Most people receive their financial education from television or a broker’s recommendation. They rely on the “expert’s” opinions rather than educate themselves and make their own. The problem is that the experts are not always looking out for your best interests. There have been numerous media releases about former brokers, and even a former SEC Director of Trading and Markets, discussing the conflicts of interests and how the equity markets have been rigged.

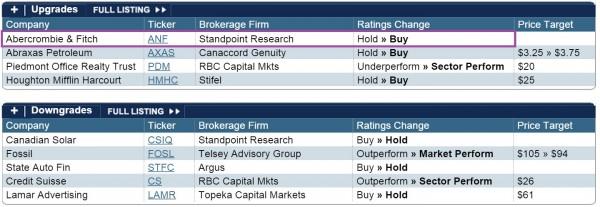

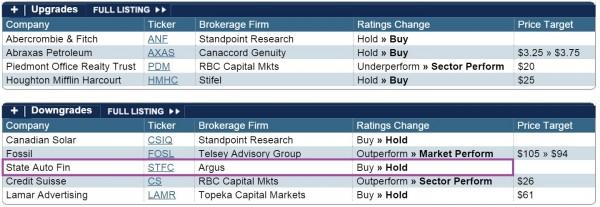

Further evidence of this bad advice are the upgrades and downgrades that brokerages provide to the public. Time after time the stocks that were upgraded saw a price jump into a supply zone only to see investors squander money as the broker’s information led them to losing choices.

The following upgrade on Abercrombie and Fitch on March 6th is an example. On the morning of the upgrade the stock gapped into a supply zone and those unfortunate people who bought the upgrade saw their money disappear.

Some may think this is a rare occurrence, but it happens more often than you would think. On the following week, March 11th, the upgrade for Five Below suffered the same fate.

Similar price movement happens when there are downgrades on stocks. Instead of stocks dropping after the brokerage lowered their expectations, the prices usually dropped into a demand zone where someone was able to purchase them at a great discount before the prices rose dramatically.

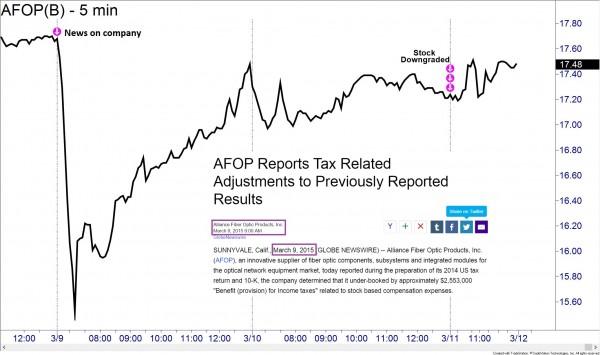

The inverse price movement doesn’t happen with every upgrade/downgrade, but it does happen enough that it should make you suspicious. Even when there is news on a security, it appears that the professionals take the opposite action of the novices who trade with the news. Alliance Fiber Optic had news that sent the stock’s price spiraling downward. It sharply rallied from strong buyers who took advantage of the wholesale prices. Two days later, there was a downgrade on the stock and, not surprisingly, the price rallied intraday after a small drop.

News on companies is often just as bad as the upgrades/downgrades. Most of the time novice traders will sell the stock when there is bad news and buy if there is good. When this happens, prices usually move directly into a supply or demand zone before professionals take advantage of the reversal that follows.

Best Buy (BBY) was on a great rally in 2013 into 2014 before a bad earnings report led to a sell off.

The sell off moved prices right into a weekly demand zone, where professionals took the opportunity to buy at wholesale prices.

So now that we know there is an inherent problem with the equity markets, what can be done about it to protect our money and allow us to profit in our trades and investments? Well, the first thing you should do is to remove yourself from the negative input. There is no need to watch retail news.

When I used to work as a hedge fund trader we paid thousands of dollars to get news as fast as possible. If you want the news first you must be prepared to pay a lot of money for it. Professional traders do not want to wait for the retail news because by the time it is broadcasted to the masses on television or via the internet, the professionals would have already positioned themselves to take advantage of the novice reaction to it.

Another simple solution is to trust your charts. News and recommendations influence people’s thoughts and perceptions. These thoughts and perceptions cause people to act and buy or sell securities. We can see these actions via our charts. By using Online Trading Academy’s Core Strategy, we can easily identify supply and demand zones where the professionals will take advantage of the novice news chasers.

We can then trade with the professionals who are usually on the correct side of the market. This increases our chances for success in our trades and investments and, most importantly, protects us from losing our precious capital. We need to reverse the old saying when it comes to brokerages; we need to do as they do, not as they say!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

USD/JPY falls further toward 156.00 as intervention risks dominate

The Japanese Yen is looking to build on its strong intraday move up amid speculations that authorities will step in to stem weakness in the domestic currency. In fact, Japan’s Finance Minister Satsuki Katayama stepped up intervention warnings and confirmed close coordination with the US against disorderly FX moves. This, along with some follow-through US Dollar selling, triggers an intraday USD/JPY turnaround from the 157.65 region, touched in reaction to Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold remains supported by China's buying and USD weakness as traders eye US data

Gold struggles to capitalize on its intraday move up and remains below the $5,100 mark heading into the European session amid mixed cues. Data released over the weekend showed that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Cardano steadies as whale selling caps recovery

Cardano (ADA) steadies at $0.27 at the time of writing on Monday after slipping more than 5% in the previous week. On-chain data indicate a bearish trend, with certain whales offloading ADA. However, the technical outlook suggests bearish momentum is weakening, raising the possibility of a short-term relief rebound if buying interest picks up.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.