Skill is defined by Miriam-Webster Dictionary as…

1a: the ability to use one’s knowledge effectively and readily in execution or performance

b: dexterity or coordination especially in the execution of learned physical tasks

2: a learned power of doing something competently: a developed aptitude or ability

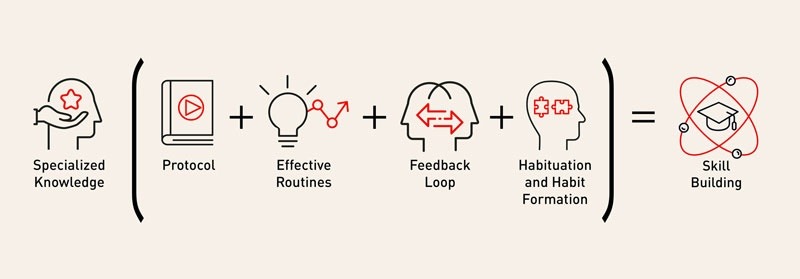

As such, skill is an obvious requirement to succeed at any endeavor. However, there are any number of ways to develop skill levels; and not all of them are created equal. So, to clarify what we mean here consider this formula: SK (P + ER + FL + HH) = Skill Building. To be sure, this is not the only example of how to grow skill levels; but it is an extremely effective one as we look at skill through the prism of trading.

Let’s begin at the beginning … SK represents specialized knowledge. Specialized knowledge starts with the foundational lessons taught in Core Strategy having to do with order flow which drives price action and creates imbalances in supply and demand. These imbalances are what establish the probability that either buying or selling will lead to profit or loss. The power of the Core Strategy lies in the advantage or edge that it provides to the trader who embraces and becomes intimate with these principles. They don’t guarantee a profit any more than using a particular platform/broker will guarantee profit. What a credible edge does is that it increases the probability that the process/edge, if used consistently, will lead to positive results.

The SK is applied to the other four variables inside the parenthesis beginning with P which stands for Protocol. Protocol has a number of definitions that relate to disciplines as disparate as diplomacy and politics to medicine and scientific inquiry. The definition that we use for traders and trading is … a series of sequentially ordered steps toward an aim or goal. This way of looking at process relates directly to the notion of Core Strategy as the edge or advantage that makes such a huge difference. The steps referenced here are those that lead to the Odds Enhancer calculation; things like the identification of zones, where on the curve is the zone appearing, time frames and trends. The category includes items such as set-ups, procedures, rules, and strategies.

Added to protocols are ER or Effective Routines. As most if not all Online Trading Academy instructor/traders will tell you, having a routine is critical to your trading. Here we go a little further to identify what the trader needs to do to support overall positions…and, of course, support the trader’s ability to write the plan and trade the plan, looking for where ever the sun might be shining as they works the routine to increase their effectiveness, which is the bottom line here.

Through this training, the goal is to process the information in the context of probability. Traders will want to ensure that their trades are following the rules…their rules. As well, a trader’s routines should be designed to support positive behaviors, allowing them to become consistent; because these often-small details work best when they are used to not only focus on what matters most in this trade but to promote overall effectiveness. Traders who are bouncing off the walls and only concerned with profit but not how they get the profit are not trading with purpose…and you are likely not getting the results they want. Consistent behavior that is supported by Effective Routines will uncover what is not working and allow traders to successfully address the issues.

The next formula item that is caught up in the middle of trading patterns is FL or Feedback Loop. A Feedback Loop is a means of evaluating the trading process which will strongly help traders to pay attention to what is happening or just happened in the trade. By using the power of introspection and self-reflection, it is possible to break down whether or not this further analysis is needed. Traders can devise questions designed to uncover simple clues, thereby becoming more critically flexible and enhancing their ability to evaluate whether or not they are getting the hit-rate in their trading that they anticipated. Tracking and evaluating trades supplies the information needed to measure, verify and document what transpired…giving details on all of the bad and some of the good in concise and tight bullet points. Revisiting this information on a regular basis will provide more and more insight into the how of each trade and also what changes need to be made. This often-detailed information is could propel a trader into the consistent column over time.

The last variable happens to be HH which means Habituation and Habit Formation. Habituation is loosely defined as becoming used to something happening. In other words, the more a stimulus is presented the less the individual responds. This is a good thing because as individuals work with these thought/behavior variables, the more their physiology will not only become acclimated to them, it will become easier and easier to follow through. Additionally, the more that they trade using all of these variables the more they will develop new habits which are the coin of getting good and powerful results.

Once traders begin using this formula consistently, they will find that getting into a skill building orientation becomes easier and easier. They will understand with greater clarity the importance of bringing disciplined skill building to every aspect of the trade.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates

Unimpressive European Central Bank left monetary policy unchanged for the fifth consecutive meeting. The United States first-tier employment and inflation data is scheduled for the second week of February. EUR/USD battles to remain afloat above 1.1800, sellers moving to the sidelines.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.