In the Extended Learning Track program we have been watching the broad markets for influence on individual stocks. I have been demonstrating a method of watching the broad market indexes that reduces the need for multiple charts. I have decided to revisit an article I wrote a while ago that describes this method.

Those of you who have attended Online Trading Academy’s Professional Trader Course know that we always have a chart of the S&P 500 or NASDAQ to view in addition to our stock chart in the class. On average, 50-60% of a stock’s movement will be directly related to the movement and trend of the broad market. 30-40% of the stock’s movement will be influenced by the sector of that stock. That leaves only 10% of influence from the company itself.

I am sure you have noticed that the stocks moving with the market trend often move faster and farther than those trying to move against it. The other choice we must make is which market should we be following, the S&P 500, the NASDAQ, DJIA, or the Russell 2000? It comes down to which of those indexes is leading in the current trend. Most traders would suffer from information overload from trying to watch the charts of those four indexes as well as their stocks. I have found a solution for keeping an eye on the markets while focusing on your stock trade.

TradeStation software allows me to chart the four indexes in one chart. This is something I have used extensively in the XLT programs to identify market trend and potential confirmation at supply and demand levels. I use the “Percent Change” feature to compare all four indexes and easily identify the leader in the dominant trend. I like to use the ETF’s: SPY, QQQ, DIA & IWM to represent all of the indexes. You could easily substitute the indexes themselves or even the futures contracts. Since the futures are listed on different exchanges, you will have to adjust your chart to local time instead of “Exchange” time for them to overlay. You can see the finished chart below.

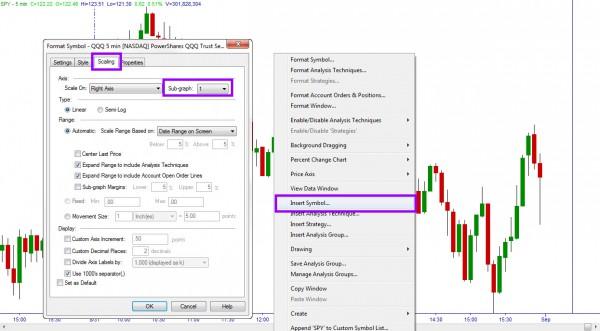

To create the chart, I start with a chart of the S&P 500. If you right click on the chart you can select “Insert Symbol” and then add the next ETF to your chart. You need to make sure you have the “Prompt for Format box checked when you add the symbol. You will need to go to the Scaling Tab and change the Sub-Graph to 1.

Once you have the second symbol on the chart, you will right click again and select “Percent Change Chart” and select “Enable.”

You can then add the additional ETF’s one at a time in the same manner. You can change the style and color of the lines when you add them if you keep the “Prompt for Format” box checked. Once all four are added your chart will look like this.

Finally, you must choose a starting point for the comparison. On intraday charts, I use the open. I right click on the chart at the line that represents the beginning of the day. Under the “Percent Change Chart” menu, I select “Calculate from This Bar.” That will start the price comparisons at zero from the open of the day. If I am using a daily chart or want to compare a longer move, I will start the chart from a major top or bottom and see when the trend is weakening from the leading index changing direction.

For more information on how we can use this tool, come join me in the Extended Learning Track of Online Trading Academy or even attend the Advanced Technical Analysis course. The skills you will pick up in these classes can greatly improve your trading.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.