Typically, when we think about real estate investing the focus is multi-family or single-family residents used as rentals to create cash flow. However, there are numerous property types to invest in and, whether looking for a place to live, work, or shop, property and structures are needed.

The earth contains approximately 15 billion acres of habitable land, of which only 1.5 percent currently has a human footprint. That small number is likely because, historically, there has been little change in the use of land. Take farmland for example, though the structures may change the land is still used for farming. Recently however, there has been a paradigm shift and we are seeing more changes in land use as well as to the structures being built.

The Growing Need for Warehouses

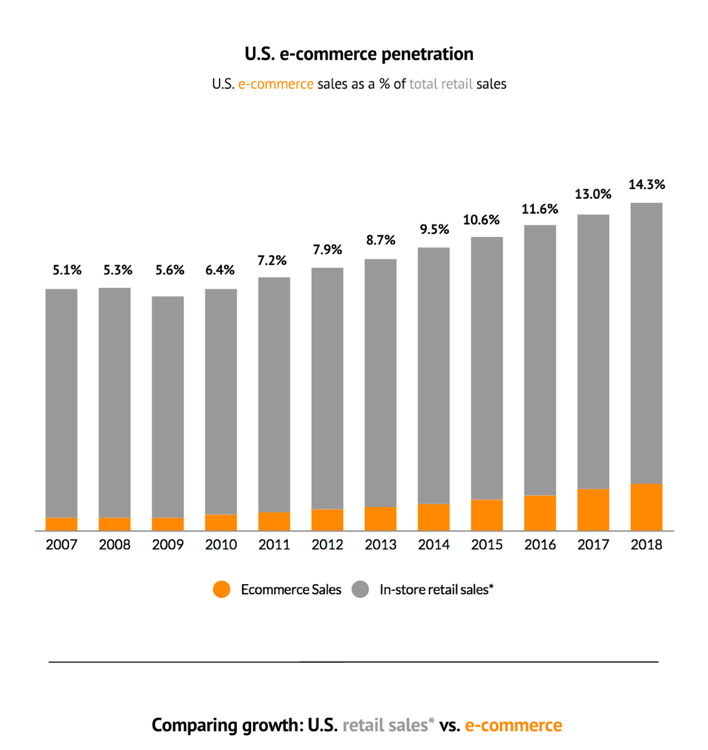

A property type I knew very little about was Industrial, that was until my son became a commercial broker specializing in the acquisition of land to develop warehouse/distribution/fulfillment and manufacturing facilities. We all know what a warehouse is, but do we really understand how the building and investment are managed? The warehouse landscape has changed over the years, most specifically as it relates to retail sales. In the past, all goods were trucked to a distribution warehouse where they were then sent out to retail stores and subsequently sold. With the explosion of eCommerce, which has more than doubled market share in a decade (see below), warehouse uses have expanded.

Today, there is a growing need for a different kind of warehouse facility, where goods can be stored and individual orders processed. These kinds of warehouses are called fulfillment centers. One of the data points that clearly shows this trend is the number and size of new warehouses built since 1990. Over forty-six percent of all warehouses in the US have been built since the ’90s, and their size varies from 25,000-100,000 square feet (there are also some larger, of course). This is a massive increase from four decades ago when the average warehouse was only 10,000 square feet.

4 Important Factors When Investing in Warehouses

We will focus on four critical items as they relate to investing in industrial real estate and specifically warehouses:

-

What makes the right location for a fulfillment warehouse?

-

What are the benefits to communities to have a fulfillment warehouse?

-

What’s the time-frame for development of a fulfillment warehouse?

-

How can individuals invest in fulfillment warehouses?

Choosing a Location for a Fulfillment Warehouse

There are a few key things to consider when choosing a location for distribution and fulfillment warehouses. Access to a major freeway, preferably where several freeways intersect headed in various directions is a must. Additionally, because large trucks will be coming and going with various shipments of items, a large parcel of land is required. For example, if you wanted to build a 100,000 sq ft building, you’d need about 145,000 sq ft of land or 3 1/3 acres. Often several pieces of land need to be combined to accommodate this size lot; this process is called assemblage. Zoning and environmental concerns also need to be taken under consideration. Often these parcels of land need to be rezoned, and within the rezoning process, environmental concerns and issues may arise.

What Benefits do Warehouses Bring to a Community?

Distribution and fulfillment centers are typically a benefit to the communities they are housed in or adjacent to for several reasons such as:

-

Employment – even though there is more automation happening in these centers – there is still a need for employees of all levels.

-

Taxes – since a fulfillment center is the point of sale, it generates tax revenue for the community it is housed in.

-

Community improvements – often, a developer will be required to add to the community’s infrastructure such as building or improving roads, parks, etc.

How Long Does it Take to Develop a Fulfillment Warehouse?

A typical development can take from 3 to 5 years depending on a few factors. It breaks down like this:

-

Acquiring the land (the ideal site is often not listed, so typically a broker has to put the deal or deals (assemblage) together which could take anywhere from 6 months to years.

-

If no extra work needs to be done regarding zoning, the building can start and takes approximately 8 months if all goes according to plan.

-

Ideally, agents have been working on filling the center with potential tenants throughout the building process. The leasing process can take six months or longer.

-

Tenants then have 2-3 months to make tenant improvements (TI)

-

Leases typically last from 5 to 10 years.

How to Participate in Warehouse Development

The easiest way to take part in a warehouse development investment is to own the land a developer wants to build a facility on. There is typically a sizeable profit potential for the landowner.

Another option is to purchase shares of a REIT (Real Estate Investment Trust) of a company like ProLogis. ProLogis is the largest international developer with 3,771 buildings that total 786 million square feet.

Interested parties could also invest in privately-held REIT such as Black Creek Group or, for smaller projects, they could create or join a Real Estate Limited Partnerships (RELP).

Shout out to my son Austin Hill – Senior VP for Lee and Associates in Ontario, CA, who was patient with his mother asking all kinds of questions about his industry so you could get an insight into this sector and also allowed me, Austin’s mom, to learn more about what her baby boy does.

Read the original article here - Industrial Real Estate: Investing in Warehouse Development

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD remains close to three-year top amid the Fed-RBA divergence

AUD/USD attracts some dip-buyers near mid-0.7000s during the Asian session on Monday, stalling last week's modest pullback from a three-year peak. The US Dollar continues with its struggle to attract any meaningful buyers amid bets for further rate cuts by the Fed, bolstered by the softer US CPI report on Friday. In contrast, the Australian Dollar retains a bullish bias on the back of the RBA's hawkish stance, which further acts as a tailwind for the currency pair.

USD/JPY retakes 153.00 after Japan's weak Q4 GDP print

USD/JPY kicks off the new week on a positive note as Japan's weak Q4 GDP growth tempers bets for an immediate BoJ rate hike and undermines the Japanese Yen. Investors, however, seem convinced that the BoJ will stick to its policy normalization path amid hopes that PM Takaichi's policies will boost the Japanese economy. In contrast, cooling US consumer inflation reaffirmed bets for more Fed rate cuts in 2026, which acts as a headwind for the US Dollar and should cap the currency pair.

Gold remains below $5,050 despite Fed rate cut bets, uncertain geopolitical tensions

Gold edges lower after registering over 2% gains in the previous session, trading around $5,030 per troy ounce during the Asian hours on Monday. However, the non-interest-bearing Gold could further gain ground following softer January Consumer Price Index figures, which reinforced expectations that the Federal Reserve could cut rates later this year.

Week ahead: Data blitz, Fed Minutes and RBNZ decision in the spotlight

The US jobs report for January, which was delayed slightly, didn’t do the dovish Fed bets any favours, as expectations of a soft print did not materialize, confounding the raft of weak job indicators seen in the prior week.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.