In our previous article, Have You Considered Preferred Stocks, we discussed U.S. preferred stocks as an investment idea. As a conservative income-generating instrument, preferred stocks have a lot to offer. Their reason for being is to pay dividends. Dividend yields for investment-grade preferred stocks are now in the mid 6 to over 8%, and sometimes even higher. On lower-rated preferreds, yields are higher still. Preferred stock prices are much less volatile than common stock prices, though they do fluctuate more than bond prices. And some preferred shares have preferential tax treatment.

The preferred stock world is pretty diverse – at last count, almost 500 different preferred stocks were available, issued by all kinds of companies. The biggest issuers of preferred stock are banks; REITs and utilities are also big users. There are quite a few web sites that are dedicated to preferred stocks, so research is not hard to do.

For individual investors interested in preferred stocks, a few selection criteria can help you narrow down the list of candidates:

1. Credit rating.

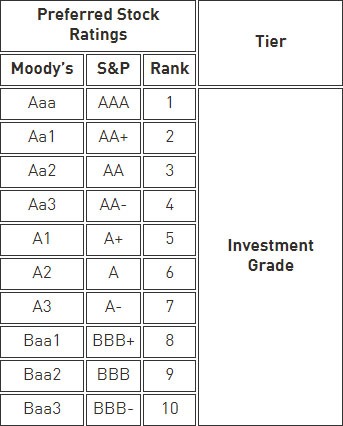

Many issuers of preferred shares have credit ratings assigned by the same rating agencies that rate bonds – Moody’s and Standard and Poor’s. A Standard & Poor’s ratings of BBB- or better, or a Moody’s rating of Baa3 or higher are considered Investment Grade, meaning there is a low risk of default. Below are the rating scales:

Interestingly, not all preferred stock issuers have their shares rated. Less than half have any ratings at all. Banks, which are the largest issuers of preferred stock, almost never submit their preferred shares for ratings. Not having a credit rating doesn’t necessarily mean that the preferred stock is a bad risk – but it does mean that you have no way of knowing. If you are concerned about the safety of your investment, sticking to preferred shares rated investment grade is a good place to start.

2. Cumulative Dividends

Some preferred stock shares are cumulative – meaning that if the issuer misses a dividend because of insufficient cash flow, they must make it up later. However, not all issues are cumulative – only about two out of three. During the 2008 financial crisis, many banks suspended their dividends for many months and were not required to make them up.

Taken together, narrowing down the entire preferred stock universe to those issues that are both investment grade and cumulative cuts down the population to under 180 issues – a manageable number to evaluate.

3. Liquidity

Liquidity of the preferred shares can be an issue. Because preferred shares are more thinly traded than common shares, the spread between the Bid and Ask prices can be large. For individual investors, who generally buy at the Ask price and eventually sell at the Bid price, the bid-ask spread is a cost of owning the shares. Even though you may have no intention of selling the preferred shares you buy today any time soon, you will eventually incur the spread. It is not uncommon for the spread to exceed a year’s worth of dividend income. A precious few preferred issues have bid-ask spreads of less than two quarters’ worth of dividends. It is easy to observe the bid-ask spread of any preferred issue you are thinking of buying within your online trading platform.

4. Qualified or non-qualified dividends

For investors who plan to hold preferred shares in a taxable (non-IRA) account, the qualified nature of many preferred stock dividends is important. For those preferreds whose dividends are qualified (which are most preferreds issued by companies other than REITS), the dividends are taxed at the investor’s long-term capital gains tax rate, rather than their ordinary income tax rate as bond interest income would be.

Filtering preferred stock shares by all of these criteria: credit ratings. cumulative vs non-cumulative, liquidity and qualification of the dividends, will narrow down your search to a handful of candidates. Choose them well, and preferred shares can reward you with years of stable income at high rates.

Read the original article here - Preferred Stocks – How to Choose?

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD treads water around 1.1900

EUR/USD edges a tad lower around the 1.1900 area, coming under mild pressure despite the US Dollar keeps the offered stance on turnaround Tuesday. On the US data front, December Retail Sales fell short of expectations, while the ADP four week average printed at 6.5K.

GBP/USD looks weak near 1.3670

GBP/USD trades on the back foot around the 1.3670 region on Tuesday. Cable’s modest retracement also comes in tandem with the decent decline in the Greenback. Moving forward, the US NFP and CPI data in combination with key UK releases should kee the quid under scrutiny in the next few days.

Gold the battle of wills continues with bulls not ready to give up

Gold comes under marked selling pressure on Tuesday, giving back part of its recent two day advance and threatening to challenge the key $5,000 mark per troy ounce. The yellow metal’s correction follows a better tone in the risk complex, a lower Greenback and shrinking US Treasuty yields.

AI Crypto Update: BankrCoin, Pippin surge as sector market cap steadies above $12B

The Artificial Intelligence (AI) segment is largely on the back foot with major coins such as Bittensor (TAO) and Internet Computer (ICP) extending losses amid a sticky risk-off sentiment.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.