You curse yourself for making trading blunders.

Also, anytime you lack patience, FOMO into positions or change your trade direction on a whim.

Keep reading to discover how combining three valuable insights can end regretful trades for good and instil confidence about your future trading.

Insight one

Before entering a trade, you always want to ask yourself, "Is the outcome known?"

I'm sure you understand the saying, "Buy the rumour, sell the fact".

Regardless of what you trade and the different methods used by institutions, algorithms, and market makers, this principle applies to everyone in the market.

Let me give you a quick example using Friday's trading.

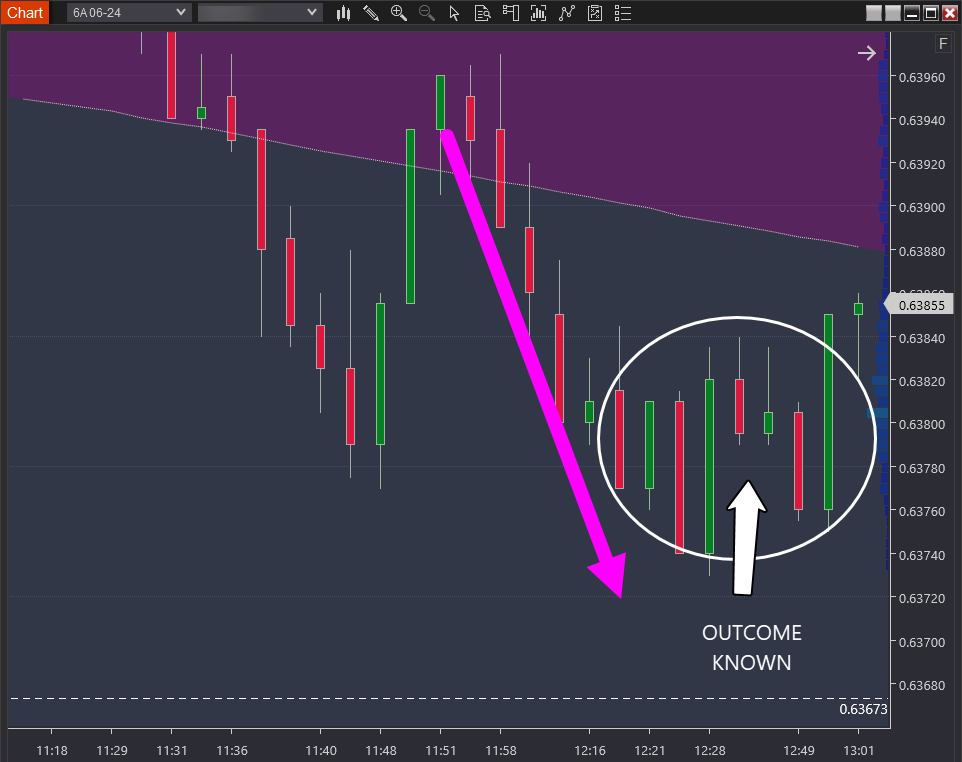

The first chart below shows a 'zoomed-in' view of the executions—only trading the short side.

The following chart you'll see is a 'zoomed out' view.

For context

The most successful blow in boxing is the "blindside punch"—a sudden, unexpected strike that the opponent didn't anticipate.

Similarly, the most successful market moves to trade are the unexpected moves that catch people off guard, using the element of surprise to gain an advantage. The pink arrow you see is the move down traded per the executions above—catching people off guard.

The white-circled area displays a stark contrast in behaviour. It refers to the 'outcome is known' when everyone in the market realises, "Geez, well, there's been a big move down." This period is by far the most challenging period to trade.

Why? Because there is a multitude of opposing views. Some are emotional, some flawed logic, but the outcome is akin to watching a tug-of-war that's a stalemate. Just as you think the team on the left has the upper hand, momentum shifts back to the right, and so on.

Successful trading requires entering your trade before 'the outcome is known' and exiting once known.

Exiting once the 'outcome is known' maximises your winnings. By contrast, setting a target is ineffective in capturing profits. You either exit too soon or give back open equity. Agree?

Insight two

Write this insight on a Post-it note and attach it to your monitors until it's deeply ingrained.

The market needs people to act irrationally and seemingly randomly to fund traders who understand how the game is played.

The most common time you'll witness this behaviour is when the outcome is known.

Consider this

When the market catches traders off guard, it's flush with traders exiting losing positions. You are not witnessing an even distribution of varying views and strategies in action.

But once the dust settles and the outcome is known, you'll see trading activity representing various views and strategies.

These are the optimum times for the market to capture profits from 'you' to fund the traders who understand how the market functions. Make sense?

When you deeply understand this, your participation completely transforms. You no longer fight with the market as if fighting against the market can ever work in your favour.

Instead: These are the periods when you know the market is executing its playbook to take money from unsuspecting traders.

And the longer it takes to execute its playbook on the unsuspecting, the bigger the number of traders it's capturing as the source of fuel for—you guessed it—the next 'before the outcome is known' event.

If there's one thing the market does with repetitive consistency, it's executing its playbook.

This means that your good idea (a game plan) can pay you several times over.

Let me show you using Thursday's game plan.

If the market moves from its current level, reaching the white-boxed area, trading on the long side is triggered.

The charts below show two opportunities to execute the above game plan.

The first time at midday and the second at 4 PM are examples of trading before the outcome is known.

And what about the period between them? Its classic outcome is known behaviour.

These periods can feel like they last a lifetime. But it's part of the market's playbook. Time for you to grab the popcorn and watch the show.

Full disclosure: I attempted three scalp trades between the two trade sequences above and lost on all of them.

Insight three

When you incorporate a multiple-points-of-evidence approach to trading and implement authentic playbook trades, you'll discover your trading opportunities don't coexist with the market's playbook. It's your ultimate defence against the market.

People often focus on finding trades to make money. But the secret to trading success is disqualification—and professionals know it.

You can filter out all the 'outcome-is-known' scenarios while the market executes its playbook using a brutal evidence-based framework. Make sense?

In summary

Your playbook makes you money and protects you from the market's playbook—which exists to take money from you.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD revisits 1.1780, or daily lows

EUR/USD now comes under further selling pressure, breaking below the 1.1800 support to reach daily troughs on Thursday. The pair’s decline comes in response to a sudden bout of USD strength amid steady geopolitical tensions. Ealier in the day, the ECB’s Lagarde delivered cautious remarks, although the currency remained apathetic.

GBP/USD makes a U-turn, challenges 1.3500

GBP/USD rapidly leaves behind Wednesday’s strong advance, putting the 1.3500 support to the test on Thursday. Cable’s deep pullback follows the strong gains in the Greenback, while investors continue to pencil in a potential BoE rate cut in March.

Gold sticks to the bid bias, flirts with $5,200

Gold is now facing some downside pressure, hovering around the $5,170 region on Thursday. The precious metal adds to Wednesday’s optimism despite the Greenback trades in a firm fashion, although geopolitical tensions in the Middle East keep the yellow metal bid for now.

Stellar: Relief bounce fades as bearish undertone persists

Stellar is trading around $0.16 at the time of writing on Thursday after rebounding more than 8% in the previous day. Derivatives data paints a negative picture as XLM’s short bets hit a monthly high while Open Interest continues to decline.

The one thing everyone is on the lookout for is US action of some sort against Iran

The FX market is minestrone soup these days. It is befuddled by conflicting data, rumors and small stories exaggerated out of proportion, and Trump-generated uncertainty.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.