Last week, I replied to a question posed from a student. I enjoy receiving these questions as it allows me to gain feedback from students and also keeps me sharp as an instructor. Another popular question I receive is, “Will Online Trading Academy’s technical analysis techniques work on Indian markets?” The answer is a resounding yes and is obvious if you understand what trading is all about.

Most people incorrectly assume that trading is all about understanding the fundamentals of the market or knowing the balance sheet of a company. It doesn’t have as much to do with that as it does with understanding people. People’s perceptions or expectations of a company or even the entire economy are what drive prices of securities. Prices of equities, commodities, and currencies are all subject to the same laws of supply and demand as is any other product. In fact, this is why you will often see prices drop after a company meets expectations for an announcement. The demand for the shares prior to the release overwhelmed the supply. Sellers realized this and raised their prices they were asking for shares. Buyers, in a desperate attempt to own shares, will raise the amount they are willing to pay for them.

For instance, if Tata Motors sells a larger amount of cars than expected, but traders have already anticipated this, then the price will not move up as you might expect. The traders who were expecting positive sales results have already bought their shares prior to the announcement. This should have caused a rise in price for the reasons I stated above. Once the data is known by everyone and there is no surprise, some buying may come in. However, the traders who already own shares are disappointed that the price isn’t rising more or they are satisfied with their profits and begin to sell. Without increased buying pressure from interested parties, these sellers must drop their price to attract buyers to take their shares.

So you see how human emotion, basically fear and greed, will motivate traders to act in the market. This is what causes price movement. So to be successful in trading, you need to know how to read this emotion and the strength of it. That is what technical analysis does. The charts show us the actions of the traders who are involved in that security. In looking at candlesticks and technical tools, we can read the strength of the emotion of those who will move the markets. We can see when this emotion is shifting and leading market turns.bullish candles

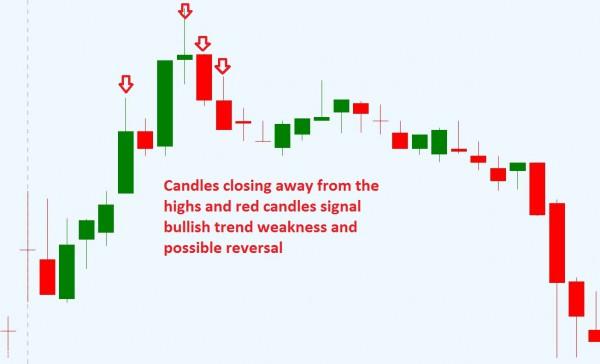

We can read the price candles for much of this information. If you are in a bullish trend that you expect to continue, you would expect the share price to close at or near to the high of the day or the high from several days. You would be seeing green candles on your chart with very few or small topping tails.

If price closes away from the highs, then the buying pressure has weakened, or selling pressure has gained. Either way, it is not good for the people holding the stock long. If there is a close that occurs significantly far from the highs, it could signal a possible change in trend.

The same applies to when selling pressure is gaining or weakening. You would expect a very weak stock to be closing at or near the lows. If it doesn’t, then buyers are strengthening or sellers are weakening or both are occurring. So by viewing traders’ actions in a graphical format, we can make assumptions about the strength of the movement of the stock price. These observations are part of our decision making process to time proper entries and exits in the market. That is what technical analysis can offer you as a trader or investor.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD holds near 1.1900 ahead of US data

EUR/USD struggles to build on Monday's gains and fluctuates near 1.1900 on Tuesday. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD declines toward 1.3650 on renewed USD strength

GBP/USD stays on the back foot and declines to the 1.3650 region on Tuesday. The negative shift seen in risk mood helps the US Dollar (USD) gather strength and makes it difficult for the pair to find a foothold. The immediate focus is now on the US Retail Sales data.

Gold stabilizes above $5,000 ahead of US data

Gold enters a consolidation phase after posting strong gains on Monday but stays above the $5,000 psychological mark and the daily swing low. US Treasury bond yields continue to edge lower on news of Chinese regulators advising financial institutions to curb holdings of US Treasuries, helping XAU/USD hold its its ground.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.