The reason I trade so many live events is that fundamental data is the best way to demonstrate how to make money in trading, quickly. Now I’m not referring to getting rich quick, I am talking about how you can profit from large market movements and volatility created by new information hitting the market. This is the first part of my rule, the 20% fundamental side. The rest of the time the markets will trade between perceived support and resistance, this is the 80% technical trading part of the rule.

The KEY thing to remember is that once you understand how to trade technically, this is 80% of the time. You can use this knowledge to trade the 20% highly volatile fundamental trades, as they will also adhere to the technical style of trading. Every move, no matter how volatile looks for support and resistance.

What is quite unique about trading is that we all have access to the same information but all use our own interpretation. This leads to conflicts in the market, some people at that time will be right and some people will be wrong. My point is that when ‘new’ information hits the markets, if it is unexpected or a shock to the market, with so many different opinions out there; the market has to then move as people get in and out of trades.

My two main views on trading:

1. The 80/20 rule. The markets move 80% of the time technically and 20% of the time fundamentally. However the 20% fundamentals trade technically with added volatility. Meaning why would you fade or discount fundamental data? Trade it – make money it’s is its own opportunity.

2. A trading edge is not necessarily knowing what others don’t. For me it is more knowing exactly what everyone else does know, and trading with them when they are right and against them when they are wrong. Look at the basic indicators like RSI, Bollinger bands and moving averages, remember the ‘self-fulfilling prophecy’ of technical trading.

Here is a working example of this thinking in the AUD/USD chart:

Look at the indicators that most other traders will use in a trading day. Build your trading strategy around this.

1. Bollinger bands – we have rejected a close below the lower boundary

2. Large H1 pin bar rejecting (blue) the ‘fake move’ down

3. The DeM is rising - positive

4. The RSI is rising - positive

5. The Fibonacci levels 100% (green) 50% (dotted white) are holding as support.

Out come? Buy the AUD against the USD

My three main views on trading fundamental volatility:With added volatility there are a couple of things that have to be adhered to.

1. Time! Invest time in your preparation and charts before any major fundamental event. There may be huge moves but they can be over in seconds. Levels can be hit and if you are not ready for the opportunity you will either miss out or lose money trying to get into a trade that has gone. Understand your risk reward, what you are actually trying to achieve from this trading opportunity.

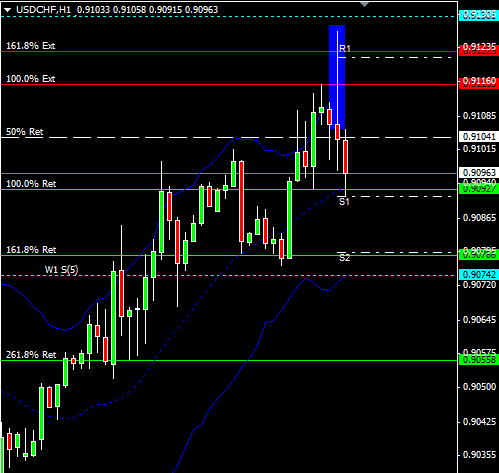

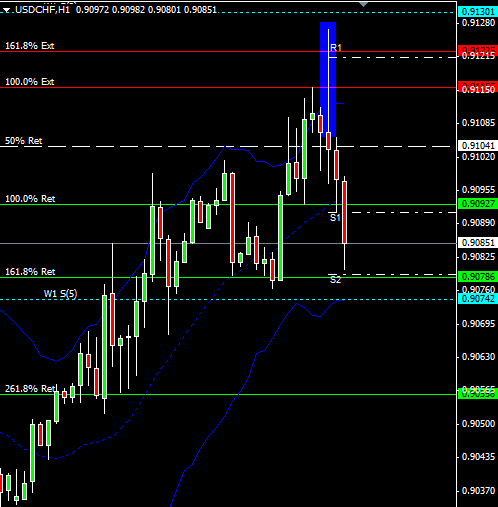

This is the USD/CHF before and after the US open.

Remember that traders will be taking into account all the fundamental data, for example (08/01/14) ADP 238 vs 200 could change people view of the markets and there is always extra volatility on the open.

Before

After

We have prepared our charts. We are focusing on:

1. Bollinger bands – closed inside the top boundary, and have tested the md point

2. Key levels – we know 0.90742 (blue) is a good down side level

3. Fibonacci – we know we are below the key 50% so the 100% and 161.8% are targets

4. ‘Fake out’ candle – the blue box indicates a rejected push higher – therefore we trade lower

In this scenario we wait for the open, and sell the USD against the CHF and make 13 pips profit.

2. Understanding fundamentals and your markets. You can either just trade the flow, or you can actually spend the time understanding what the data means and why it moves your market up or down. It depends on you, but don’t trick yourself into thinking you understand what the data means! If you don’t and just want to just sell your market because it is going down, that is fine as long as you have the technical and risk side covered in your preparation.

3. Size. Trade the appropriate size. The rules of trading generally dictate that you should trade 1% of your capital on each trade. I don’t agree personally this statement in general and certainly not for fundamental trades. Each trade should be on its own risk merit. You should not be trading a 100 times a day so you don’t need a basic general rule. Especially for fundamental trading where there maybe 2 key events a month, why would you only risk 1%, if you are prepared and have been patient why not 5% or 10%? NEVER RISK MORE THAN YOU CAN AFFORD TO LOSE

To really summarise all this fundamental and data trading is just another aspect of trading. If you understand the basic principles of short term volatility and are prepared, it is just another way of being involved in the markets for short periods of time and maximising you returns.

I will be trading the BoE and FED minutes every month on FXStreet this year so join in these events and see how you can look to profit from trading volatile fundamental data in a technical manner. Visit my page to register for my upcoming webinars

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

USD/JPY keeps the red below 157.00 on intervention risks

The Japanese Yen sticks to its modest intraday recovery gains against a broadly weaker US Dollar on the back of speculations that authorities will step in to stem weakness in the domestic currency. In fact, Japanese officials stepped up intervention warnings and confirmed close coordination with the US against disorderly FX moves. This, in turn, triggered an intraday USD/JPY turnaround from the 157.65 region, or a two-week top, touched in reaction to Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold remains supported by China's buying and USD weakness as traders eye US data

Gold struggles to capitalize on its intraday move up and remains below the $5,100 mark heading into the European session amid mixed cues. Data released over the weekend showed that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Cardano steadies as whale selling caps recovery

Cardano (ADA) steadies at $0.27 at the time of writing on Monday after slipping more than 5% in the previous week. On-chain data indicate a bearish trend, with certain whales offloading ADA. However, the technical outlook suggests bearish momentum is weakening, raising the possibility of a short-term relief rebound if buying interest picks up.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.