I’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

What is Delta? You see options prices are influenced by what they call the Greeks.

A few of the Greeks are Delta, Gamma, and Theta. These are just three of the Greeks there are more.

When you’re trading options, it is important that you know about the Greeks and what they do.

For this article, we will focus on Delta, what it is, and why you should know exactly what Delta is.

Then we’ll go through a specific example explaining it, and then I’ll share with you a few things that you need to know about Delta.

So let’s get started.

The Greeks

OK, so as I mentioned, there are the option Greeks. Here are a few of them and what they tell you:

1) Delta is actually measuring the sensitivity. It’s a mouthful, but I’ll show you exactly what it means, for the option’s premium relative to the underlying asset in this article.

In a nutshell, though, it basically says, how much does the option price change if the stock moves $1 to the upside or the downside?

2) Gamma is the rate of change of the Delta.

3) Theta, and Theta basically measures time decay.

What Is Delta?

So what is Delta? Delta is a number between 0 and 1 that measures how much the price of an option changes if the stock moves by $1.

I know all of this sounds super theoretical, so let me actually give you a specific example.

Now, the example that I want to use here is Microsoft (MSFT) when it was trading at $211.20.

I want to show you different strike prices of options, because, again, options have strike prices and expirations.

We are looking at the current price of this option and we will look at the new price of this option if Microsoft moves by $1 from $211.20 to $212.20.

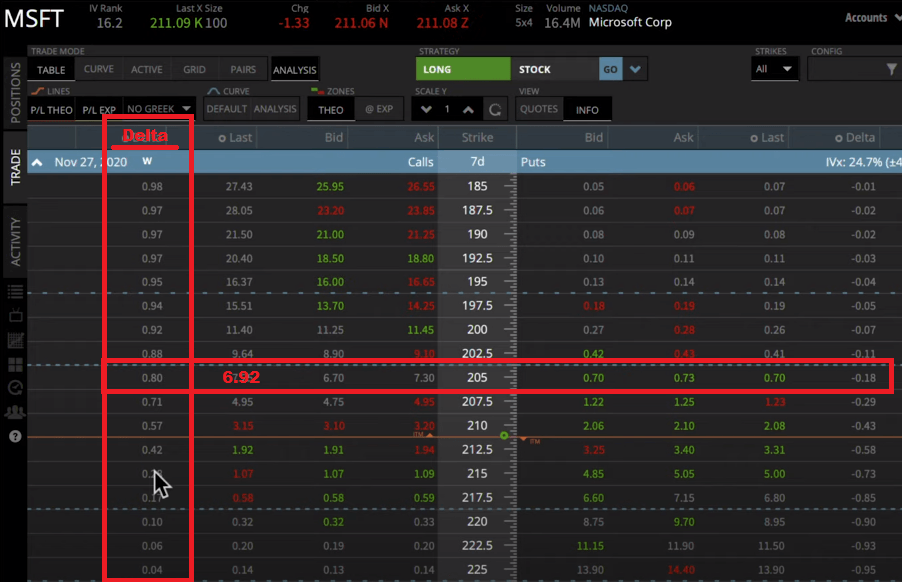

When we bring up the option chain in our trading platform, in this case, Tastyworks, the option we are using as an example is expiring on November 27th.

So as you can see, there are different call options on this site with different strike prices.

You can also see that they have all sorts of different Deltas. So let’s get started with the 205 that is right now trading at $7.30, and the Delta is 0.8. Remember, the Delta is 0.8 because again, the Delta is between 0 and 1.

I’ll tell you about negative Delta in just a moment. The current price of the option is what we are seeing right here. We look at the last traded price, the last traded price is $6.92.

So what does it mean? It means if Microsoft goes up by $1 to $212.20, that the new price is $6.92 plus the Delta ($0.80).

So, you see this where it’s really important that you understand Delta. Some people think that options move even more than the stock, and this is not true at all.

So option prices always move less than the stock price. So the new price here of the option would then be $7.72.

So this is for a strike price of 205, and this is a strike price that is so-called ITM “In The Money” because its value, its strike is less than the current price.

Now let’s take a look at a strike that is at the money.

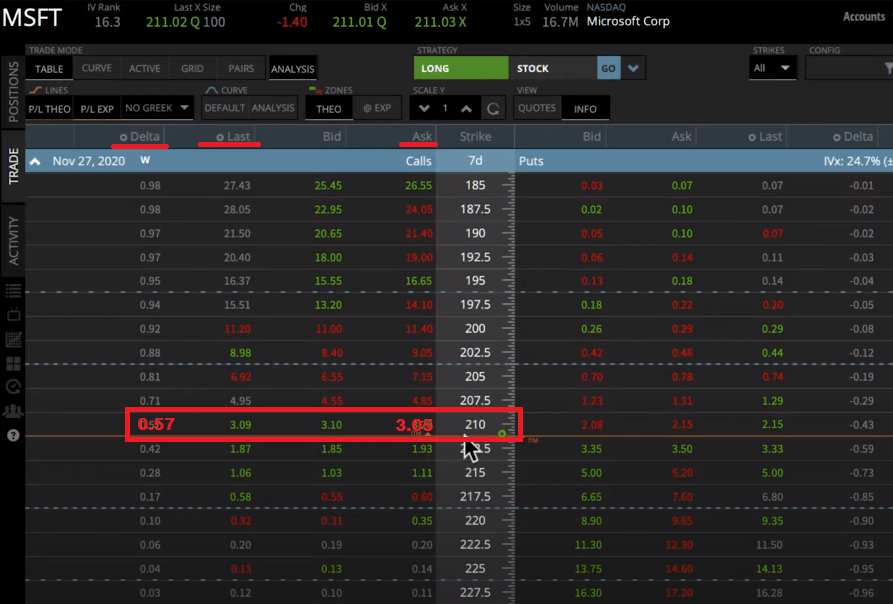

Now assuming Microsoft is trading at $211 we will use the 210 strike price here.

As you can see, the 210 strike price has a Delta of 0.57, and this would be a so-called ATM “At The Money” with a Delta of 0.57.

Again, it is between 0 and 1. The current price of the 210 strike here is $3.05. We are using the last traded price here.

So if Microsoft moves by $1 upwards, this option only moves 0.57. So this means that this option moves to $3.62.

I’ll show you one more example.

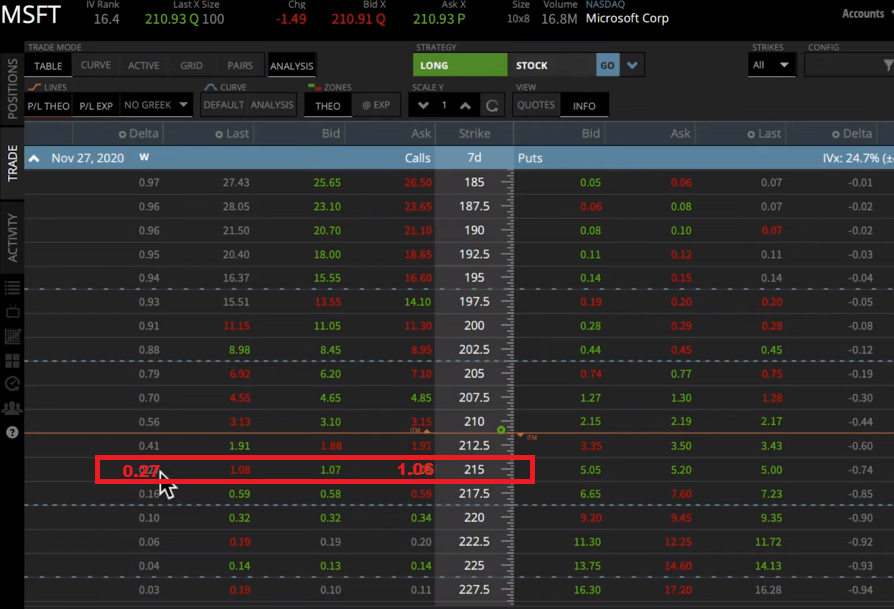

So we are using a strike of 215. So that would be OTM “Out Of The Money,” and the Delta is 0.27. So the current price of this option is $1.06.

So if the stock moves up by a dollar, this option only moves up by $0.27.

Even though the stock moves up by $1, this only moves to $1.33.

Things You Need To Know

So let’s talk about the things you need to know.

Options that are ITM have a higher Delta then options OTM. So this means that ITM options move more.

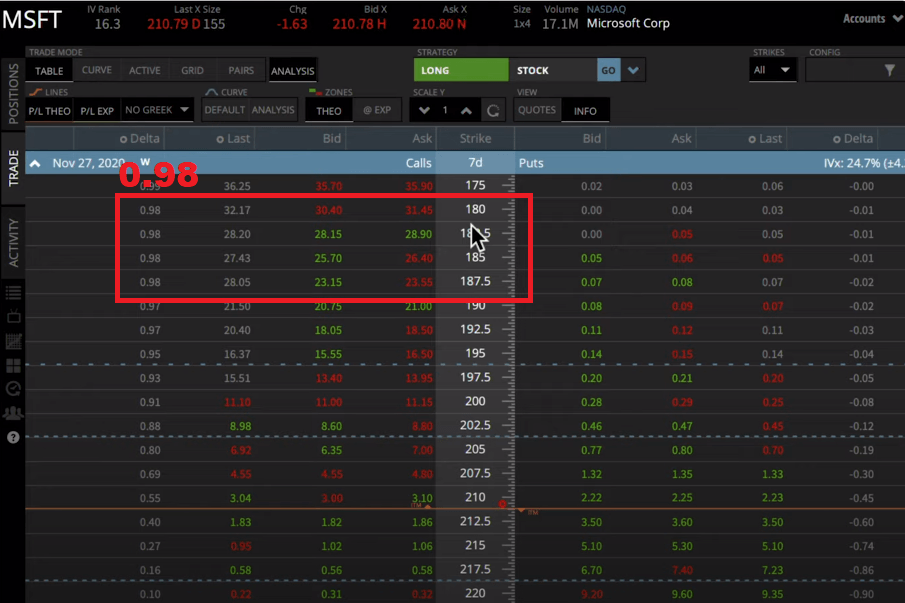

Now, if you go back to our options chain here, you see that the Delta for deep in the money options is 0.98.

So this basically means that if the stock goes up by $1, the price of this option goes up by $0.98, so the deeper in the money, the closer to $1 the price will move.

So options that are ITM are more expensive. This is where it’s important that you see that there’s a relationship between the Delta and the price.

The higher the Delta, the higher the price, because the higher the Delta, the more it is in the money.

As a rule of thumb, options ATM “At The Money” which are right where the strike price is right at the level where the current price is, are usually around 0.5.

Now, all this applies to call options. Now put options have a negative Delta which is between -1 and 0.

Well, the price of a put decreases if the option goes up. So the Delta for put options is all negative.

Now, put options that are ATM, are usually closer to one. And options that are OTM, don’t move a whole lot.

This is very important because some people just think,

“Oh, my gosh, I’m buying out of the money options because they are cheap. It is so much cheaper to pay $1.6 than $6.92.”

But they don’t really move a whole lot.

Now here’s a really cool tip that you might not have known. The Delta is a rough estimate of the probability of the stock price closing above the strike.

So here, you see with a delta of 0.8, it means that there’s an 80% probability right now that the stock will be above that strike price. If the Delta is 0.27, then that means there’s a 27% probability that the stock will be above that strike price.

So I think it’s kind of cool as an options trader to know this. So the Delta is giving you a rough approximation of how likely is it that the stock will be above or below the current strike price on exploration.

Now here’s the tricky part, Delta is not fixed. So the Delta changes as the price changes and here’s why.

right now, if, for example, Microsoft (trading at $211) goes up to 215, the current strike price of 210 is deeper in the money therefore, then the Delta will be higher.

So now you know what Delta is, how it influences the option price, and you see that this is important when you are trading options. If you think that this is cool stuff that you should share with your friends, feel free to share this video on Facebook, on Twitter, by email and I will see you for the next article.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD clings to small gains near 1.1750

Following a short-lasting correction in the early European session, EUR/USD regains its traction and clings to moderate gains at around 1.1750 on Monday. Nevertheless, the pair's volatility remains low, with investors awaiting this weeks key data releases from the US and the ECB policy announcements.

GBP/USD edges higher toward 1.3400 ahead of US data and BoE

GBP/USD reverses its direction and advances toward 1.3400 following a drop to the 1.3350 area earlier in the day. The US Dollar struggles to gather recovery momentum as markets await Tuesday's Nonfarm Payrolls data, while the Pound Sterling holds steady ahead of the BoE policy announcements later in the week.

Gold stuck around $4,300 as markets turn cautious

Gold loses its bullish momentum and retreats below $4,350 after testing this level earlier on Monday. XAU/USD, however, stays in positive territory as the US Dollar remains on the back foot on growing expectations for a dovish Fed policy outlook next year.

Solana consolidates as spot ETF inflows near $1 billion signal institutional dip-buying

Solana price hovers above $131 at the time of writing on Monday, nearing the upper boundary of a falling wedge pattern, awaiting a decisive breakout. On the institutional side, demand for spot Solana Exchange-Traded Funds remained firm, pushing total assets under management to nearly $1 billion since launch.

Big week ends with big doubts

The S&P 500 continued to push higher yesterday as the US 2-year yield wavered around the 3.50% mark following a Federal Reserve (Fed) rate cut earlier this week that was ultimately perceived as not that hawkish after all. The cut is especially boosting the non-tech pockets of the market.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.