Forex EA (Expert Advisor) specifically refers to automated trading systems that run on MT4/5 terminals. EA can automatically monitor the market and execute orders 24 hours a day, effectively avoiding the impact of time, physical strength, emotions and other factors on manual trading. For more details, please see the Appendix at the end of the article.

Almost every Commercial EA vendor will provide the corresponding backtest data. One should download or request a Demo Version to fully assess whether the data can be duplicated.

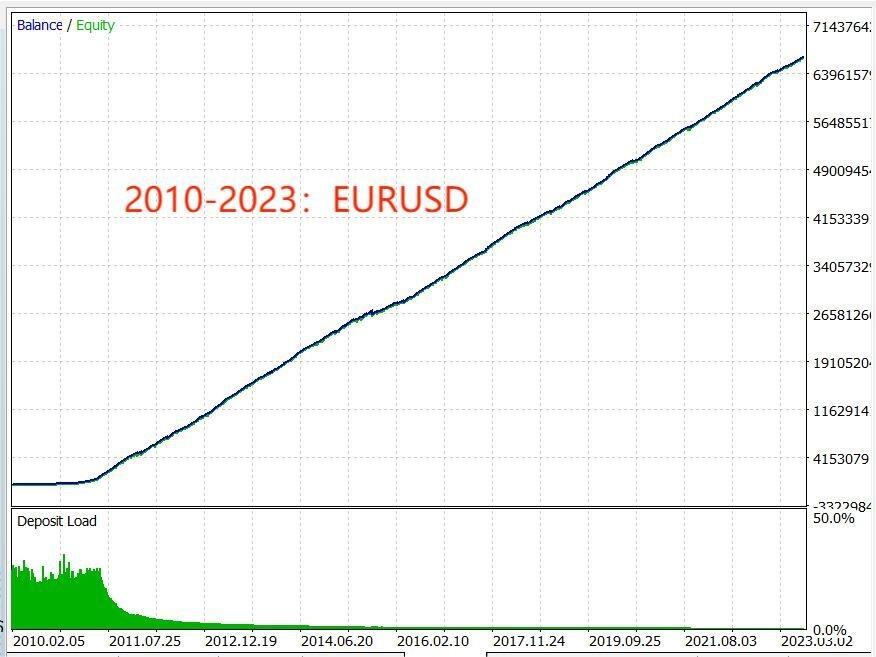

This is one of the most popular MT4 EAs in a third party Forex EA sales sites. Not only is it ranked on the front page, but all users give 5-star reviews. The vendor said the EA was designed with advanced algorithms and utilized deep learning technology, providing the MT5 Tickdata backtest report, the yield curve of EURUSD, AUDUSD, GBPUSD was a straight linear rise. (Tickdata is the abbreviation of Tick-by-tick data. It's a type of financial market data that records every individual transaction that occurs for a particular financial instrument, such as a stock, commodity, or currency pair. For currency pairs, the Tickdata currently available is based on M1 Timeframe.)

About the EA

Backtest of EUR/USD provided by the vendor

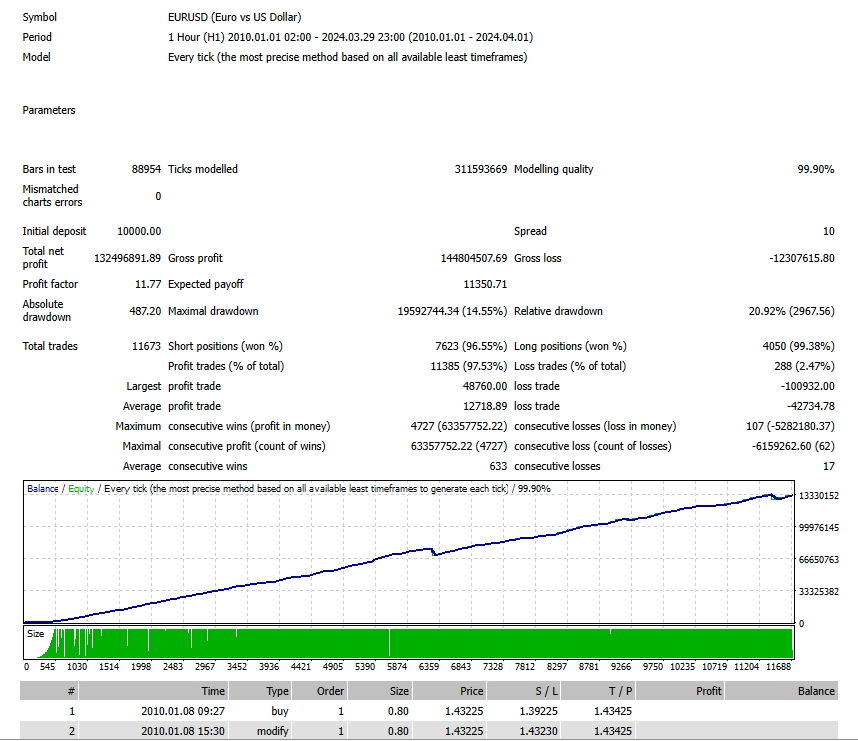

After downloading the demo version, we ran a Tiackdata Backtest on EURUSD in MT4, and the yield curve was basically the same as the vendor provided. (Default Setting, Spread= Fixed 1 pip, No Slippage)

Tickdata backtest from 2010

The price of this EA is $938, which is slightly higher than the other EAs on the site, but it is certainly a Holy Grail to have such a consistently profitable EA. Backtesting results show that an initial investment of $10k generated $130 Million after 13 years in EURUSD. The initial one-time $938 investment seems very cheap.

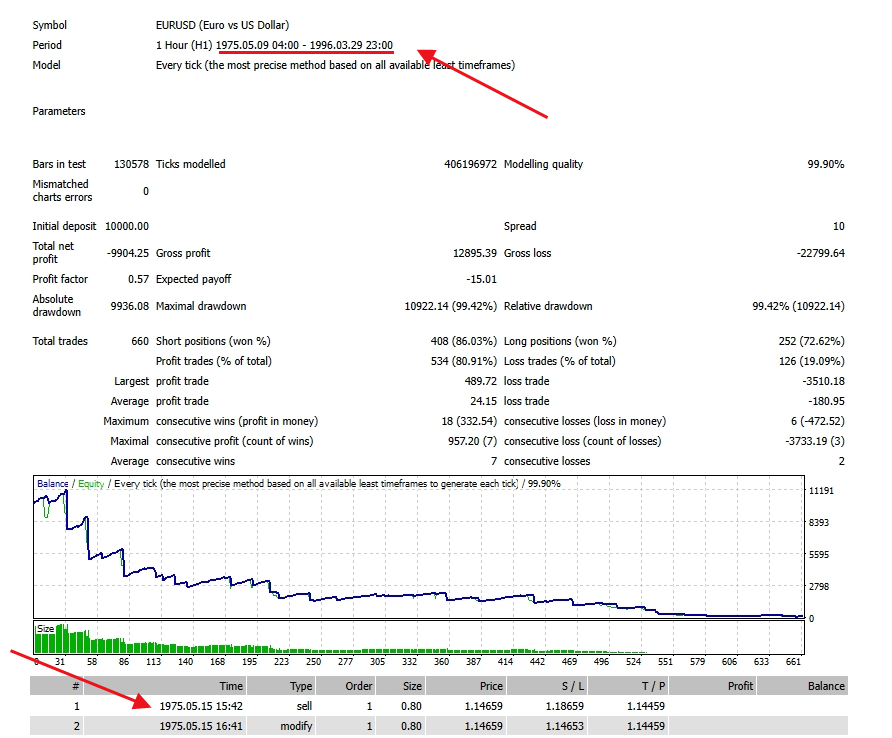

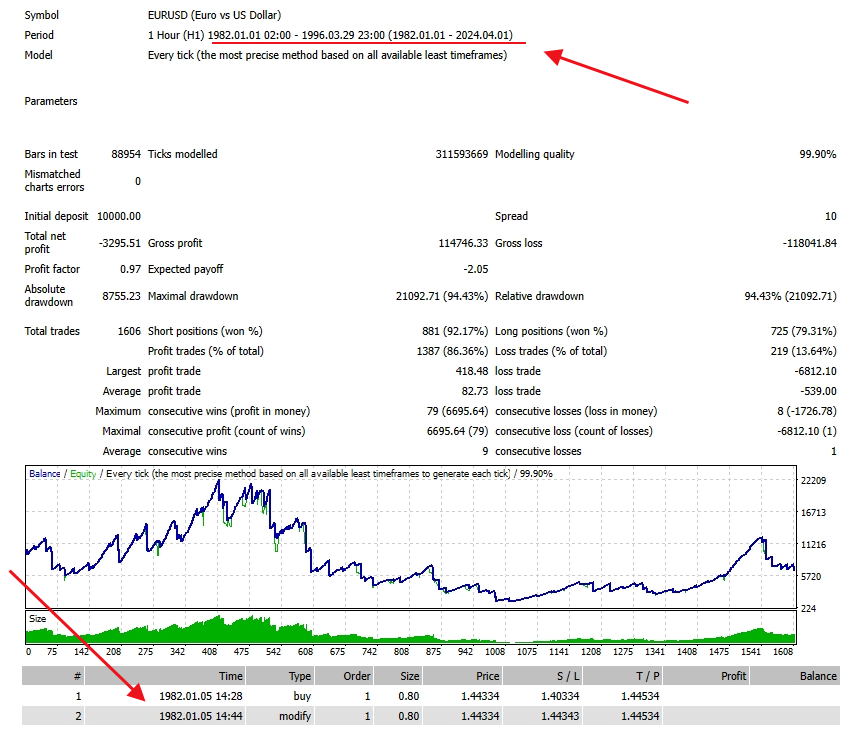

However, after the mood calmed down a bit, a new question arose: With such a stable and profitable EA, why would the vendor sell it at such a low price of $938 instead of trading it himself? In addition, in the spirit of being highly responsible for our own money, we tried to modify the timing of Tickdata and re-tested it with the exact same quote.

A miracle did occur at this time, and we saw that the results of all backtests were basically a steady decline in a straight line.

Tickdata backtest from 1975

Tickdata backtest from 1982

Comparing the backtest results before and after modifying the timing of the data, we have to think that this is a potential Scam EA.

Conclusion

1. Before purchasing any Commercial EA, be sure to run a Tickdata backtest.

2. It is necessary to modify the timing of the Tickdata for the testing.

3. Even if the results are satisfactory, it is necessary to think differently: From the author's point of view and psychology, assume you have created a stable and profitable EA through years of study and practice, why don't you make money by trading yourself, but sell this EA? Especially most No DLL EAs can be decompiled very easily within a few minutes. Then think about the various potential problems from that perspective.

Check our website to see this full trade copy service and other fully automated systems

Appendix

Forex EA (Expert Advisor) specifically refers to automated trading systems that run on MT4/5 terminals. In general, EA is based on proven manual trading methods and experience, built with various technical indicators and coded in MQL language. EA can automatically monitor the market and execute orders 24 hours a day, effectively avoiding the impact of time, physical strength, emotions and other factors on manual trading. EA is one of the most important trading tools for both professional and retail traders.

In addition, through rigorous and scientific backtesting, we can not only test whether the key logic of the EA is feasible, but also have a reasonable expectation of the risk and reward of trading performance in the future.

However, MT4/5 EA is not omnipotent. The MQL language is similar to the C language, the function is relatively simple. Some complex and/or advanced trading logic can not be expressed well. Then we need to use Java Script and other languages in eSignal, Reuters Eikon, CQG or other professional platforms to build the trading system.

The series of articles "Commercial EA Review by LinoCapital" aims to provide readers with some principled guidance in selecting a commercial EA through our knowledge and experience. Welcome to all kinds of feedback and discussion.

We hope all the traders succeed. Good Luck!

Promoted content

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.