Investment advisors have long promoted a strategy of buying securities and holding them indefinitely. This strategy, called Buy and Hold, is a passive strategy that ignores market trends and attempts to increase the value of the portfolio over a long period of time. But does this strategy really work or are there better opportunities for knowledgeable investors and traders?

Does Buy and Hold Work?

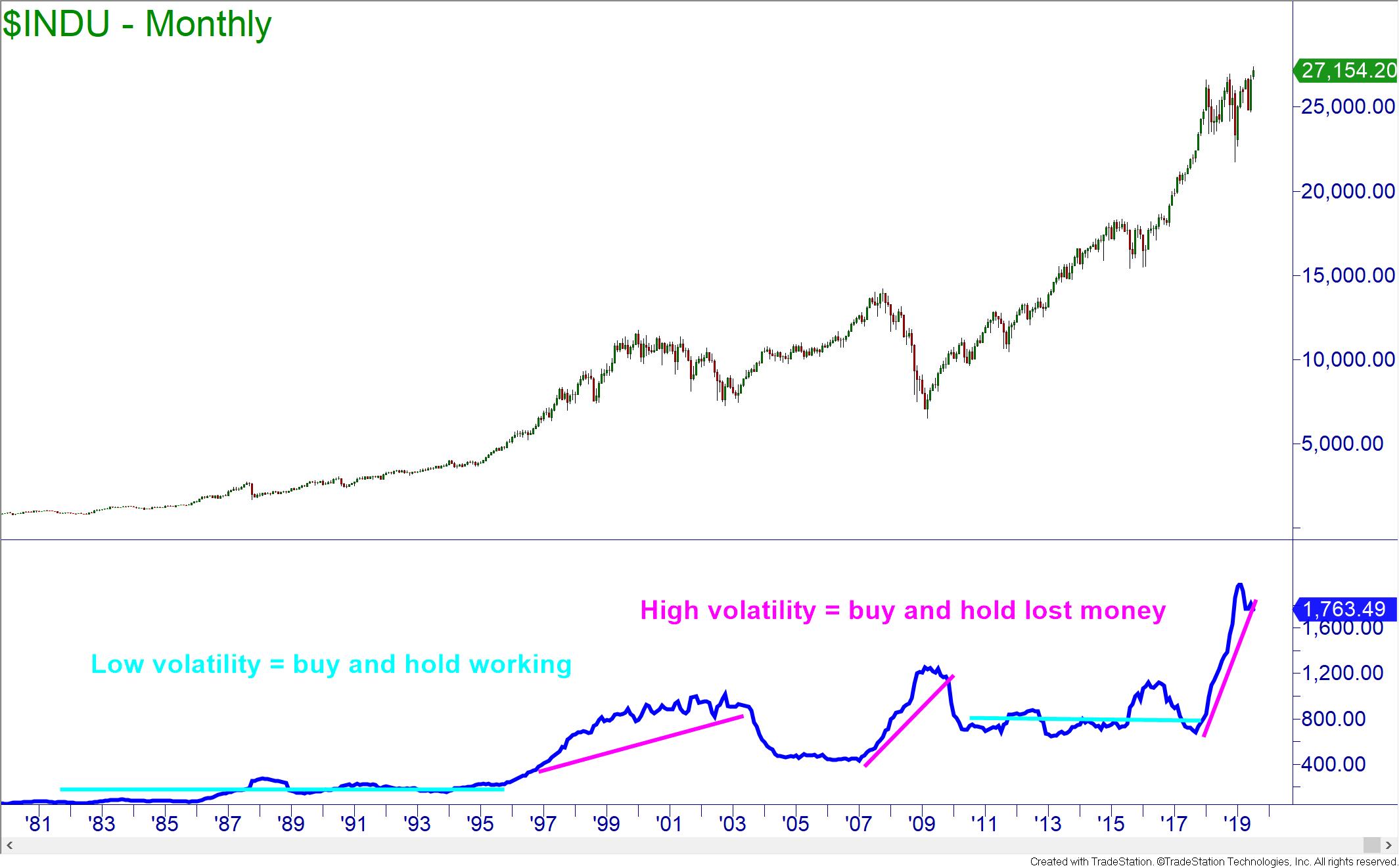

Looking at the historical chart of the Dow Jones Industrial Average, there seems to be times where simply holding a basket of stocks or the index itself would have indeed made profits for the individual investor. However, there are other market environments where that strategy would have resulted in no gain or even lost money.

For example, buy and hold worked here for 22 years.

But was followed by 18 years where it did not work!

Which was followed by nearly 17 years where buy and hold worked out for investors!

And then 12 years where buy and hold didn’t work.

The periods seem to be shortening as the last buy and hold period to work was only a little over six years long.

So how do you know what market condition you will be in for the next few years? There are several signs that can help you. Markets that are conducive to buy and hold are those with low volatility. Volatility is a measure of price movement away from the average. It measures how far and how fast prices are likely to move. It is also considered to be an investor fear gauge. Investors love stability and steady growth. If volatility increases, they become worried about sharp price movements and may exit the markets.

Gauging Expected Market Conditions Using Average True Range

As we can see in the chart below, volatility can be measured by an indicator called Average True Range (ATR). When ATR increases, expect faster and more dramatic price movements. When ATR is low, prices move slower and usually upward. When ATR gets too low, it usually means that a large price movement is coming soon.

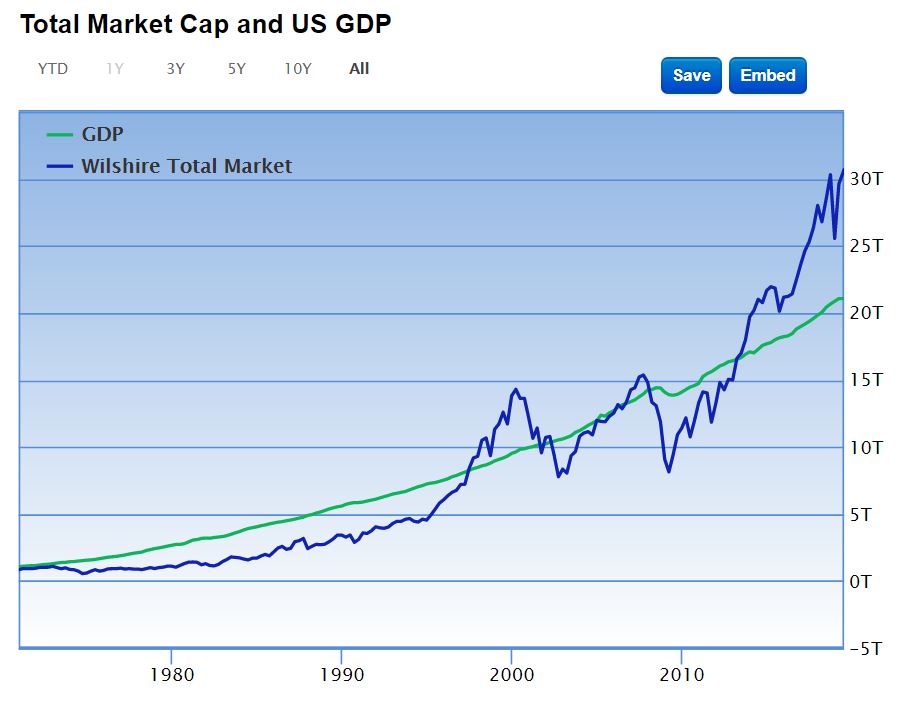

Gauging Expected Market Conditions Using Market Valuation

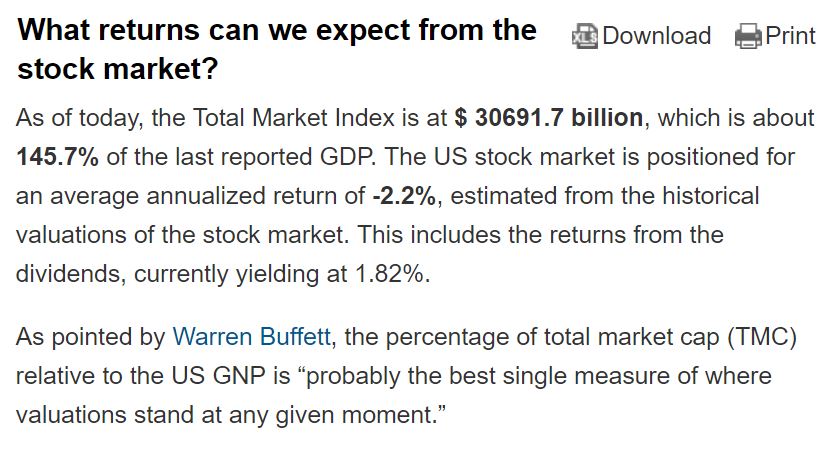

Another indication that major price swings could be imminent in the markets is the valuation of the market. Warren Buffett is reported to have used the ratio of the total market capitalization versus the GDP. When stocks become too overvalued, the price will generally track back to the norm. However, often they will overcorrect first, leading to wild price swings and market crashes before finally settling at the fair value.

According to the Buffett indicator available on www.gurufocus.com, the stock market is likely to offer an annualized return over the next eight years of -2.2%. This means that we are likely to return to a market environment filled with large price swings both up and down. While this is great for the active investor who times the tops and bottoms, it is disastrous for the buy and hold investor.

Causes of Market Movement as a Gauge of Expected Market Conditions

The cause of market movement is another major influence on market behavior that is often overlooked. Looking back in history, there are two major creations that launched the prices of the stock markets skyward and changed the face of the markets themselves: the 401(k) and the internet.

How 401(k)s Affected the Markets

In the late 1970’s companies found out about the 401(k) part of the tax code. Ted Benna, considered to be the father of the 401(k), popularized this investment vehicle in 1981. This allowed for a major tax deduction to companies and created an alternative investment vehicle that was cheaper and easier for companies to provide versus the pension.

In the 1980’s, baby boomers made up a major part of the US work force. The sheer number of them entering into the stock markets changed the face of the markets and caused the greatest bull market ever seen up to that time in the history of the markets.

Unfortunately, the cause of the boom may also be its undoing as the earliest baby boomers are now 73 years old. Mandatory distribution of retirement money begins at age 70 ½. This means that the largest portion of the population is now being forced to withdraw their investments from the stock markets. With these required sales, the market will likely see a drop.

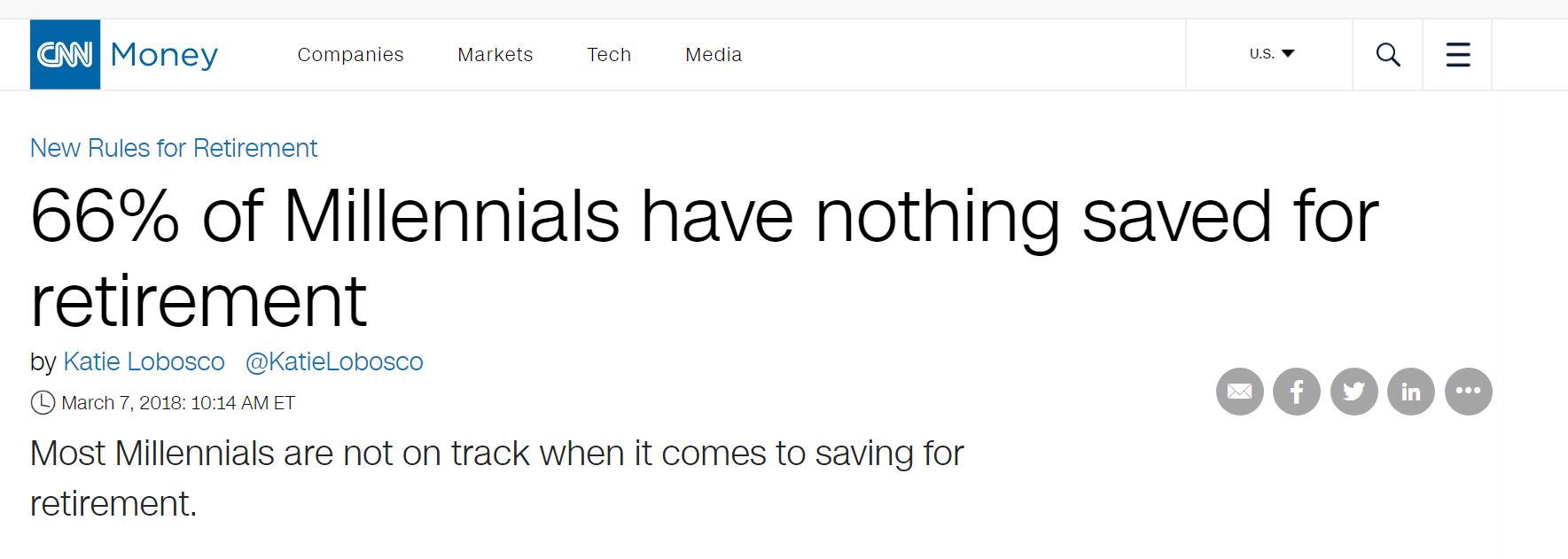

This is especially true because the Millennials who are now entering the work force and replacing the aging retirees are burdened with many expenses and are not saving money in retirement accounts. Without new money replacing the withdrawn retirement funds, the markets can likely not sustain these lofty levels.

How the Internet Affected the Markets

On 6 August 1991, the world changed in a major way. On that date, the World Wide Web became accessible to the public and sped up communications globally. Individual investors reaped major benefits in terms of speed of communication, transparency and better pricing for commissions and execution.

With online account access available in the mid-1990’s, investors could bypass the dreaded broker’s phone call and get their orders placed and confirmed immediately. They could now see the true pricing of securities from the exchange itself instead of relying on the quoted price from a broker which was often marked up greatly.

Transparency and direct access to the markets allowed the individual investor to front-run the brokerages. They could make a minor adjustment to their prices to get to the front of the line and get orders filled before the institutions could. Front-running on both the bid and ask prices narrowed the spreads and all investors benefited with improved pricing for shares.

Buy and Hold Expectations in the Current Market Environment

So, the evidence is pointing toward a future market environment that does not work well for buy and hold but rather benefits from an active investment approach. This type of market requires more attention and education in order to spot and take advantage of the market swings. Those who choose to ignore these moves, could have zero or negative returns for the foreseeable future. It is worse when you add in inflation and the cost of missed opportunity.

The markets took approximately five years to recover from each of the last two market crashes. Do you have an extra five years to wait before retiring? If you continue to buy and hold, you may have no choice. The alternative is to become educated and build your skills so that you can not only protect your money but grow it during these volatile times.

Read the original article here - Is Buy and Hold Dead?

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

The EUR/USD pair loses ground to around 1.1905, snapping the two-day winning streak during the early European trading hours on Tuesday. Markets might turn cautious ahead of the release of key US economic data, including US employment and inflation reports that were pushed back slightly due to the recently ended four-day government shutdown.

GBP/USD edges lower below 1.3700 on UK political risks, BoE rate cut bets

The GBP/USD pair trades on a weaker note around 1.3685 during the European session on Tuesday. The Pound Sterling edges lower against the US Dollar amid political risk in the United Kingdom and rising expectations of near-term Bank of England rate cuts.

Gold drifts lower as positive risk tone tempers safe-haven demand; downside seems limited

Gold drifts lower during the Asian session on Tuesday and snaps a two-day winning streak, though it lacks strong follow-through selling and shows some resilience below the $5,000 psychological mark amid mixed cues. The outcome of Japan's snap election on Sunday removes political uncertainty, which, along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Follow the money, what USD/JPY in Tokyo is really telling you

Over the past two Tokyo sessions, this has not been a rate story. Not even close. Interest rate differentials have been spectators, not drivers. What has moved USD/JPY in local hours has been flow and flow alone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.