The Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output. In other words, the PPI measures the prices offered to manufacturers of goods and services, in contrast to the CPI which measures the prices consumers (end-users) pay to obtain the good or service. The prices included in the PPI measure the first commercial transaction for products and services. This was the main reason for compiling such an Index in the first place, i.e. to measure price changes in goods sold in primary markets before they reached the final stage of production at the retail market level. Overall, the PPI is another indicator of the purchasing power of money and is an important tool in the design and conduct of monetary and fiscal policy.

As you can guess, an increase in the PPI would signal that sellers are obtaining higher prices for their products and services and as a result, producers have either chosen to increase their price margins or they are witnessing higher demand for their products and services. To confirm which of the two holds we need to observe the CPI inflation over the past months. If the CPI inflation is in line with the PPI inflation, then we can confirm that price increases are due to higher demand and not because of higher margins.

Even in the case of higher margins, the PPI serves an important cause: if producer prices have increased due to higher margins then we can expect that CPI prices (i.e consumer prices) will also be increasing in the future. Hence, the PPI can also serve as a proxy of future inflation.

The rationale in regard to how the PPI affects stock and currency markets is similar to the usual CPI. If the PPI figure is higher than expected then firms are expected to generate higher profits, hence the stock market should rise. In contrast, if the PPI is lower than expected, the stock market should drop. Regarding the stock market, if the currency market expects a high PPI growth rate, then the currency should depreciate. Otherwise, if PPI is higher than expected and abides with the CPI path the currency should rise. Note though that the reactions should be much smaller compared to CPI ones, for the simple reason that the PPI is viewed as a precursor of the CPI.

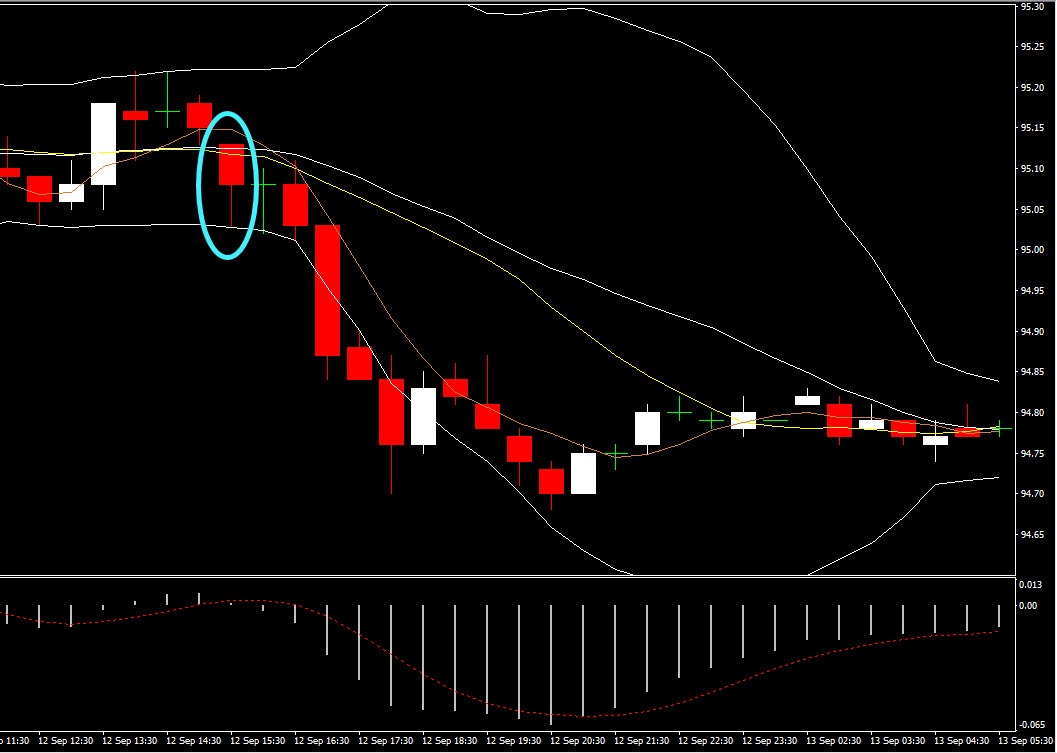

This prediction is supported by the market behaviour on September 12, 2018. The PPI came out less than expected, at 2.3%, compared to expectations of 2.7%. This prompted a negative reaction in the FX market, as the Dollar Index dropped by 5 pips. Similarly, the USA500 also dropped by 1 point on the announcement. While the market moved in the expected direction, the price volatility was not as large as in the CPI case.

Editors’ Picks

EUR/USD rises to 1.1800 neighborhood amid renewed USD selling and trade uncertainties

The EUR/USD pair regains positive traction during the Asian session on Wednesday and jumps to the 1.1800 neighborhood in the last hour, reversing the previous day's modest losses. The intraday move up is sponsored by the emergence of fresh US Dollar, which continues to be weighed down by persistent trade-related uncertainties.

GBP/USD remains stronger above 1.3500 following Trump’s State of the Union

GBP/USD remains in the positive territory for the fourth successive session, trading around 1.3510 during the Asian hours on Wednesday. The pair appreciates as the US Dollar remains subdued following US President Donald Trump’s first State of the Union address of his second administration before a joint session of Congress.

Gold re-attempts $5,200 amid tariffs and geopolitical woes

Gold buyers are back in the game early Wednesday after seeing a correction from monthly highs on Tuesday. The US Dollar slips after Trump’s SOTU fails to impress and as AI-driven worries ease. Dovish Fed bets also weigh. Gold looks north so long as the key 61.8% Fibo resistance at $5,142 holds on the daily chart.

Bitcoin, Ethereum and Ripple post cautious recovery amid downside risks

Bitcoin, Ethereum, and Ripple are posting a cautious recovery on Wednesday following a market correction earlier this week. BTC is approaching a key breakdown level, while ETH and XRP are rebounding from crucial support levels.

The Citrini report: How a debatable AI narrative can shake Wall Street Premium

That AI-related headline alone was enough to rattle investors.US stocks slid sharply on Monday after a widely circulated Citrini Research memo outlined a hypothetical “2028 Global Intelligence Crisis”, warning that rapid AI adoption could push US unemployment into double digits as early as by mid-2028.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.