At a time when traders are faced with a huge number of new financial products, it would be important for them to know some of the important criteria for choosing these products.

In the best interest of customers and markets

The most important thing about financial products is that they should have the ability to act in the interest of traders and also the ability to work for the stability of the entire financial market. To achieve this goal in 2018, the concept of Product Governance was introduced across the EEA to ensure that companies that manufacture and distribute financial instruments and structured deposits act in the best interests of customers and markets at all stages of the product or service life cycle. Product governance is the process of creating, maintaining, and retiring financial products to ensure the customer receives a product suitable for their immediate and future financial goals. Providers and distributors must treat customers fairly and provide good value throughout the product's life cycle. For product governance, a company must conduct its business with integrity with due skill, care and diligence and must take care to organize and control its affairs responsibly and effectively, with adequate risk management systems.

Scenario analysis

Traders should be cautious when choosing whether to buy a new financial product from a company that manufactures or distributes it to them. When a company undertakes to manufacture or make a financial product available to traders, it should do a scenario analysis of the financial instruments it provides and assess under which conditions risks may arise for end customers. The company evaluates the financial instrument under negative conditions covering what would happen if, for example, the market environment worsened. Or if the manufacturer or the third party involved in the construction and operation of the financial instrument is experiencing financial difficulties, and thus counterparty risk arises. It should also analyze whether the financial instrument fails to become commercially viable or if demand for the financial instrument is much higher than expected, straining the firm's resources or the market for the underlying instrument.

Analyze the design and features of the financial instrument

The design and features of the financial instrument should not adversely affect end customers, nor should they lead to market integrity problems. Essentially, the financial instrument should not allow the company that created and provides it to be able to mitigate or spread its own risks or exposure to the underlying assets of the product to its customers/traders. In addition, before deciding to proceed with the release of the product, the manufacturer should consider in advance whether the financial instrument is designed in such a way that it is likely to threaten the orderly functioning or stability of the financial markets. Possible conflicts of interest that are incorporated in the design of the product, and relate to remuneration incentives of the personnel of the companies that manufacture or provide it, must be taken into account.

Cost of the charges, renumeration conflicts & contrary trade exposure

A very important parameter regarding the evaluation of a new financial product is the cost of the charges of this product. These costs should be compatible with the customers' needs, goals and characteristics, while the charges should not undermine the performance expectations of the financial instrument.

Also, costs or charges should not exceed or detract from the expected benefits associated with a financial instrument.

It is very important that the fee structure of the financial instrument is appropriately transparent to the customers/traders in the sense that it should not obscure the manufacturer's and/or the distributor's fees. Also, it should not be too complicated so that it can be easily understood.

A particularly critical parameter is the one that concerns the possible conflicts of interest regarding the remuneration of the personnel who manufacture and distribute new financial products so that their motivations are taken into account. If their remuneration conflicts with the interest of customers and the market, appropriate measures have to be taken.

In terms of analyzing potential conflicts of interest, clients/traders will also need to assess whether the financial instrument provided by a manufacturer or distributor creates a situation where clients/traders may be adversely affected,

-

If they get a trade exposure contrary to the one the manufacturer previously had, or

-

If they get a trade exposure contrary to what the manufacturer wants to maintain after the product is sold to clients/traders.

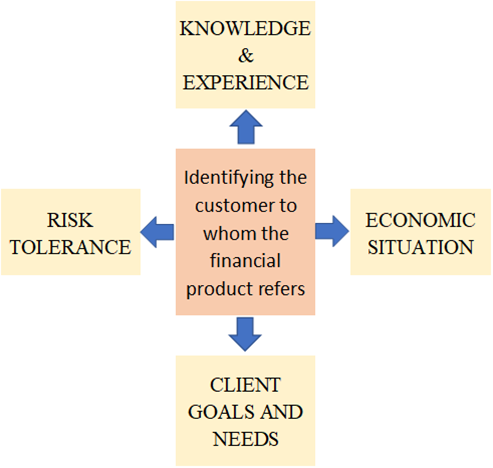

Identifying the customer to whom the financial product refers

The most important feature of a financial product is to have the ability to identify the customers to whom it is addressed so that the features and objectives of the product are compatible with those of the customers. This determination should be based on both quantitative and qualitative criteria.

So,

-

The risk/reward profile of the financial instrument should be consistent with that of the clients while

-

The design of the financial instrument should be based on features that benefit the customer/trader and not on a business model design based on negative customer/trader outcomes for this instrument to be profitable.

Traders, when choosing a financial product, should fully recognize the following issues

knowledge and experience

To what extent do you have the knowledge and experience to fully understand the product provided? For example, do you understand what leverage means for derivatives or how structured products with complex performance profiles work? Can you identify how these products generate returns? How much hands-on experience do you have with a relevant type or the relevant features of a new financial product?

If you have limited or no experience in a particular type of financial product, then you could compensate for this lack by attending training courses.

Economic situation

A very critical factor concerns the financial situation of the customer/trader. As a customer/trader, you should be able to calculate how much you are able to cover any financial losses that may arise from the acquisition and use of a financial product. Ideally, you should be able to determine the percentage of financial losses you can afford. A good approach could be to determine the maximum percentage of your assets you can lose in relation to your exposure to a financial product.

Risk tolerance

The risk/reward profile of the financial product must match that of the trader/customer. It is important for you as a client to be able to clearly distinguish whether the product is "speculative" or whether it is a "risk balanced" product or whether it is a "conservative" product in order to assess whether the financial product fits your risk profile.

Since the definition of risk has different approaches, the criteria that must be met to categorize a product should be clarified. Companies manufacturing and providing financial instruments should use the risk index set by the PRIIPs Regulation or the UCITS Directive, where applicable, to meet this requirement.

Client goals and needs

As a client, you will need to investigate whether the financial product being promoted identifies your investment objectives, including your wider client's financial objectives or the overall strategy you follow when investing.

For example, it is good to clarify each product's expected trading or investment horizon. If the horizon is short-term, the product is kept for a short period of minutes, hours or days, or if it is a product that can be kept for a medium or long-term horizon of months or years. Time horizons largely determine customer expectations for each product being promoted.

Traders should thoroughly analyse financial product features to understand whether the product provided to them is suitable and compatible with their objectives and investment profile. Any deviation is dangerous as it can bring unspecified negative consequences that are best avoided.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

USD/JPY rebounds above 153.00 ahead of US inflation data

USD/JPY stages a comeback and regains 153.00 in the Asian session, snapping a four-day losing streak amid some repositioning ahead of the US CPI report. However, expectations that Japan's PM Sanae Takaichi could be more fiscally responsible, along with bets that the BoJ will stick to its policy normalization path and the risk-off mood, could support the safe-haven Japanese Yen, capping the pair's upside.

Gold: Will US CPI data trigger a range breakout?

Gold retakes $5,000 early Friday amid a turnaround from weekly lows as US CPI data loom. The US Dollar consolidates weekly losses as AI concerns-driven risk-off mood stalls downside. Technically, Gold appears primed for a big range breakout, with risks skewed toward a bullish break.

AUD/USD consolidates below 0.7100 as traders await US CPI report

AUD/USD consolidates the previous day's retracement slide from the vicinity of mid-0.7100s, or a three-year high, holding below 0.7100 as traders move to the sidelines ahead of Friday's release of the US consumer inflation figures. In the meantime, the divergent RBA-Fed outlooks might continue to support spot prices amid subdued US Dollar demand, though the risk-off impulse could act as a headwind for the Aussie.

Bitcoin, Ethereum and Ripple stay weak as bearish momentum persists

Bitcoin, Ethereum and Ripple remain under pressure, extending losses of over 5%, 6% and 4%, respectively, so far this week. BTC trades below $67,000 while ETH and XRP correct after facing rejection around key levels. With bearish momentum persisting and prices staying weak, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.