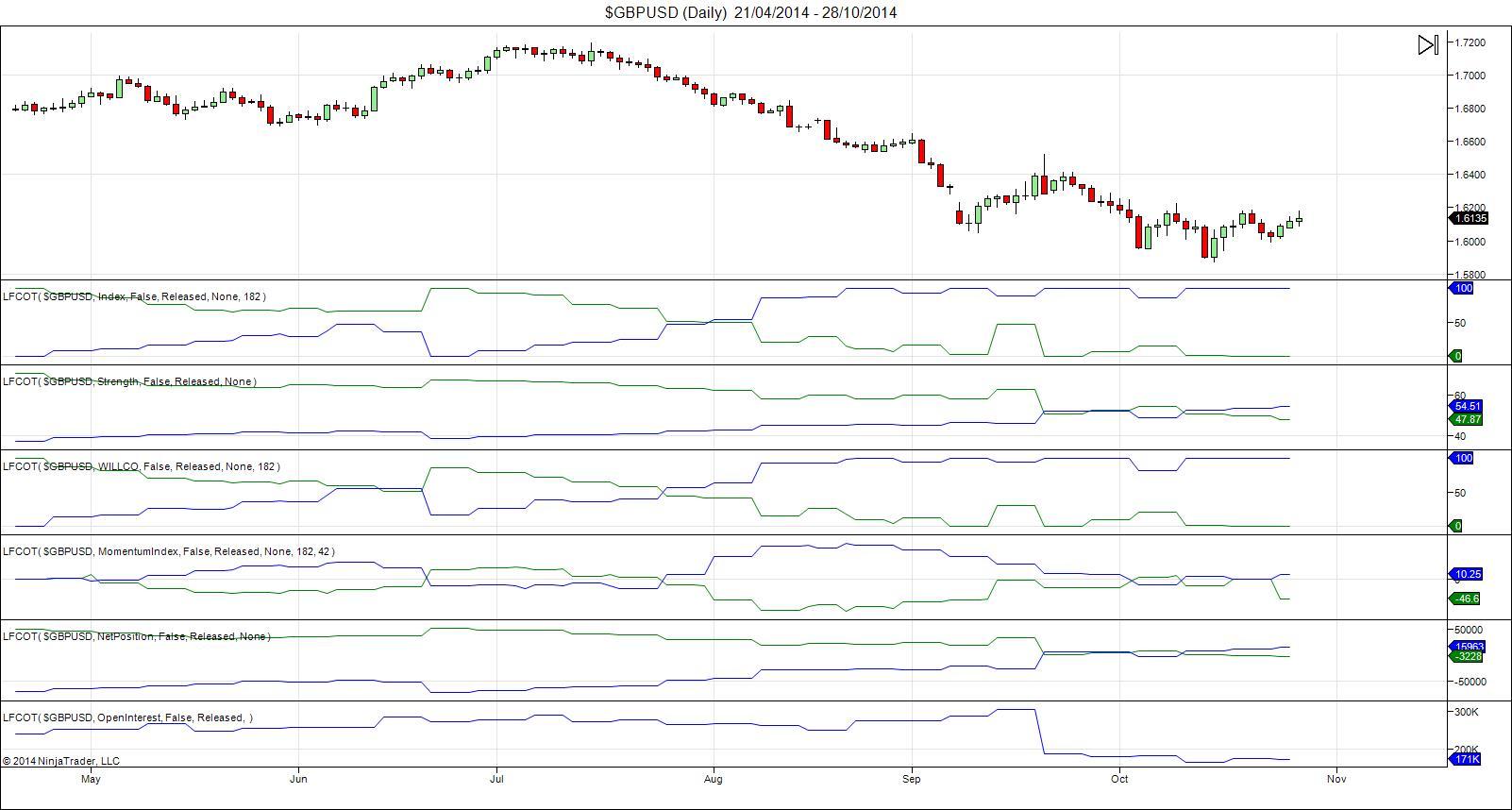

What It Looks Like

In the above chart we can see the COT indicator represented in the 6 panels featuring blue and green lines. Each panel is tracking a different measurement

Index – A normal stochastic on net positioning

Strength – Simply the net long position over the total net position, indicating the strength of the movement in overall positions

Momentum – Represents the difference between current Index and same Index 6 periods ago to provide a reference for trends reaching an end point

Net Position – Shows how the three types of market operator (Commercial, Non-Commercial & speculator) are positioned

WILLCO – An adjusted variation of the Index measure giving a slightly smoother reading

Open Interest – A volume tool showing the amount of open positions in the market

The Indicator Has Two Key Elements To It

- The green line shows the Non-Commercials (Banks & Institutions) that we look to align our trades with and the blue line shows the Commercials ( Corporates, Multi-Nationals) that we want to trade against

- In the chart above we only use green and blue lines for Non-Commercial & Commercial positioning but there is an option in the settings to turn on red lines showing speculators ( leveraged funds & other reportable)

Video – More Info

Editors’ Picks

EUR/USD trims gains, hovers around 1.1900 post-US data

EUR/USD trades slightly on the back foot around the 1.1900 region in a context dominated by the resurgence of some buying interest around the US Dollar on turnaround Tuesday. Looking at the US docket, Retail Sales disappointed expectations in December, while the ADP 4-Week Average came in at 6.5K.

GBP/USD comes under pressure near 1.3680

The better tone in the Greenback hurts the risk-linked complex on Tuesday, prompting GBP/USD to set aside two consecutive days of gains and trade slightly on the defensive below the 1.3700 mark. Investors, in the meantime, keep their attention on key UK data due later in the week.

Gold loses some traction, still above $5,000

Gold faces some selling pressure on Tuesday, surrendering part of its recent two-day advance although managing to keep the trade above the $5,000 mark per troy ounce. The daily pullback in the precious metal comes in response to the modest rebound in the US Dollar, while declining US Treasury yields across the curve seem to limit the downside.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.