Let’s face it, there has been much discussed about Ego. That sense of getting carried away with yourself, bigging yourself up, making yourself the only thing that matters. But in trading and certainly with many clients I coach and mentor there is little appreciation of exactly how ego fits in with trading and how variable your state needs to be through the trade process.

For a start, we all know that to trade you need to make a commitment, a decision, to pull the trigger. The truth is that you need to turn up your own emotional temperature, your ego, to do that. Otherwise, you just screen stare with all of the indicators screaming “Buy” but you didn’t buy, locked in a state of observational normality and watching the trade profit into the distance with you not on board. The trading world is full of those “could have been” trades.

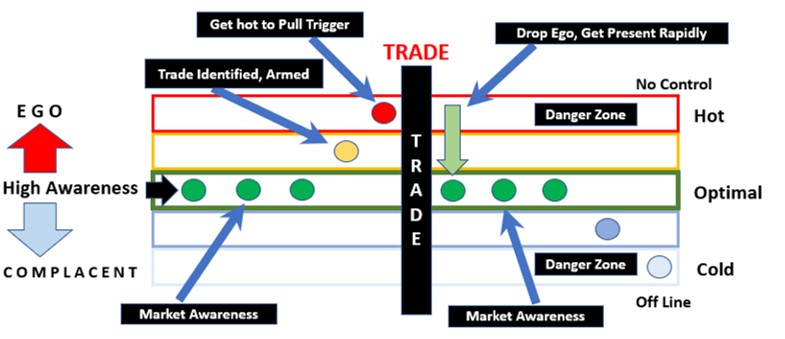

Trading commitment and the associated emotional decision thus becomes very critical to the process of putting on a trade. It comes from moving your state from that of open market awareness, looking for ideas, tuned into the flow, leading to the emergence of an insight. And at that light-bulb moment your attention then needs to switch internally, a kind of slap in the face to wake you up, get smart, get prepared, and then bang, the trigger is pulled, commitment drives the trade and risk is in play. The next step is critical. you need to drop the ego with risk on, you need to reset and recalibrate yourself to a natural state of calm and open awareness, watching out for curve balls, sensitive to peripheral risk, and with your trade radar tuned to spot counter trade signals. In essence, you need to get present, and do so rapidly. You can do that via a breath exercise to bring your attention to your senses to open up to your instinct and intuition, creating a state of HDMI awareness. You can do it via a quick bit of outside exposure, a walk, I even know someone who washes his face with cold water to mark the state of awareness he needs to be in to be managing “Risk On”. This state is where you own your market strategy, you own your observation, your decision making, and importantly the trajectory of the trade.

If you do not do this process of self-re-alignment post trade then you have significant “Ego Risk”. Staying emotionally “Hot” post trade risks you gripping the trade too tightly, to the point where the market now owns you and you’ve lost control. Trade profitability is outside of your control, your self-belief and trade belief is so hardwired to that trade, so hard that you cannot escape its grip, you watch every tic, you feel every move, your markets related stress increases to the point of you becoming markets blind, position blind, you lose track of process, you make simple stupid mistakes and all because you let your ego stay in control.

Now you can go to the other extreme of trading hyperthermia and get too cold post trade, where you drop the relationship with yourself and the market to a level of cold frigidity. Where you become complacent, maybe you had a series of great runs and feel invincible, but such a state of complacency endangers your agility and ability to feel the market and to accurately assess and manage your risk. A state that leads you having your market mind so off the ball that it is off line to the point of being useless.

So maintain an optimal operating temperature to enable identifying the trade, warm up into the insight, get hot to engage that ego to pull the trigger on the trade and then very quickly drop the ego. And I mean quickly!

AlphaMind do not offer trading or investment advice and do not take responsibility for any investment or trading actions or decisions taken by clients or any observers of our material in any form of media, either now or in future.

Editors’ Picks

USD/JPY tumbles below 156.00 on hawkish BoE-speak, risk-off mood

USD/JPY holds lower ground below 156.00 in the Asian session on Thursday, deep in the red amid hawkish BoE commentary, looming intervention fears and risk-off mood, which lend support to the Japanese Yen. The US Dollar remains on the back foot amid concerns about the fallout from Trump's trade policies, adding to the pair's downside.

AUD/USD grinds higher toward 0.7150 on weaker USD

AUD/USD picks up bids and grinds higher toward 0.7150 in the Asian session on Thursday. The pair eyes a three-year peak amid bets for another RBA rate hike in 2026, bolstered by the latest Australian consumer inflation figures. Moreover, a softer US Dollar acts as a tailwind for the Aussie, though trade uncertainties seem to limit the Aussie's upside.

Gold struggle with $5,200 extends ahead of more US-Iran talks

Gold is replicating the recovery moves seen in Wednesday’s Asian trading early Thursday, as buyers continue to flirt with the $5,200 level. Sustained US Dollar weakness and looming US-Iran talks aid the bright metal’s rebound.

Top Crypto Gainers: Polkadot, Near Protocol, Uniswap lead market rebound

Altcoins, such as Polkadot, Near Protocol, and Uniswap, are leading gains over the last 24 hours as Bitcoin jumped 6% on Wednesday. The altcoins are holding steady at press time on Thursday following a rebound the previous day, testing the waters around their 50-day Exponential Moving Average.

Nvidia delivers another monster earnings report, and forecasts big things to come

It was another monster earnings report from Nvidia for fiscal Q4. Revenues were $68.1bn, smashing estimates of $65bn. Gross profit margin was a healthy 75%, up from 73.5% in the prior quarter, and the outlook for this quarter was monstrous.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.