Prior to joining the Online Trading Academy team, I had a brief stint as a trader for a regional brokerage in California. As a trader, I was charged with executing the brokers’ orders from their customers. I was to work the orders and try to gain some advantage for the brokerage in the spread that would not be passed on to the customer. All of this while the customer was paying a commission too! That is why, as a trader for myself, I would never think of trading without a direct access platform.

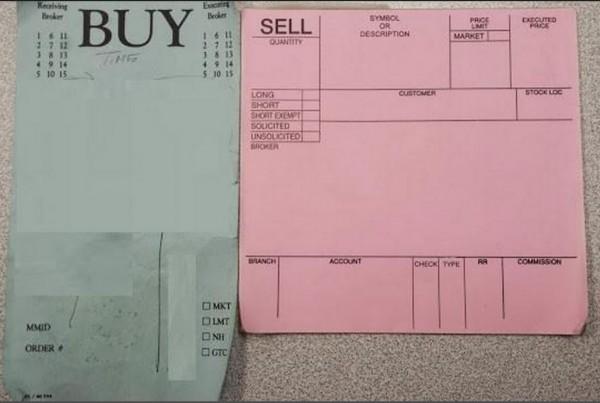

The brokers used small pieces of paper called a chit. A blue chit was a buy order and a pink chit was a sell order. As the trader for the brokerage I would be met every morning in the office by a big pile of chit on my desk (don’t worry, you’ll get the joke if you read it again). I had the task to execute these orders so the brokerage would make commissions and, as I mentioned, some of the spread too.

This daily process was repeated throughout brokerage offices all over the nation. All of these retail orders would flood in every morning fueled by investors who heard about the next biggest thing on the news or a recommendation from the broker the night before. As my duty required, I would execute the orders at the open of the market; feverishly working to fill all of those investors’ dreams of retiring from one great trade!

Knowing what we do about supply and demand, what do you think would happen as soon as those orders were filled? The markets would immediately reverse as all of the emotion that was driving price strongly in one particular direction was suddenly over. Think about it, if everyone who wanted to buy a particular stock just did, then how can the price continue to rise? The stock becomes saturated with nervous sellers and collapses under its own weight. I do not use the term nervous seller lightly. Anyone who buys a stock becomes a nervous seller as they can only profit by selling the same stock they just bought. The nervousness enters as they decide when to sell to maximize profits and minimize losses.

Brokerages do not only have to fill the customer orders in the open market, but can also transfer shares from their inventory, or even sell short as a market maker as long as they give the customer the best price as indicated by the exchange at the time of processing the order. A smart trader who has seen the pattern repeat time after time would take the opportunity to short into this strength in anticipation of the reversal that occurs from profit taking or stop losses being triggered once the buying pressure has been exhausted. This is exactly what many market makers and specialists do every day.

The same reversal action occurs when there is bad news and panic in the markets. For every share that is sold by a scared investor, someone had to buy it to either close a short or initiate a new long position. Once the selling flood has subsided the prices will typically rise as there is nothing to hold down price and some bottom pickers try to profit from a bounce. The professionals who traded counter to the masses are now profiting as supply is gone and prices move higher.

Be careful not to think that this new trend will last as those who profited from the reversal will look to book profits as those who did not participate in the initial thrust of the market try on the second test. Yes, there will usually be a second reversal that sends the stock into its trend for the rest of the day.

Knowing how to anticipate trend reversals and timing them correctly is something that we work on all the time in the Extended Learning Track (XLT) program. If you are not aware of how to identify or trade these key reversals of the morning, then you should learn before venturing into trading that time frame. Fortunately, we teach that in our Professional Trader courses at Online Trading Academy and trade it live in the XLT online. I welcome you to join us and learn how to trade like the professionals. Until next time, trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.