For most investors, the preferred vehicle in which to engage in the financial markets are stocks, or derivatives related to this asset class. The most common of these would be mutual funds. More sophisticated investors will use Exchange Traded Funds for their trading and longer term investing.

These financial instruments are fine, but just like any other asset they carry the inherent risk of gaping (opening substantially higher or lower than the previous day close) from one day to the next. There are ways to mitigate this risk, but this is not what this article is about. Instead, we want to introduce readers to the markets that never sleep (except for the weekends).

I’m aware that some of you already know what Futures are, however, you may not yet be familiar with some of the attributes of the Futures markets that make them more appealing than stocks. There is one huge caveat though, since Futures assume a sizable amount of leverage, a trader that doesn’t exercise strict risk management skills will have a very short stint as a futures trader.

Along with the leverage, which, if exercised properly can be a tremendous attribute, there is the aspect of continuous trading. This means that these markets trade —for the most part— uninterrupted twenty four hours a day, five and a half days a week. The benefit to a trader engaged in this market is the vast amount of opportunities presented, at all hours of the day and night.

Unlike with stocks, where the window of opportunity is six and a half hours daily, there are no such constraints in the futures market. Granted, there are times when the markets will give us better opportunities than others. But for the most part, because the futures markets are Global, they will have the tendency to move throughout the day and night.

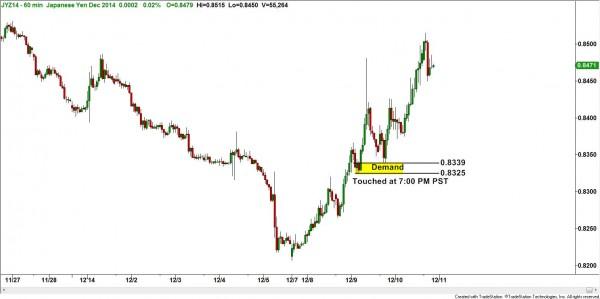

Below are three example of trades that touched entry, at what some would consider unconventional hours.

The last chart shows a corn supply level that provided a good short-term income shorting opportunity. As you can see by the annotations on the chart, it touched the supply zone in the middle of the night for those of us that reside on the West Cost of the United States (hence the PST time).

The other two examples are in the Currency markets. Specifically, the Australian Dollar and Japanese Yen which release most of their economic data early in the morning there. This translates into a late afternoon, early evening time zone here on the west coast of the United States. As we see, when the Australian government released their Labour survey report, which is equivalent to our Non-Farm Payrolls here in the States, the Aussie Dollar rallied into a nice supply zone right around 4:30 pm, giving a trader an attractive shorting opportunity. Similarly, the Japanese Yen hit its demand level for a long trade at 7:00 pm on the west coast.

Some of you might be thinking that you don’t have the time to be watching all the markets around the world, because like me, you don’t want to be glued to your computer, and also cherish your sleep. The good news is that if you identify the levels in advance, and are willing to assume the risk, you can simply place the orders and leave your computer. After the order is placed in the market we have to live with the two possible outcomes ( small loss, or profit target). This can only happen of course, if you have a low risk, high probability strategy.

In short, the futures market can be a great source of opportunity around the clock, Sunday through Friday, but only for those that know how the markets really work, and can execute a low risk strategy. If that’s not you, then my advise is to learn, before you start trading futures.

Until next time, I hope everyone has a great week.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

USD/JPY drops back below 157.00 on Japan's verbal intervention

USD/JPY has come under moderate selling pressure below 157.00 in the Asian session on Monday. The Japanese Yen lost ground to near 157.70 following Japan’s ruling Liberal Democratic Party's outright majority win in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi. However, JPY buyers jumped back and dragged the pair southward on FX verbal intervention by Japan’s Finance Minister Katayama.

Gold holds gains near $5,000 as China's gold buying drives demand

Gold price clings to the latest uptick near $5,000 in Asian trading on Monday. The precious metal holds its recovery amid a weaker US Dollar and rising demand from the Chinese central bank. The delayed release of the US employment report for January will be in the spotlight later this week.

AUD/USD: Buyers eyes 0.7050 amid upbeat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Bitcoin Weekly Forecast: The worst may be behind us

Bitcoin price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.