In the midst of a dynamic and fast-evolving financial era, traditional finance is undergoing a seismic shift. Digital currencies, once viewed as a niche interest for tech enthusiasts, are rapidly moving into the mainstream, presenting a viable alternative to conventional financial practices.

Increasingly, individuals across the globe are now looking toward the vibrant sphere of cryptocurrencies. At the center of this transformative tide is Paybis, a leading cryptocurrency exchange platform actively shaping the emerging contours of this digital financial revolution.

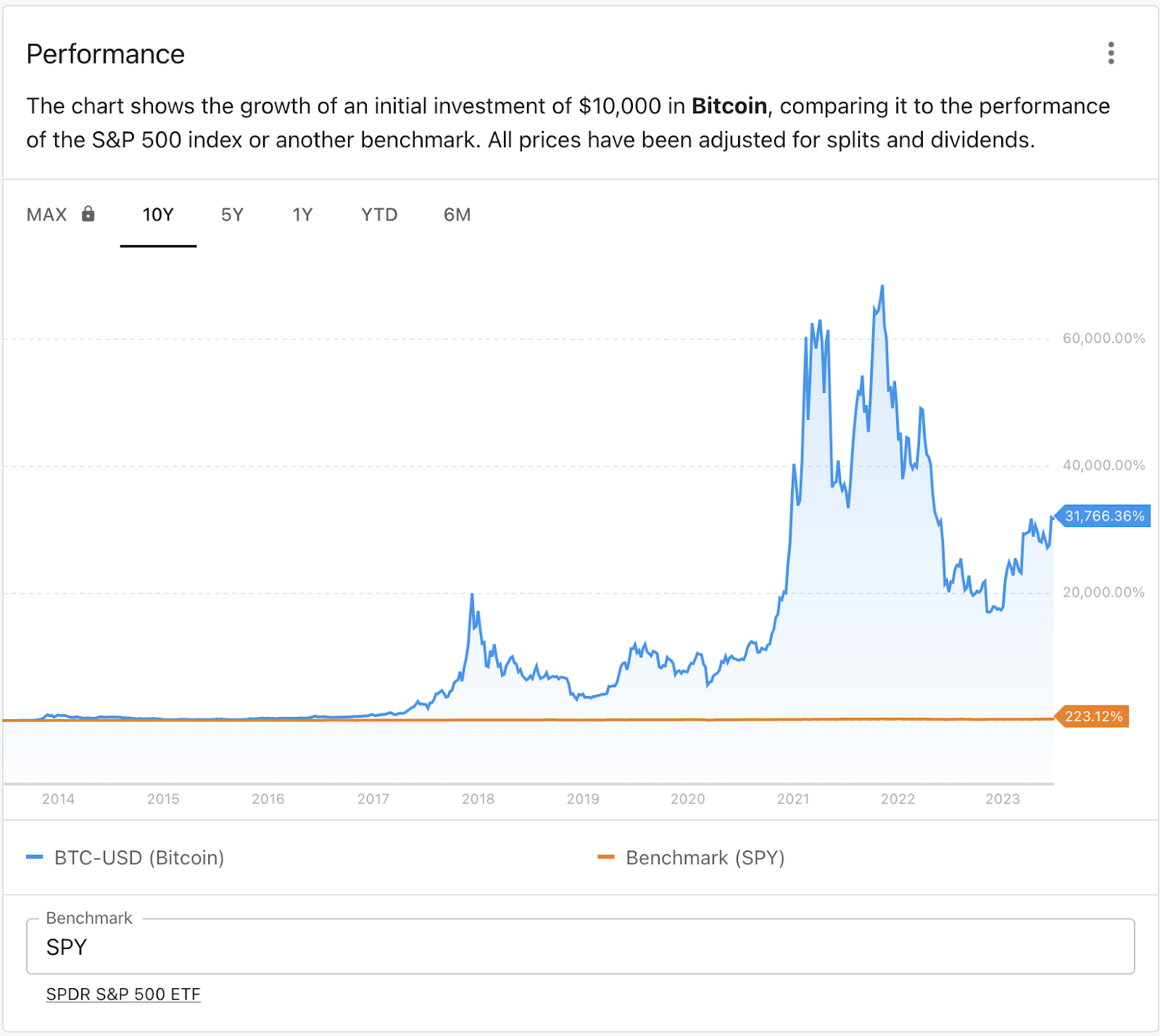

Source: portfolioslab.com/symbol/btc-usd

Unleashing the Power of Cryptocurrency Investments

Investing in cryptocurrencies can offer various benefits, including portfolio diversification and alternative options to traditional financial institutions. While it's important to note that past performance is not indicative of future results, Bitcoin has demonstrated impressive growth compared to the S&P 500 over the past decade. BTCUSD has seen an annualized growth rate of over 48% in the last ten years, outperforming the widely used benchmark index, which achieved 8% growth during the same period.

In addition to traditional asset classes like stocks, bonds, commodities, and real estate, cryptocurrencies have emerged as a new and distinct asset class. Operating independently of any specific country's fiscal policies or the global stock market, cryptocurrencies have experienced remarkable growth in the past decade. This unique characteristic offers the potential for substantial value appreciation.

Amidst geopolitical instability and concerns about rising inflation, some individuals view cryptocurrencies as a digital safe haven. While digital currencies may offer potential hedging benefits against such disruptive forces, it's important to consider the risks associated with investing in them.

For example, the cryptocurrency market isn’t regulated, nor are cryptocurrencies backed by any government, central bank, or commodity like gold. As a nascent asset class, cryptocurrencies are highly susceptible to price volatility, and are particularly sensitive to sudden changes in the macroeconomic or regulatory environment. Therefore, caution is advised.

Entering the world of cryptocurrency investing can be challenging, particularly for newcomers. Factors such as market complexity, security considerations, and the costs associated with digital currencies can present significant barriers. At Paybis, we aim to address these concerns by providing an intuitive, secure, and cost-effective platform that facilitates entry into the world of digital currency investments.

Minimizing Transaction Costs with Paybis

While there are numerous trading platforms available, Paybis distinguishes itself by addressing a common concern among cryptocurrency traders: transaction fees. Most trading platforms charge fees for transactions, which can accumulate and deter potential users.

Paybis sets an exceptionally low minimum buy limit, complemented by low, transparent transaction fees, for substantial cost-savings and accessibility. As a result, Paybis has designed its platform to be as inclusive as possible, enabling users to start investing in cryptocurrencies with transactions as low as $5.

In addition, Paybis places a strong emphasis on user satisfaction. Their platform offers clear instructions and readily available customer support, ensuring that even those new to the world of cryptocurrencies can easily navigate the process of buying, selling, and managing their digital assets.

Opting for Financial Freedom with Cryptocurrencies

As the digital era continually reshapes our lives, it also magnifies the shortcomings and vulnerabilities of traditional financial systems. Each transaction conducted within these conventional systems leaves a digital footprint, weaving a detailed tapestry of personal financial data that can be potentially exploited. However, with their innate decentralization and privacy attributes, cryptocurrencies offer a compelling departure from this norm.

Alongside decentralization, cryptocurrencies provide a unique advantage: privacy. In an era of increasing concerns about data collection and privacy infringements, the capacity to transact anonymously is becoming critically important. Paybis plays a significant role in this domain by enabling users to leverage the privacy features of cryptocurrencies.

Consequently, Paybis simplifies not only the process of investing in cryptocurrencies but also enables users to step towards greater financial freedom and privacy. The revolution is well underway, and Paybis is paving the path for everyone to participate in and navigate this novel financial landscape.

Conclusion

As we navigate the ever-evolving financial landscape, cryptocurrencies are becoming a mainstream investment choice. Paybis, with its user-friendly platform and low minimum purchase limit, is enabling more and more individuals to begin their journey into the world of digital currencies.

Paybis is unlocking a universe of investment opportunities, opening up the financial future to a broader audience, and pioneering a new path toward democratized, secure, and private financial engagements.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: Gains remain capped by 1.1650

EUR/USD remains in recovery-mode following the closing bell in Euroland on Wednesday, hovering around the 1.1650 zone amid renewed downside pressure on the US Dollar and a marginal improvement in the global sentiment.

GBP/USD appears bid around 1.3370

GBP/USD reverses part of its recent multi-day decline, gathering some balance and managing to reach the 1.3400 region, where some initial resistance seems to have turned up. Cable’s uptick comes in response to some loss of momentum in the Greenback despite the geopolitical scenario remaining fragile.

Gold recovers modestly despite intensifying Middle East crisis

Gold keeps its daily gains well in place, although a break above the $5,200 mark per troy ounce still remains elusive on Wednesday. The yellow metal’s rebound comes in response to the persistent flight-to-safety amid intense geopolitical tensions in the Middle East and the bearish performance of the US Dollar.

Crypto Today: Bitcoin, Ethereum, XRP rebound amid mixed ETF flows

The cryptocurrency market is showing subtle recovery signs despite heightened global uncertainty following the United States (US) and Israel attacks on Iran and the subsequent retaliations that have morphed into a wider Middle East war.

First Venezuela, now Iran: The US-China energy war escalates Premium

At first glance, the latest escalation involving the United States with both Iran and Venezuela looks like another chapter in a long-running geopolitical story. But viewed through a broader strategic lens, something else may be unfolding: Energy.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.