When it comes to trading, most of it is done by making a directional bet. In other words, if the probabilities are high that the market will decline, we short it anticipating we will make money as it moves lower. Conversely, when the prevailing odds are that a given market will move higher, we buy it with the hope that we will sell at higher prices in order to garner a profit. In addition, to exercise sound risk management we will cut our losses swiftly if the market proves us wrong. This is conventional market speculation.

There is however, a lower risk method to participate in the markets. This method is not as widely known, or practiced for that matter, but can be a viable method to making money in any market. What I’m referring to is what is commonly called spread trading. Spread trading involves buying one contract and concurrently selling another contract in order to profit from a relative change in price in both contracts.

These can be done in the same market, known as Intra-market spreads, and they can also be done among two related markets, referred to as an Inter-market spread. Institutions are heavily involved in this type of trading in stocks, options, and the futures markets. One premise in spread trading is that a situation arise when markets become misaligned or are trading outside of the norm. Most of the time they will almost always revert back to alignment. This price movement between two markets can produce profits for the astute spread trader.

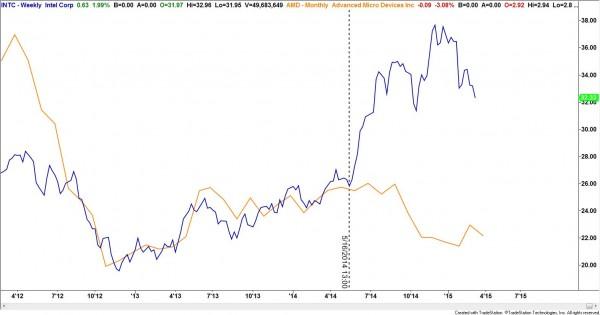

The second premise in spread trading is to look at several related markets and then identify the strongest and weakest of those markets. The stronger market is to be bought and the weaker market should be shorted, assuming that strength begets strength and weakness begets weakness. The best example of this type of spread is to look at two competing companies, identify which one is the strongest and weakest competitor in the given space and apply this technique. Specifically, if you think about the chip maker AMD competing against Intel. The most obvious spread in this scenario is to buy shares of Intel, since they are the market leader, while simultaneously shorting shares of AMD. As we can see from the chart below (the orange line representing the closing price of AMD versus the blue line plotting shares of Intel) a trader in this particular pairs (spread) trade would have done very well.

Although this is not a futures example I’m showing it to convey the point of this strategy.

As I mentioned earlier, some futures contracts go out of alignment. So what does this mean specifically? Let’s take interest rates for instance. We know that in a normal yield curve interest rates in the shortest maturities are lower than longer maturities. For instance, the yield on a 3 month T-Bill is only a few basis points whereas the yield on a thirty year bond is about 2.6 %. In most commodities today’s price is usually lower than the price in the future. Below are two charts; one is displaying the April of 2015 Crude oil contract and the other is the December of 2015 contract. Notice the price on the April contract is $48.17 and the December is $57.06. Oil is in Contango, which is normal.

A spread trader can sell the December and buy the April if he feels that the price differential will shrink.

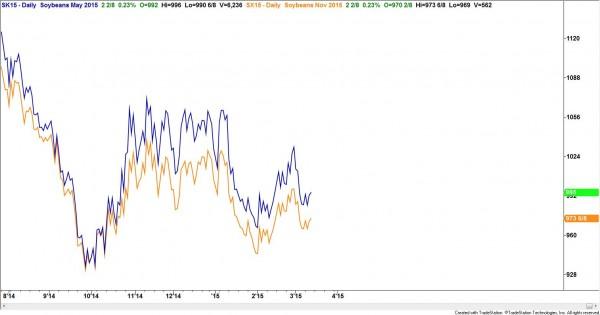

There are instances, however, where the front months are more expensive than the further out months. This phenomenon is called backwardation. Below we see this between the May (blue line ) and November (orange line ) Soy bean contracts.

This distortion in price, if corrected, can represent opportunity for the spread trader.

Spread trading, in addition to having less risk than buying or selling the outright contracts, comes with an additional benefit,which is much lower margin requirements.

The bottom line is that spread trading is not for everyone. Yes, there’s less risk but also there’s less potential reward. So, some food for thought, explore it and see if it’s for you.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

USD/JPY drops back below 157.00 on Japan's verbal intervention

USD/JPY has come under moderate selling pressure below 157.00 in the Asian session on Monday. The Japanese Yen lost ground to near 157.70 following Japan’s ruling Liberal Democratic Party's outright majority win in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi. However, JPY buyers jumped back and dragged the pair southward on FX verbal intervention by Japan’s Finance Minister Katayama.

Gold holds gains near $5,000 as China's gold buying drives demand

Gold price clings to the latest uptick near $5,000 in Asian trading on Monday. The precious metal holds its recovery amid a weaker US Dollar and rising demand from the Chinese central bank. The delayed release of the US employment report for January will be in the spotlight later this week.

AUD/USD: Buyers eyes 0.7050 amid upbeat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Bitcoin Weekly Forecast: The worst may be behind us

Bitcoin price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.