Understanding liquidity, participation, and timing in the 24-hour market

Introduction: A 24-hour market that does not move equally

The forex market operates 24 hours a day, five days a week, making it accessible to traders around the world at almost any time. For beginners, this constant availability often creates the impression that opportunity is evenly distributed throughout the trading day.

In reality, forex markets do not move uniformly. Liquidity, volatility, and directional price behavior vary significantly depending on which global financial centers are active. Understanding session timing is therefore not a minor detail—it is a structural component of professional trading.

This article explains how forex trading sessions work, why volatility clusters around specific hours, and how traders can align their activity with periods of meaningful market participation.

The three major forex trading sessions

Forex trading follows the global business day as it moves across time zones. Activity is generally divided into three primary sessions:

- Asian session

- European session

- North American session

Each session reflects the participation of major financial institutions, corporations, and central banks within that region. As participation changes, so do liquidity conditions and price behavior.

The Asian session: range-bound and selective

The Asian session is typically the first major session of the trading day. It is dominated by participation from financial centers such as Tokyo, Sydney, and Singapore.

Key characteristics include:

- Lower overall liquidity compared to later sessions

- More range-bound price action in many major pairs

- Increased relevance for pairs involving JPY, AUD, and NZD

While large directional moves are less common during this session, it can establish important intraday ranges and provide early signals for later volatility.

For many traders, the Asian session is better suited for range-based strategies rather than momentum-driven approaches.

The European session: liquidity and direction

The European session marks a significant increase in market participation. London, in particular, plays a central role in global currency trading.

Key characteristics include:

- High liquidity and tighter spreads

- Increased volatility and trend formation

- Strong reaction to economic data and news

Many of the most significant daily moves in forex occur during the European session, especially in major pairs such as EUR/USD and GBP/USD.

This session is often where directional bias becomes clearer as institutional participation increases.

The North American session: volatility and resolution

The North American session overlaps with the latter part of the European session, creating the most liquid period of the trading day.

Key characteristics include:

- Peak liquidity during the overlap with Europe

- Strong reaction to US economic data

- Increased volatility and potential trend continuation or reversal

US dollar pairs are particularly active during this period, and many intraday moves are either confirmed or reversed as North American participants enter the market.

After the European session closes, volatility typically declines, and markets may consolidate.

Why session overlaps matter

Session overlaps represent periods when multiple major financial centers are active simultaneously. This concentration of participation leads to:

- Higher trading volume

- Faster price discovery

- More reliable breakouts and follow-through

The overlap between the European and North American sessions is widely regarded as the most active and liquid window in the forex market.

Professional traders often focus their trading activity around these overlaps rather than attempting to trade continuously throughout the day.

Volatility is a function of participation

Volatility is not random. It increases when more participants are active and decreases when participation declines.

Common drivers of session-based volatility include:

- Scheduled economic data releases

- Central bank communications

- Institutional order flow

- Market positioning and risk sentiment

Understanding when these forces are most likely to interact helps traders avoid low-quality trading environments.

Aligning trading style with session timing

Different trading styles align better with different sessions:

- Range-based strategies may perform better during lower-volatility periods

- Breakout and momentum strategies typically require high-liquidity sessions

- News-driven trading depends heavily on the timing of economic releases

Rather than forcing trades throughout the day, professional traders select sessions that match their strategy and risk tolerance.

Common mistakes related to session timing

Many beginners struggle not because of strategy flaws, but because of poor timing. Common issues include:

- Trading low-liquidity hours with high expectations

- Using the same strategy across all sessions

- Ignoring session-specific volatility characteristics

Recognizing that time is a variable in trading, not just price, helps improve consistency and decision quality.

Final thoughts

The forex market may operate around the clock, but meaningful price movement does not occur evenly across time. Liquidity, volatility, and opportunity are concentrated in specific sessions and overlaps driven by institutional participation.

Understanding session timing allows traders to focus their energy on higher-quality market environments rather than forcing activity in unfavorable conditions.

In forex trading, when you trade is often just as important as what you trade.

This analysis and any provided information can be used only for educational purposes. SharmaFX is not a professional financial institution nor provides any financial services. SharmaFX does not provide any financial advice, investment advice, or trading signals. SharmaFX is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

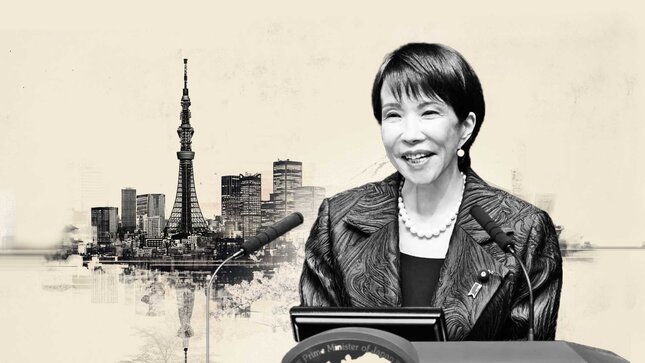

Japan's Takaichi secures historic victory in snap election

In Japan, Prime Minister Sanae Takaichi's coalition secured a supermajority in the lower house, winning 328 out of 465 seats following a rare winter snap election. This provides her with a strong mandate to advance her legislative agenda.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.