Online Trading Academy graduates know that their trading decisions should be based on price action and volume. Technical indicators are very popular in the trading community but need to be used only as an odds enhancers. It is important to remember that an odds enhancer is used to increase the probability of a trade working out, not to signal the entrance to a trade itself. You should still execute trades based on price analysis and supply and demand levels. Whenever I start to discuss technical indicators, everyone always asks me what my favorite one is. I never get bored from watching the disappointment on their faces when I answer, “Price!”

The truth is, all indicators are built on past price and relationships to that price with volume included on some. If you understand the mechanics of the indicator, then you know how it is likely to read Price movement and when the indicator will give signals by simply reading price on a chart. When you can do this, then you will be ahead of those who are relying on an indicator to render a buy or sell signal prior to acting. Indicators can be helpful when used properly. Since the buy or sell signals usually appear late, we must observe the behavior of the indicator and take our signals from changes in that behavior.

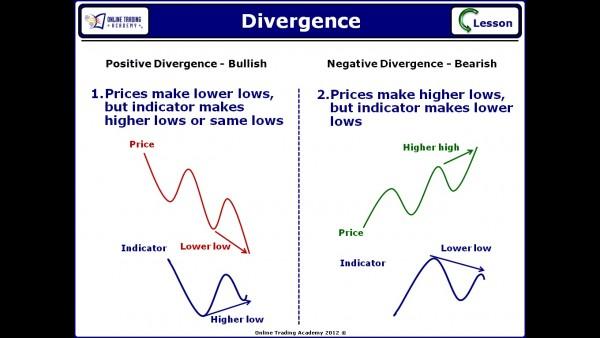

Enter divergence. Divergence is when the indicator is not exhibiting the same characteristics as the price of the security. When prices rise, you should be seeing higher highs and higher lows for the uptrend in price. You should also be seeing higher highs being made in the indicators. The opposite is true when in a downtrend, lower lows in price and the indicator. There are two types of divergence, positive and negative. Positive divergence typically signals the pause or end of a downtrend. In positive divergence, the price of the security makes lower lows and lower highs, a downtrend. However, the indicator makes the same lows or possibly higher lows.

The divergence of the indicator shows that even though prices are continuing in the trend, they are doing so with less momentum and are unlikely to continue without a pause, correction or even a reversal. This is shown in the following chart with positive divergence in the Stochastics.

Negative divergence typically signals the end, pause or correction of an uptrend. It occurs when prices are making higher highs and higher lows (an uptrend), but the indicator makes similar or lower highs. This lack of momentum being demonstrated by price and reflected in the indicator is a signal of weakness of the trend. Be watchful for reversal signals in this environment.

A trader can use technical indicators, but you want to be sure to use them properly. Relying on them to signal your entry or exit to trades could lead to disaster. Looking for divergence to confirm your trade that was based on price action is the best way. Learn how to read price correctly by joining one of our courses today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD holds firm above 1.1900 as US NFP looms

EUR/USD holds its upbeat momentum above 1.1900 in the European trading hours on Wednesday, helped by a broadly weaker US Dollar. Markets could turn cautious later in the day as the delayed US employment report for January will takes center stage.

USD/JPY cracks 153.00 on unabated demand for Japanese Yen

USD/JPY is extending its three-day rout below 153.00 in the European session on Wednesday, awaiting the closely-watched US NFP report. Rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance bolster the Japanese Yen, weighing on the pair amid intervention fears.

Gold sticks to gains near $5,050 as focus shifts to US NFP

Gold holds moderate gains near the $5,050 level in the European session on Wednesday, reversing a part of the previous day's modest losses amid dovish US Federal Reserve-inspired US Dollar weakness. This, in turn, is seen as a key factor acting as a tailwind for the non-yielding yellow metal ahead of the critical US NFP release.

Bitcoin, Ethereum and Ripple show no sign of recovery

Bitcoin, Ethereum, and Ripple show signs of cautious stabilization on Wednesday after failing to close above their key resistance levels earlier this week. BTC trades below $69,000, while ETH and XRP also encountered rejection near major resistance levels. With no immediate bullish catalyst, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.