Like traditional forms of asset-based investments, CFD trading accommodates different aims, plans and risk/reward ratios.

However, CFDs are a derivative-based market – you’re buying and selling contracts between yourself and the CFD provider.

What are CFDs?

Purchasing shares on the London Stock Exchange (LSE) involves submitting a request to a share dealing broker specifying the company of interest and number of shares. In doing so, you’re buying a share of the company’s assets and profits – a part owner of the company.

A CFD, or contract for difference, on the other hand, is a financial derivative enabling market participants to speculate on rising or falling market moves without taking ownership of the underlying asset.

Trading CFDs involves purchasing/selling contracts whereby you’ll pay/receive the difference between the executed price and liquidation price. The asset, in this case, never changes hands.

CFDs are also leveraged products. This makes it possible to increase market exposure while only laying out a percentage of the full notional value of the financial instrument.

CFD brokers supply clients with a broad range of CFD products, including individual share CFDs, Index CFDs, Forex CFDs, Commodity CFDs, Cryptocurrency CFDs and more.

Short-Term Trading

A short-term trading strategy aims to exploit minor price movements in the market. Depending on the trading strategy employed, a short-term position varies between a few minutes (in some case seconds) to several days. Conversely, the objective of long-term trading, or position trading, is targeting long-term trends, lasting anywhere from a month to several months, or even years.

Irrespective of whether you employ a long or short-term trading plan, risk management remains a key component to successful trading.

As a whole, there are three types of short-term trading styles used to trade CFDs: scalpers, day traders and some would say, swing traders.

Scalping

Scalping involves placing multiple trades throughout the trading session with a short-term intraday focus. The aim of scalping is to frequently skim small profits from small price movements. Trades are often exited shortly after becoming profitable.

Many trades are placed throughout the trading day/session, with signals predominantly derived from technical analysis. However, its still practical to keep an eye on the economic calendar as news releases can drastically affect a scalp trade.

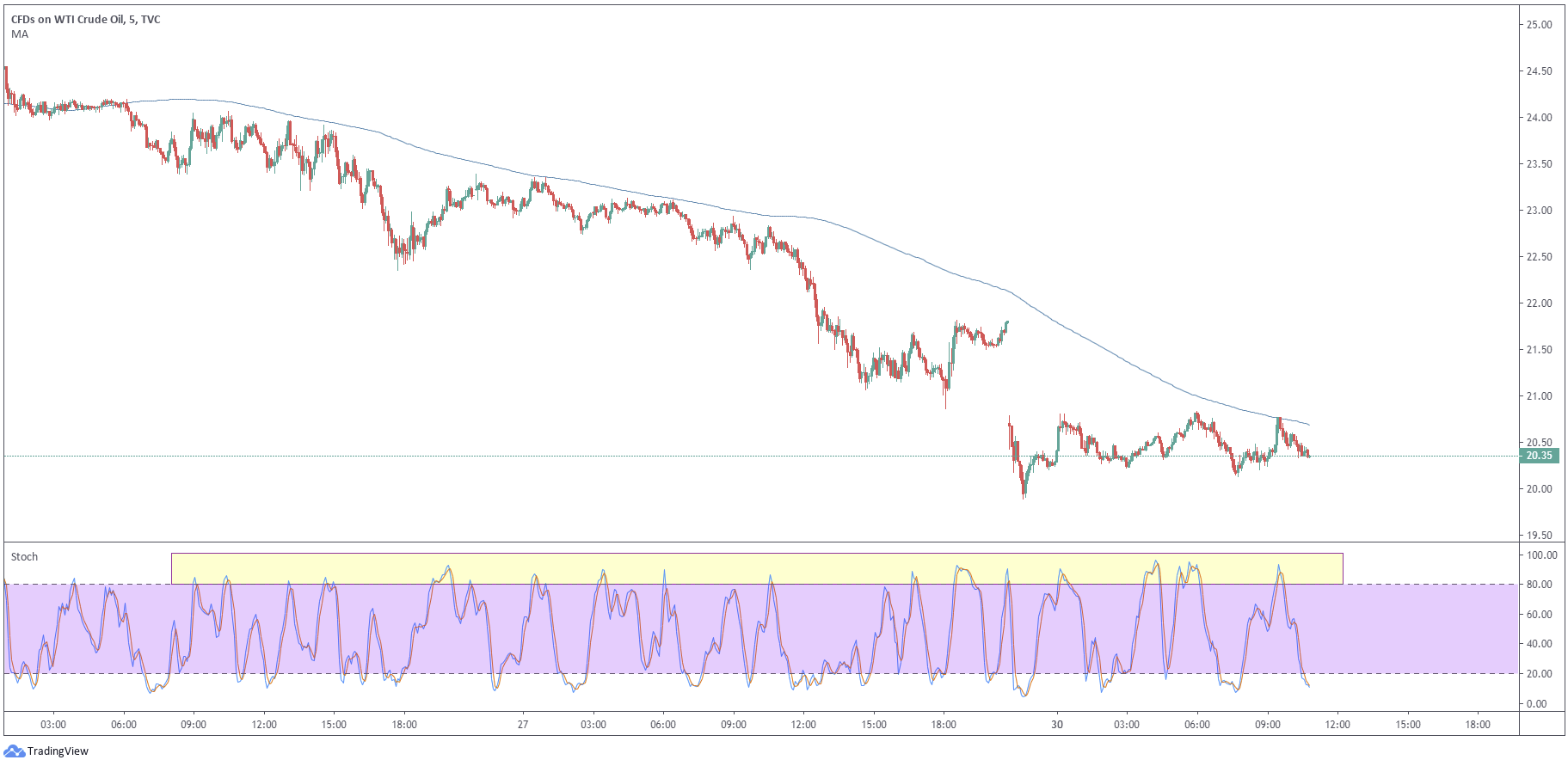

A popular method to scalp markets is using a combination of moving averages and the stochastics oscillator on the M5 chart, which can be used on most major currency pairs. It involves applying a 200-period EMA (exponential moving average) and the stochastics oscillator using standard settings. The whole point of the 200-period EMA is to define if a market is trending. When market price is below the EMA value, traders look for a short position (sell), and vice versa when price trades above the 200-period EMA.

Traders look for a stochastics overbought signal when price trades beneath the EMA. This alerts a possible selling opportunity. As shown in figure 1.A on WTI Crude Oil, several opportunities to enter short are seen, according to the stochastics. It is worth pointing out, though, most traders adapt this method to suit their trading approach, usually by way of combining other forms of technical indicators to justify a position.

FIGURE 1.A

Day Trading

Day trading typically involves liquidating positions before the close of trade. However, some hold on to a position overnight if market conditions are favourable.

Similar to scalping, day traders tend to shine the spotlight on technical analysis to base trading decisions, while also factoring in the day’s upcoming news schedule.

While trader dependent, timeframe selection for day trading strategies tend to be higher than a scalping approach. Some lean towards the M15 timeframe; others prefer the slower M30 and H1 timeframes.

Although countless day trading strategies are available, simple price-action based methods tend to perform well over the long term.

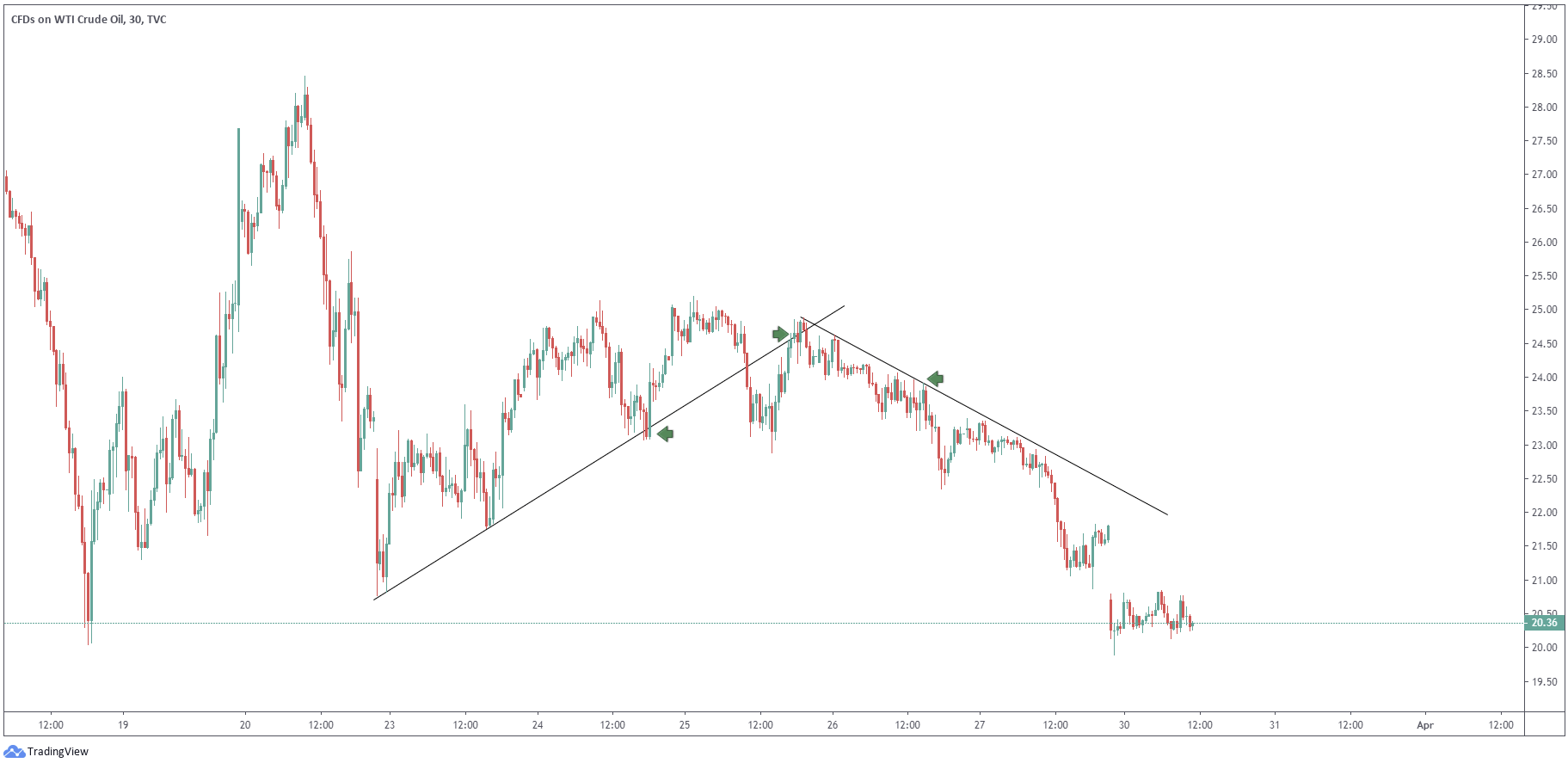

Figure 1B, the WTI Crude Oil M15 chart, illustrates a simple trendline-based strategy, with potential trading opportunities denoted by green arrows. Note, once a trendline is consumed it often offers support/resistance on a retest (the central green arrow represents such an example).

Of course, traders can add weight by applying additional technical tools, such as a support/resistance area, a Japanese candlestick pattern or Fibonacci studies. However, do bear in mind it is the simple trading strategies that generate returns. Complexity generally clouds the view and leads to a concept known as analysis paralysis.

FIGURE 1.B

Swing Trading

Swing Trading focuses on exploiting gains in short-term swings. A swing trader is concerned with capturing price movements between defined highs and lows.

Swing Trading positions are usually active between a few days to a couple of weeks. The difference between swing trading and day trading is time and, for some, the approach. Swing traders tend to lean towards the H1 timeframes and higher; traders in this category may also include fundamental analysis in their trading approach.

Trend trading is a popular swing trading style, with the aim of capturing a portion of the trend.

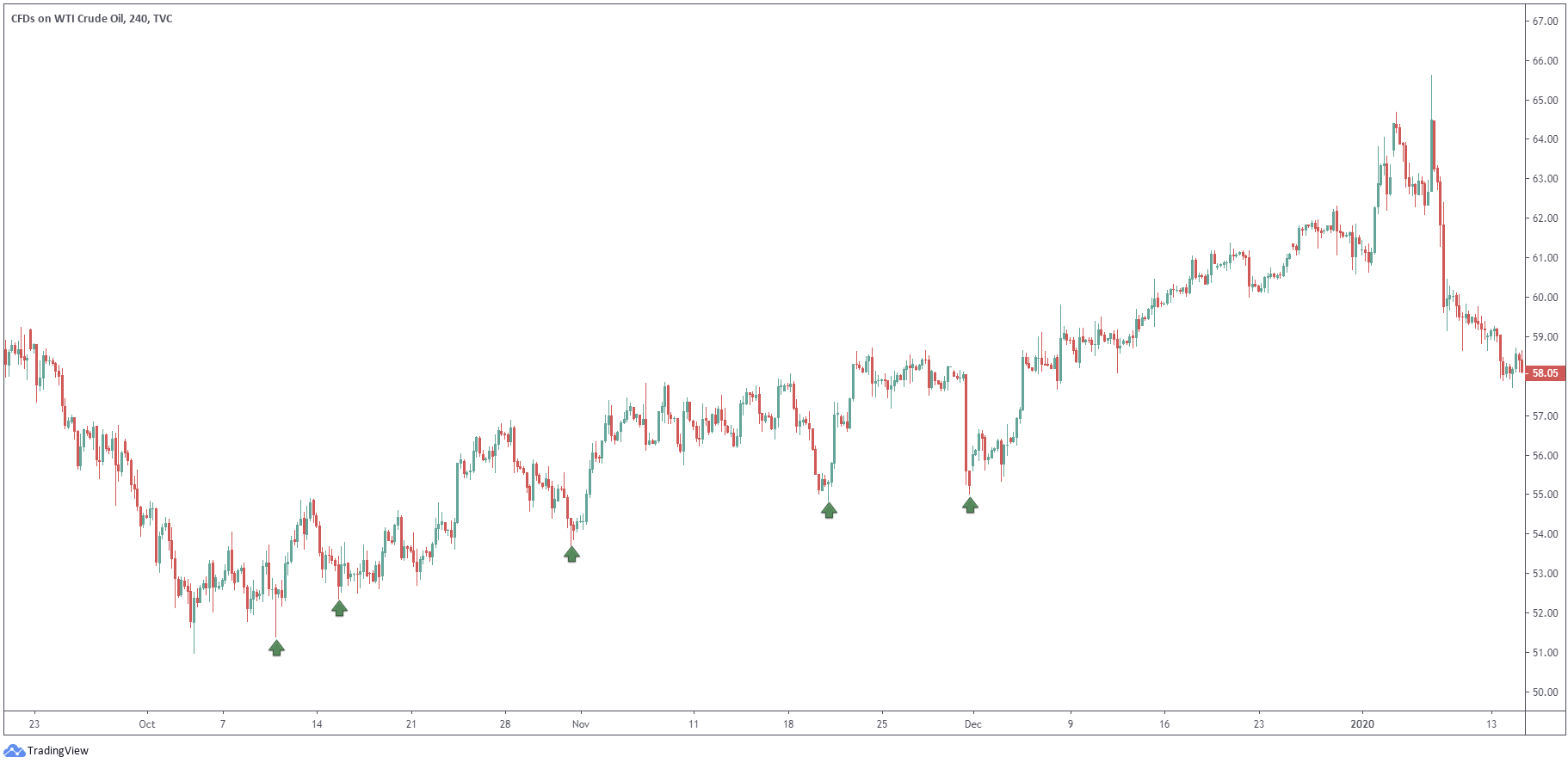

Figure 1.C shows the WTI Crude Oil H4 chart offering a number of successful swing trades (green arrows). Generally, traders buy (enter a long position) the dip at Fibonacci levels, the 61.8% Fibonacci retracement ratio is popular, and position protective stop-loss orders beneath the prior swing low. To add additional confirmation, some traders also seek converging price-action based structures.

FIGURE 1.C

Trading Style

Several methods of engaging with the market exist.

While short-term trading is a trading style by and of itself, subcategories, such as scalping, day trading and swing trading are in place.

Are you a trader who prefers to be in and out of the market in a few minutes to an hour, and only has 1-2 hours screen time per day? In this case, scalping could be an option. On the other hand, a trader who likes the idea of perhaps holding a position overnight and targeting swings might favour a swing-based trading approach.

It’s important you decide which trading style fits your personality before committing. Successful CFD traders know which category they fit in and exploit this.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.