There are only three types of trading losses.

They're not as obvious as you might think—but knowing what they are is vital to trading consistently.

Avoidable yet unavoidable

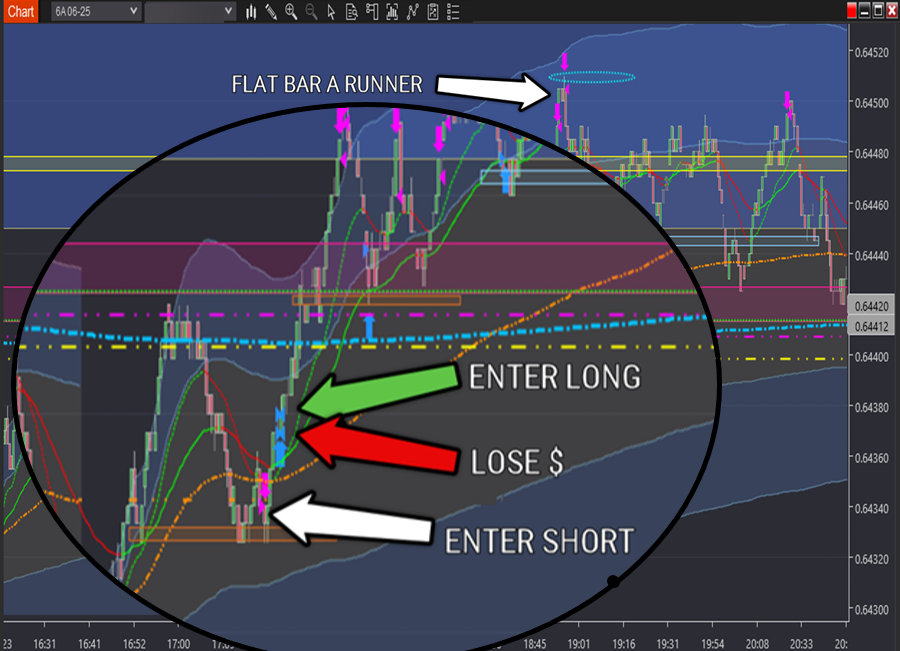

Here's a trade loss of mine from Wednesday.

Returning from a break at the screens, I failed to identify the current narrative correctly and missed several key points of evidence.

I rushed my process and missed what was staring me in the face. A losing short trade was the outcome.

And while I should know better... I'm not perfect. I make unforced errors every trading day.

Unforced errors

But here's what really matters:

You will make errors. Everyone does. The difference is whether they bleed you slowly—or barely leave a mark.

When you trade from a playbook of signature trades—they reveal early when a scenario isn't playing out. You can exit before real damage is done.

But that small cost is only a fraction of the benefit.

A big loss doesn’t just cost money—it shakes you. Not only do you face the challenge of making it back, your confidence drops and you second-guess yourself. Hold that thought...

Looking again at the trade loss, two things stand out:

- Avoided was a brutal loss when the price moved quickly and vertically higher by exiting swiftly.

- Advantage was then taken of the strong move up by entering a long position.

The right trading framework shows you what won't work—fast.

And when it runs on multiple points of evidence, you spot your misreads early. This way:

- A small loss isn't a challenge to make back.

- A small loss doesn't rattle your confidence.

- You don't hesitate on the next trade.

You’ll never trade flawlessly. No one does. But you can trade in a way that absorbs mistakes.

if you're averaging 3–4 unforced errors for every 20 trades—that’s exceptional. It’s not enough to stop you from running a profitable trading business.

However, if you're making eight or more errors every twenty trades, then it's the next kind of loss.

Donations

There are two types of traders. Winners and losers.

Winners don't win every trade but win overall. While losers don't lose every trade but lose overall—having some winning trades is what keeps losing traders continuing to trade, even though they lose overall.

Yet, we can take this one step further.

You don't trade to make money—you trade to take it.

Unless you can see how, where and why losing traders lose (so you can take their money), then you're a donator, not a taker.

But even if you do know how to identify losing traders, taking their money won't happen with intellectual understanding alone—no different to mastering how to ride a bike.

When you fully embrace 'you don’t trade to make money—you take it', you appreciate why trading demands repetition—to execute precisely in trades you already recognise and understand.

Because it’s the price of taking money from the many not willing to pay it.

Exclusivity tax

The third and final loss is a tax you pay to keep the game exclusive to the rare minority who are winners.

None of the signature trades from my playbook work all the time—making the outcome of each trade uncertain and their success probabilistic.

But it needs to be this way.

We're wired for certainty. We find probabilistic thinking challenging because it's unnatural.

Yet they're the root cause of trader behaviours and actions that pay us:

- Fear

- Impatience

- Lack of confidence

- Procrastination / hesitation

- Over-leverage

- Mental exhaustion

- Over confidence

- Binary thinking

- Hope

- Greed

- Discomfort of the unknown

But how much tax you pay comes down to how fast your process exits trades that don't pan out.

Some losses tell you what you missed.

Others tell you what you're still not seeing.

The difference is usually in the feedback from an experienced trader.

Something to sit with, next time you're sizing up a loss.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

AUD/USD: Some profit-taking should not be ruled out

AUD/USD has quickly faded Wednesday’s strong advance despite climbing to new multi-year highs around 0.7150 earlier on Thursday. The pair’s decline comes amid a marginal uptick in the US Dollar, while investors gear up for US CPI data and relevant Chinese releases on Friday.

EUR/USD faces next resistance near 1.1930

EUR/USD has surrendered its earlier intraday advance on Thursday and is now hovering uncomfortably around the 1.1860 region amid modest gains in the US Dolla. Moving forward, markets are exoected to closely follow Friday’s release of US CPI data.

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

Ripple collaborates with Aviva Investors to tokenize funds as XRP interest declines

Ripple (XRP) exhibits subtle recovery signs, trading slightly above $1.40 at the time of writing on Thursday, as crypto prices broadly edge higher. Despite the metered uptick, risk-off sentiment remains a concern across the crypto market, as retail and institutional interest dwindle.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.