When most investors and traders purchase stock it is because they intend to profit from the rise in its price. They are familiar with the mantra: ‘buy low and sell high!’ But there are several other ways of profiting from the ownership of stock shares without having to part with them. In this article, we will examine dividends as an additional method of making money from stock ownership.

When a publicly traded company reports their quarterly earnings from operation, they will often decide to share some of the profits with the owners of the company. This is called a dividend. Whoever owns shares of the company is considered a partial owner of the company. In effect, a dividend is a way of receiving your share of the company’s profits.

Many investors look to dividends as a way of receiving a regular income from an investment portfolio. However, things in the business world can change drastically and knowing how to pick the right stocks to create that regular, dependable cash flow is very important.

One critical thing to remember is that if a company is paying a portion of its profits to shareholders, it may reduce the amount of money available for growing the business itself. Most dividend investors are focused on value rather than profiting from the rapid appreciation of the stock price. Remember, the money they pay you cannot be invested by them in operations.

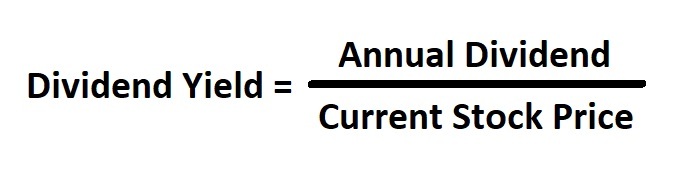

So as a dividend value seeker, we should learn about a ratio called dividend yield. The dividend yield is a simple calculation and many financial websites provide this information freely. The dividend yield tells you how much cash flow you will be receiving for your investment in the shares. It is simply the dividend amount divided by the share price.

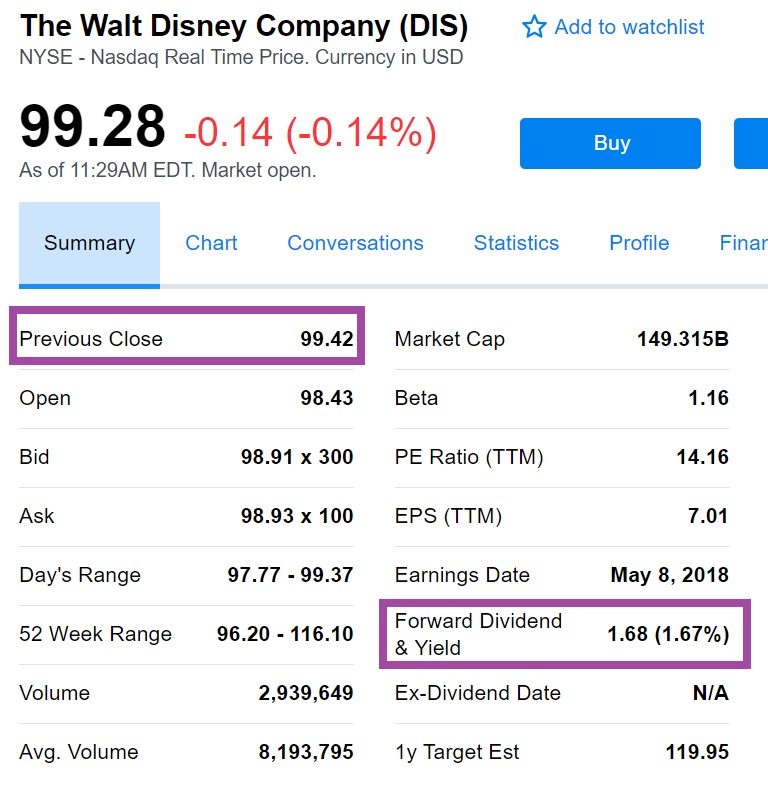

As an example, The Walt Disney Company (DIS), pays an annual dividend of $1.68. The previous close, as of this writing, was $99.42 per share. So, the dividend yield is 1.69% ((1.68/99.42) x 100 = 1.689). In the picture below, Yahoo Finance shows a slightly different yield number.

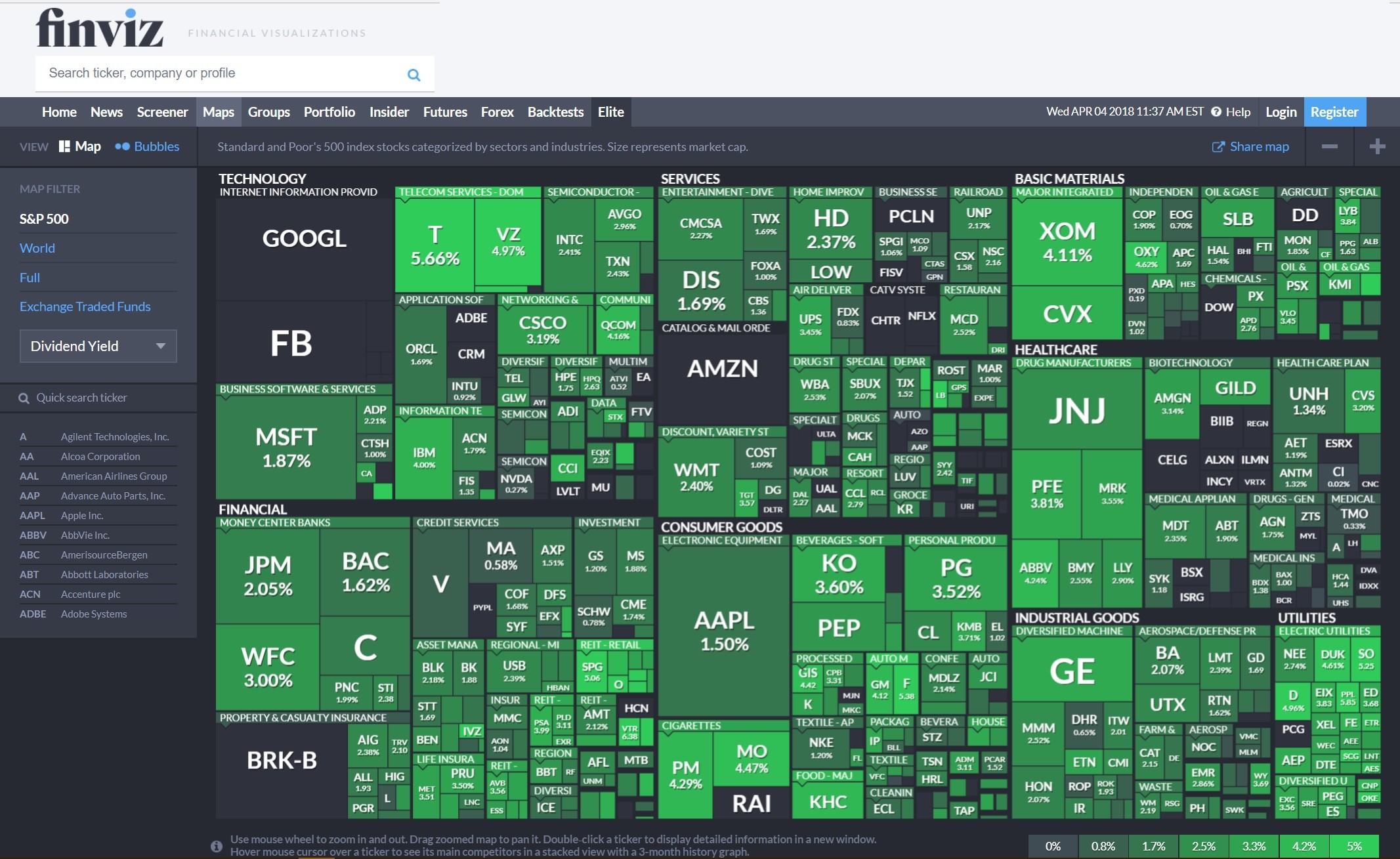

All other things considered equal, when comparing two companies as an investment you would generally want to buy the one with the higher dividend yield. This is considered getting more ‘bang for your buck.’ There are several screeners and maps of the market found online that can help you see which stocks carry higher dividend yields.

As mentioned earlier, business environment conditions change. This could affect the amount of the dividend paid out to shareholders. If the company’s business slows due to competition or economic reasons, the company may decide to reduce or eliminate the dividend altogether. To reduce the chance of this happening, investors should make sure the company is not paying out too much of its profits as dividends.

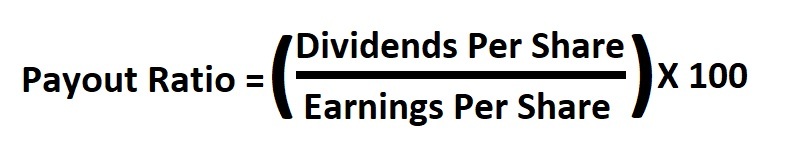

There is another ratio that investors should be aware of, the payout ratio. The payout ratio is expressed in percentages and tells an investor how much of the company’s profits are being paid to shareholders.

Looking at the financial data of DIS once again, we know the dividend is $1.68. The EPS is stated online as $7.01. So, the payout ratio should be 23.96%, ((1.68 / 7.01) x 100). But is this a good number? Well, it depends. If a company is paying out too much of their profits they may not be able to sustain that dividend when times get tough economically.

There is no set number for what would make a great payout ratio because it varies from sector to sector. Generally, over 50% would be considered high and potentially unsustainable. A 0% to 35% is generally considered to be good in the industry. 36% to 50% is ok and sustainable if there is earnings growth in the company. Higher ratios may be acceptable if other factors are in place within the operations of the company.

Overall, dividends are a great way to earn extra cash flow while holding an investment. There are others as well. Learn about them and how to select the correct stocks to invest and trade at Online Trading Academy’s newly released Professional Stock Trader Course. You can enroll at your local office. Until next time, trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD hits fresh three-year highs above 0.7100 on hawkish RBA-speak

AUD/USD has refreshed three-year highs to regain 0.7100 and beyond in Wednesday's Asian trading. The pair remains undeterred by the mixed Chinese inflation data for January, which showed the growth in the Consumer Price Index slowing more than expected, while the Producer Price Index beat estimates. RBA official Hauser's hawkish commentary provides an extra boost to Aussie bulls.

USD/JPY extends three-day rout below 154.00, NFP eyed

USD/JPY is extending its three-day rout below 154.00 in the Asian session on Wednesday, awaiting the release of the closely-watched US NFP report. In the meantime, rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance underpin the Japanese Yen, weighing on the pair amid intervention fears.

Gold awaits US Nonfarm Payrolls data for a sustained upside

Gold remains capped below $5,100 early Wednesday, gathering pace for the US labor data. The US Dollar licks its wounds amid persistent Japanese Yen strength and potential downside risks to the US jobs report. Gold holds above $5,000 amid bullish daily RSI, with eyes on 61.8% Fibo resistance at $5,141.

Bitcoin, Ethereum and Ripple show no sign of recovery

Bitcoin, Ethereum, and Ripple show signs of cautious stabilization on Wednesday after failing to close above their key resistance levels earlier this week. BTC trades below $69,000, while ETH and XRP also encountered rejection near major resistance levels. With no immediate bullish catalyst, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.