Key points

-

Market highs often create hesitation for investors on the sidelines, but history shows that long-term investing at these levels can still deliver strong returns.

-

With tools like limit orders, thematic diversification, and dollar cost averaging, there are still smart ways to put money to work—even at elevated levels.

-

Instead of trying to time the top, focus on building a resilient, well-diversified portfolio that can navigate different economic scenarios.

-

Long-term success comes from consistency and discipline, not perfect timing.

Markets continue to print record highs, and with them, investor uncertainty.

Some worry that valuations have run too far. Others fear missing out on the next leg higher. And somewhere in between are those asking, “Should I wait for a correction before putting money to work?”

It’s a fair question, but history suggests it’s the wrong one.

The myth of waiting for the perfect entry

In theory, “buy low, sell high” sounds perfect. In practice, most investors struggle to do either.

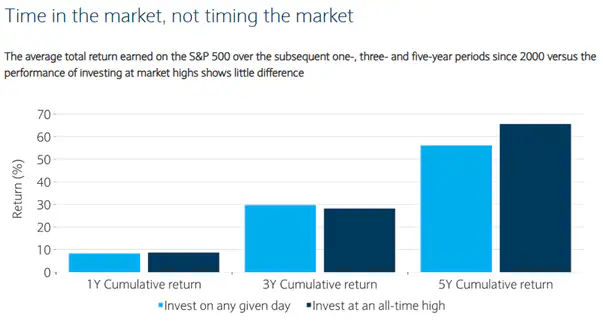

In fact, if you only invested on days when the S&P 500 hit an all-time high, your long-term returns would often be higher than if you invested on any random day.

Source: Bloomberg, Barclays Private Bank, March 2024

That’s because record highs typically happen during bull markets, and bull markets tend to last longer than expected.

The real challenge isn’t timing the market. It’s having a strategy that works when prices feel high, and sticking to it.

What to do instead: smart moves at market highs

1. Make pullbacks work for you

Even when the overall market is rising, individual stocks and sectors often face short-term dips. Those can be opportunities.

What you can do:

- If you’ve got cash on the sidelines, set price alerts for stocks or ETFs you want to own at better value.

- Use limit orders to automate discipline. These let you set a specific price you're willing to pay, and the order only executes if the market reaches that level. This helps avoid buying in a rush or at inflated prices.

- Keep a watchlist of high-conviction investments and gradually add to them during short-term weakness.

- Consider selling a put option (if you're familiar with options), which can let you earn income while waiting to buy at a lower price.

2. Look for what hasn’t rallied yet

While technology and AI stocks have led the charge, many parts of the market have lagged, and may offer better value and catch-up potential if the rally broadens out.

What to consider:

- Small-cap stocks and value-oriented sectors (like banks, energy, or healthcare) have underperformed and may benefit from stronger economic growth or a shift in investor focus.

- Dividend stocks can provide a steady income stream and may become more appealing if interest rates begin to fall.

- Rather than trying to pick individual stocks, consider broad-based ETFs that offer exposure to these less-loved areas of the market, helping you diversify while keeping costs low.

3. Diversify based on what drives markets

Market leadership today is shaped less by geography or sector, and more by macro forces like interest rates, trade policies, and geopolitical risk. Traditional diversification alone may not be enough. It’s time to think about how different parts of your portfolio respond to shifting policy and economic drivers.

How to position:

-

Tariff-sensitive sectors like autos and semiconductors may benefit if global trade tensions ease, but could struggle in a more protectionist environment. On the other hand, utilities, healthcare, and defense tend to be more insulated from global supply chains and policy swings.

-

Utilities and real estate often perform well when interest rates fall, as their steady income becomes more attractive relative to bonds and cash.

-

Defense stocks, commodities, and gold can help cushion your portfolio during periods of geopolitical uncertainty or broad market volatility.

-

Consider thematic funds that align with long-term structural trends such as clean energy, digital infrastructure, and healthcare innovation. These can offer growth potential across different macro cycles.

Even if some of these areas have gained attention recently, their relevance over the long term means they may still be underrepresented in many portfolios.

4. Stay consistent with a plan

Waiting for the “perfect moment” to invest often leads to missed opportunities. Even when markets dip, fear and uncertainty can prevent action, leaving cash on the sidelines and long-term goals unmet.

What works better:

-

Adopt a dollar-cost averaging (DCA) approach – invest a fixed amount at regular intervals (monthly or quarterly), regardless of market levels. This helps reduce the impact of short-term volatility and takes the emotion out of decision-making.

-

Set calendar reminders to review and top up your investments, just like you would with other recurring commitments like bill payments or insurance.

-

Stay focused on your long-term goals, not the day-to-day headlines. Markets will fluctuate, but a consistent, disciplined approach tends to win over time.

Final thought

Buying at market highs can feel uncomfortable, but history shows that long-term investors are often rewarded for staying the course.

If you diversify smartly, lean into underappreciated areas, and stay consistent with your investing plan, you won’t need to worry about whether you’re “too late.”

Because long-term wealth isn’t built by picking the perfect moment.

It’s built by showing up, again and again.

Read the original analysis: Should you invest when markets are at record highs?

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Editors’ Picks

EUR/USD rebounds after falling toward 1.1700

EUR/USD gains traction and trades above 1.1730 in the American session, looking to end the week virtually unchanged. The bullish opening in Wall Street makes it difficult for the US Dollar to preserve its recovery momentum and helps the pair rebound heading into the weekend.

USD/JPY rallies to near 157.00 as Yen plunges after BoJ’s policy outcome

The USD/JPY is up 0.85% to near 156.90 during the European trading session. The pair surges as the Japanese Yen underperforms across the board, following the Bank of Japan monetary policy announcement. In the policy meeting, the BoJ raised interest rates by 25 bps to 0.75%, as expected, the highest level seen in three decades.

Gold stays below $4,350, looks to post small weekly gains

Gold struggles to gather recovery momentum and stays below $4,350 in the second half of the day on Friday, as the benchmark 10-year US Treasury bond yield edges higher. Nevertheless, the precious metal remains on track to end the week with modest gains as markets gear up for the holiday season.

Crypto Today: Bitcoin, Ethereum, XRP rebound amid bearish market conditions

Bitcoin (BTC) is edging higher, trading above $88,000 at the time of writing on Monday. Altcoins, including Ethereum (ETH) and Ripple (XRP), are following in BTC’s footsteps, experiencing relief rebounds following a volatile week.

How much can one month of soft inflation change the Fed’s mind?

One month of softer inflation data is rarely enough to shift Federal Reserve policy on its own, but in a market highly sensitive to every data point, even a single reading can reshape expectations. November’s inflation report offered a welcome sign of cooling price pressures.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.