Based on the many emails we receive about this, there is a requirement to get a proper understanding of how exhaustion candles work, what they mean and when they're relevant. In the webinar in the video below, Navin Prithyani will go into details with many examples of when an exhaustion candle / pin bars are relevant.

What are Exhaustion Candles?

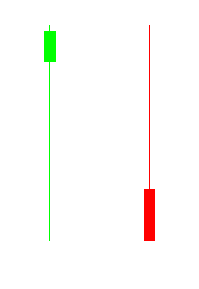

An exhaustion candle is a very important indicator of a reversal of a trend. It is sometimes also called a hammer and it is named like this, because the market is attempting to hammer out a market bottom (if it is a downtrend).

How to recognise an exhaustion candle: it appears during a trend (either up or down) only. The body of the candle has a long tail or wick - at least 2-3 times the length of the body and little if any tail or wick on the other side. The colour of the body does not matter as much.

How you can use Exhaustion Candles

Exhaustion candles are not to be used as a leading indicator to enter a trade solely based on them. There is however, a huge amount of information embedded in them. They give some clues as to what is happening in the market and what the current sentiment is. They can be an indication that the trend is stalling or even reversing. However, as said, it's just an indication and nothing more. So we need more confirmation than that.

Firstly we need the exhaustion candle to be, or occur in the right place in your charts. So for instance you want to see them bouncing at round numbers, pivot points or recent highs and lows. Our Pro Trading Strategy for instance, uses exhaustion candles as a tool to determine entry. Never look at these kind of technical tools as more than tools. As mentioned often by us, we need the story to match our technical side of things. This is something we extensively dig into in the Urban Forex members courses.

Watch the video above for the full lesson so you can continue to enhance your skills and be better everyday.

#UrbanForex - Be conscious of your trading!

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Urbanforex will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.<7p>

Editors’ Picks

AUD/USD: Some profit-taking should not be ruled out

AUD/USD has quickly faded Wednesday’s strong advance despite climbing to new multi-year highs around 0.7150 earlier on Thursday. The pair’s decline comes amid a marginal uptick in the US Dollar, while investors gear up for US CPI data and relevant Chinese releases on Friday.

EUR/USD faces next resistance near 1.1930

EUR/USD has surrendered its earlier intraday advance on Thursday and is now hovering uncomfortably around the 1.1860 region amid modest gains in the US Dolla. Moving forward, markets are exoected to closely follow Friday’s release of US CPI data.

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

Ripple collaborates with Aviva Investors to tokenize funds as XRP interest declines

Ripple (XRP) exhibits subtle recovery signs, trading slightly above $1.40 at the time of writing on Thursday, as crypto prices broadly edge higher. Despite the metered uptick, risk-off sentiment remains a concern across the crypto market, as retail and institutional interest dwindle.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.