In an age of uncertainty and systemic disruption, investors and traders are no longer seeking just returns. They are seeking clarity, accountability, and purpose. The term "on-chain" does not simply describe a technical structure, it captures a movement toward financial truth, encoded in the very architecture of the blockchain.

In this piece, I invite you to explore:

-

What on-chain means

-

Why it matters, and

-

How it is transforming not only our systems but our thinking

This is more than a shift in tools, it is a shift in mindset.

A transformation not only in technology, but in trust. In the architecture of markets, and in the character of those who participate in them.

What does “on-chain” mean?

At its core, "on-chain" means living on the blockchain. Every transaction, smart contract execution, token issuance, or governance vote becomes part of a permanent, public, and tamper-proof record. No centralized gatekeeper. No hidden ledgers. Just pure, mathematical trust verified by a decentralized network.

On-chain is where:

-

Ownership is not claimed, it is proven.

-

Agreements are not promised; they are executed automatically.

-

Market behavior is not speculated; it is observed in real time.

To understand on-chain is to understand that we are entering a new realm of financial behavior, one in which the code becomes the law, and the ledger becomes the light. It is the foundation of a new financial reality, where transparency becomes strategy, and truth becomes alpha.

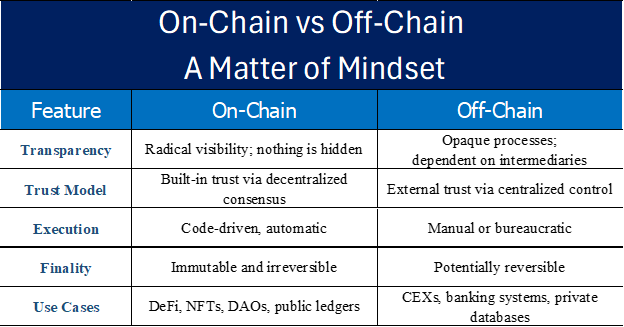

This comparison is not just technical. It is philosophical. On-chain is financial truth in motion. It empowers those who want to act with transparency, discipline, and speed. It removes the shadows and invites accountability.

This is not just a new system, it is a new ethos. It invites every trader, investor, developer, and policymaker to participate in a more principled, observable, and merit-based marketplace.

On-chain liquidity and the power of decentralized confidence

Let me paint the picture. Imagine you trade on a decentralized exchange like Uniswap. Every token you swap, every fee you pay, every change in liquidity, is visible, permanent, and indisputable.

There is no need to wonder what happens behind closed doors. There are no closed doors. Everything unfolds before your eyes, with precision and honesty.

This is not a dream, it is happening now. And it matters, because:

-

You can track large wallets moving capital before the crowd catches on.

-

You can assess liquidity depth without relying on reports.

-

You can measure protocol health by what is actually happening, not what someone claims is happening.

This is what I call Strategic Transparency: the ability to align your trading strategy with real, verifiable market dynamics.

And in a market where reaction time is measured in milliseconds, and credibility is measured in blocks, on-chain visibility becomes your most powerful edge.

On-chain intelligence is the strategic compass for the modern investor

We no longer navigate markets with blindfolds, waiting for delayed reports or filtered narratives to make informed decisions. In today’s real-time economy, on-chain data has become the investor’s compass, a living map of financial behavior, capital flow, and market sentiment.

Used wisely, it enables you to:

-

Follow the smart capital by observing wallet movements across networks.

-

Monitor DeFi ecosystems to anticipate shifts in risk appetite and liquidity.

-

Identify protocol strength or vulnerability before trends appear in traditional media.

But this is more than raw data. It is actionable insight. And when insight meets experience, conviction, and discipline, it leads to strategic precision.

As I often say: in an age of information overload, clarity is the new alpha. On-chain intelligence cuts through noise and speculation. It transforms reactive participants into forward-looking strategists.

This isn’t just evolution, it’s a rebirth of financial awareness. It’s a paradigm where data empowers you to think like an architect, act like a tactician, and trade with integrity.

Building the new normal through the future of on-chain finance

We stand on the threshold of a financial transformation, a shift that is rewriting the very foundations of how markets operate. On-chain finance is no longer a theoretical framework it is an unfolding reality. And while its benefits may not arrive evenly across the globe, its momentum will be unstoppable.

Five trends are shaping the future of on-chain finance:

1. Institutional awakening

Across the financial spectrum, organizations are transitioning on-chain, not for novelty, but for necessity. The reasons are clear: real-time settlement, transparent audit trails, automated compliance, and frictionless access to global capital. What was once considered innovation is now becoming infrastructure.

Traditional financial institutions are beginning to engage with tokenized assets, on-chain settlement, and blockchain-native compliance. Examples include:

-

Networks using blockchain for wholesale payments.

-

On-chain money market funds built on public blockchains.

-

Tokenized funds exploring the composability of DeFi.

These developments signal that on-chain transparency, auditability, and automation are no longer risks; they are competitive advantages.

2. The rise of programmable capital

Capital is becoming dynamic. Instead of passive investment, we're entering an era of programmable finance, where money moves according to coded logic, risk parameters, and real-world data triggers. This marks a shift from contracts written on paper to agreements embedded in code: composable, enforceable, and transparent.

Next-generation DeFi protocols are evolving to support:

-

Dynamic interest rates.

-

Tokenized real-world assets (RWAs).

-

Multi-chain interoperability.

This is where on-chain lending meets real-world asset financing, bridging traditional and decentralized capital markets.

3. Borderless, transparent governance

Decision-making itself is evolving. Through decentralized governance structures, communities and stakeholders now coordinate capital and policy without borders, hierarchies, or opacity. These emerging financial democracies are not just theories, they are functioning, measurable, and redefining what it means to allocate resources at scale.

Decentralized Autonomous Organisations (DAOs) governed entirely through on-chain mechanisms are redefining how financial systems allocate capital. The ability to encode governance rules, automate treasury functions, and audit decision-making on-chain is increasingly being viewed as a model for future public and private sector finance.

4. The synergy of AI and on-chain data

Artificial Intelligence is not a threat; it is a tool of empowerment. When paired with transparent, real-time blockchain data, AI can detect early risks, model scenarios, and manage portfolios with unparalleled efficiency. This synergy lays the groundwork for intelligent, adaptive finance, one that learns, evolves, and acts in harmony with both markets and human judgment.

As AI and machine learning integrate into blockchain ecosystems, on-chain data will increasingly:

-

Power automated asset rebalancing.

-

Drive liquidity routing algorithms.

-

Detect anomalies in real time.

-

Enable predictive credit scoring and risk modeling.

This convergence could lead to self-governing, self-adjusting financial agents, powered by both on-chain data and AI logic.

5. Regulated transparency and trusted innovation

Decentralization and regulation are not opposing forces. In fact, they are converging. The future lies in frameworks that honor decentralization while enforcing accountability. Compliant on-chain finance will become the bridge that connects innovation with institutional trust. It will allow public, transparent systems to meet the standards of global finance without compromising the ethos of openness.

Contrary to early fears, regulation is not dismantling on-chain finance, it is refining it. MiCA in the EU, Tokenized Securities in Singapore, and SEC interest in blockchain disclosures point toward a regulated, yet decentralized, financial future.

The emerging framework supports permissioned DeFi, identity-aware liquidity pools, and compliant stablecoins, making on-chain finance viable for regulated institutions and sovereign entities.

The future of on-chain finance is not about replacing traditional systems, but about re-architecting trust, transparency, and efficiency at scale. In this new landscape:

-

Investors will evaluate protocols based on on-chain activity, treasury health, and community governance.

-

Trading strategies will evolve to incorporate wallet analysis, smart contract signals, and real-time cross-chain metrics.

-

Institutions will increasingly allocate capital based on programmable compliance and verifiable transparency.

A new financial consciousness

The rise of on-chain finance is not merely a technical evolution. It is a revolution of thought, a call to action, a return to truth.

-

For the trader, it is a sharper edge.

-

For the investor, a clearer horizon.

-

For the institution, a more resilient foundation.

But above all, on-chain finance is a mirror, one that reflects who we are becoming as market participants, builders, and citizens of the new digital economy.

It challenges us

- To trade with integrity.

- To build with transparency.

- To govern with vision.

The question is no longer "what is on-chain?"

The real question is: Are you ready to operate where truth lives, and where your strategy becomes part of the chain of trust that defines tomorrow’s markets?

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD Price Annual Forecast: Growth to displace central banks from the limelight in 2026 Premium

What a year! Donald Trump’s return to the United States (US) Presidency was no doubt what led financial markets throughout 2025. His not-always-unexpected or surprising decisions shaped investors’ sentiment, or better said, unprecedented uncertainty.

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

GBP/USD Price Annual Forecast: Will 2026 be another bullish year for Pound Sterling? Premium

Having wrapped up 2025 on a positive note, the Pound Sterling (GBP) eyes another meaningful and upbeat year against the US Dollar (USD) at the start of 2026.

US Dollar Price Annual Forecast: 2026 set to be a year of transition, not capitulation Premium

The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.