Do you know what makes your trading harder than it needs to be?

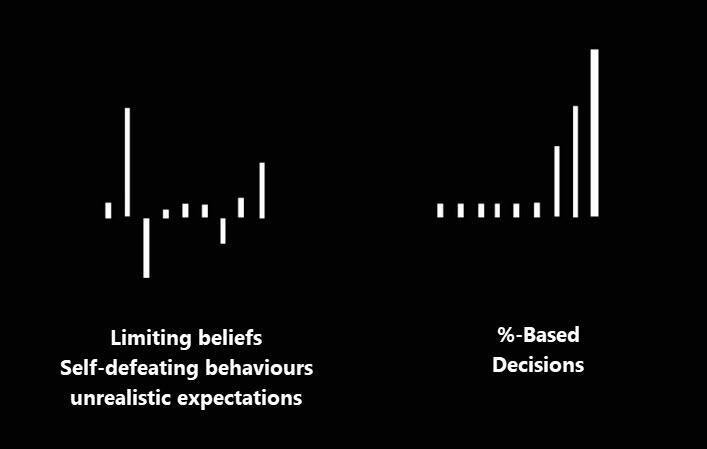

Limiting beliefs, self-defeating behaviours, and unrealistic expectations.

But what do you know about eliminating them? Do deep meditations or thought control come to mind

The good news is, it's far easier than that. Keep reading to discover the simple cure illustrated with real-world trading examples.

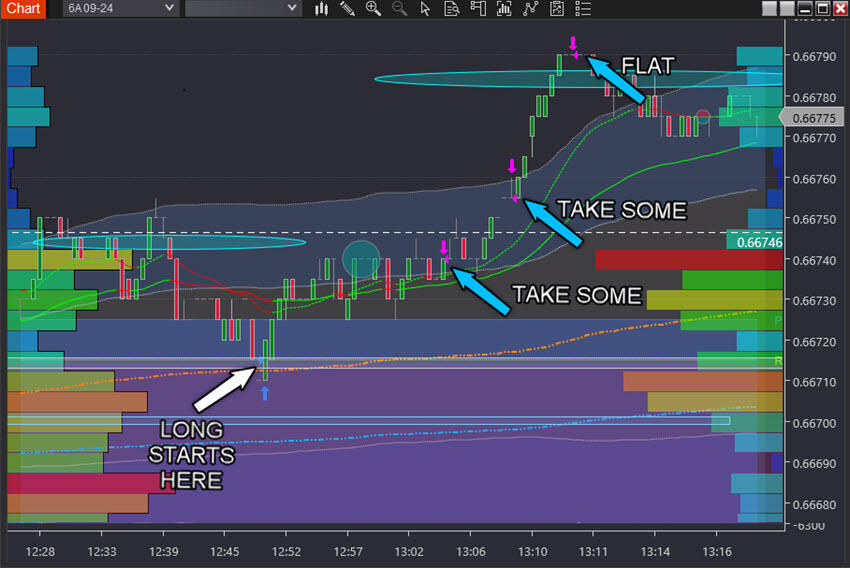

Now I bet you're a bit like me: You have losing trades. Tuesday starts with two losers in a row, as you can see in the chart below:

Quick question

How do two losses in a row make you feel? Hold that thought.

The next trade was a long trade. It was more than three times the size of the short trades. Was I revenge trading?

I'll show you the long trade in a minute. But first, I'll provide you with some context explaining how I *felt* after two losses in a row.

The plan for today's trading is to benefit from a short-covering rally by getting on the long side, but...

See the pinkish-shaded area in the chart above? It's a relative-value area where dealer selling is occurring. The price won't move higher until the dealer business is complete.

In the meantime, I can scalp the short side until the selling is done.

Notice anything?

I'm making a decision based on a specific scenario I am familiar with. I make this same trade several times a week, many times a month, and have been doing so for years. I have real-world experience making this identical trade.

It's a decision based on a percentage-based opportunity. Not 'I hope this makes money.' See the difference?

As a risk-averse person, I don't act on bouts of courage or push through barriers of fear. I commit because I have something far more reliable and powerful.

Any guesses to what that is?

Real-world experience in this specific trade, in the same instrument, during the same trading hours. That's the power of specificity.

When you first got behind the wheel of a car, it was daunting.

But even 'driving' isn’t specific.

Driving a manual versus an automatic, doing a hill start compared to a flat start, and reverse parking versus driving straight into a park—each action is specific in its own way.

The second short trade I took was not exactly the specific scenario I have traded hundreds of times previously.

It was close but not exact. I made an error, resulting in a loss.

It's easy to feel frustrated when you make a mistake, right? And when you get frustrated, it can lead to further impulsive, poor decisions. Sound familiar?

How did I feel about making a mistake? Did I beat myself up?

If you had asked me many years ago, the answer would have been yes. Did those mistakes sometimes lead to impulse trades? Guilty!

But when you have developed the skills and experience (repetitions) necessary to trade successfully, you gain a new perspective.

When you only make trades that align with specific trade criteria that you've traded hundreds of times before, you don't make many mistakes. But some mistakes are okay, aren't they?

Trading, like tennis or golf, is not a game of perfect. I make mistakes every day. Yet I know that even when I make mistakes (which mostly result in losing trades), I still win overall.

Imagine how it feels to know you can mess up but still win. It's incredibly empowering. You trade with a sense of freedom to 'swing the bat' without fear of the consequences. Here, I'll show you:

The long trade mentioned earlier is another example of a very specific trade. Intellectually, I know the odds.

But more importantly, I feel comfortable taking it regardless of what happened earlier because I've made this trade hundreds of times.

This trade is larger in size than the first two trades because those trades didn't warrant the same size commitment based on the percentage-opportunity.

You don't have to mentally wrestle with deciding 'what size?' when you enter. It's all determined well in advance of taking the trade and is based on real-world experience, not theory.

To sum up

The cure for limiting beliefs, self-defeating behaviours, and unrealistic expectations is simple: replace those behaviours and feelings with percentage-based decisions.

It's reasonable to expect that transforming your inner beliefs isn't an overnight process.

But by instructing you in all the specific percentage-based trades, the path to transformation takes a fraction of the time compared to the many years it took me and all the traders you read about.

As a guide, a professional trading firm or mentor with a professional trading background will provide mentorship for at least nine months, allowing you the time to complete enough repetitions to make the transition.

This makes nine to twelve months to develop professional trading skills a bargain compared with year-on-year mental torture and brutal losses. Agree?

But let me add this: I love trading. But why might surprise you—it's the sensation of getting better.

Many people experience a love-hate relationship with trading because of the challenges we discussed. But this perception shifts once you begin to experience the sensation of seeing and feeling yourself improve.

This is when trading begins to deeply resonate with you.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD climbs to two-week highs beyond 1.1900

EUR/USD is keeping its foot on the gas at the start of the week, reclaiming the 1.1900 barrier and above on Monday. The US Dollar remains on the back foot, with traders reluctant to step in ahead of Wednesday’s key January jobs report, allowing the pair to extend its upward grind for now.

USD/JPY recedes to multi-day lows near 155.50

USD/JPY is pulling back sharply at the start of the week, slipping back toward the 155.50 area as speculation mounts that authorities could step in to rein in further Yen weakness. That narrative gained traction after PM S. Takaichi secured a landslide victory in Sunday’s election, stoking expectations of a tougher line in defence of the domestic currency.

Gold treads water around $5,000

Gold is trading in an inconclusive fashion around the key $5,000 mark on Monday week. Support is coming from fresh signs of further buying from the PBoC, while expectations that the Fed could turn more dovish, alongside concerns over its independence, keep the demand for the precious metal running.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.