In a recent post, we defined what the “Dead cat bounce” phenomenon is. In short, it is a term used when a market manages to muster a temporary rebound within a prolonged period of downside. A dead cat bounce is typically considered a price pattern, while it can also be explained as the repositioning of market participants, by closing short positions to lock profits, on the assumption that market has reached its bottom. Hence they then flip to the long side of the market, on the belief that the market is oversold and it’s time to move up.

In this post we will now elaborate how to trade this phenomenon. However before we go through the “dead cat bounce” strategy, we need to once again highlight that a dead cat bounce can be seen both in the broader economy, such as during the depths of a recession, or it can be seen in the price of an individual stock or group of stocks. However it is difficult to predict beforehand.

Is it possible to trade it?

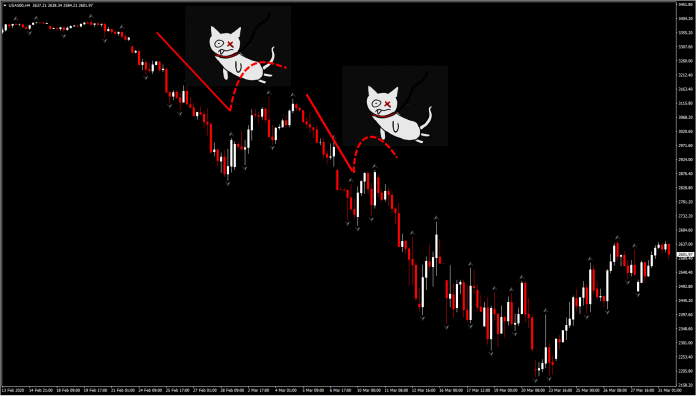

Generally, in the market, like in physics, there is the view that every action has a reaction, hence every sharp move will have a correction. That means market participants are confident that an uptrend could turn back after decline. However, the mentality of a dead cat bounce pattern is the exact opposite. The mentality here is that every steep sharp decline could see a temporary recovery before extending further lower again. An example is the USA500 in March.

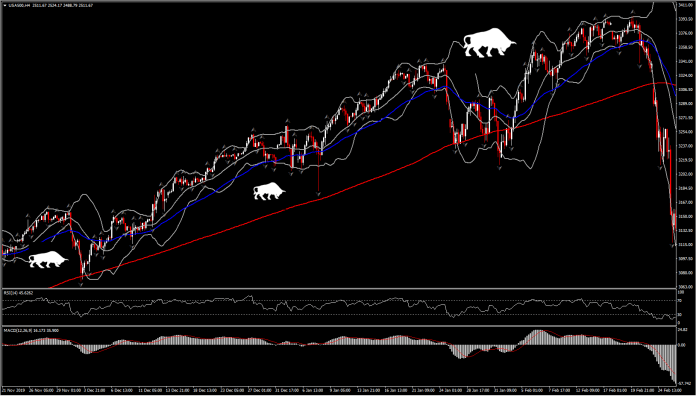

This 4-hour chart, between November 2019 up to February 2020, clearly presents the “buying the dip” mentality, since bulls have taken advantage of every pullback, e.g. December 2nd, January 6, January 30 and many more.

However, in a period of long sustained decline, the market changes its perceptions. In a period of an extended bear market, any swing lower is the harbinger for further collapse, while any swing higher are usually fading, on market participants’ perception that they will not last for long. The only tool that could help traders identify whether this might be a dead cat bounce or a trend reversal, is the Fibonacci retracement indicator.

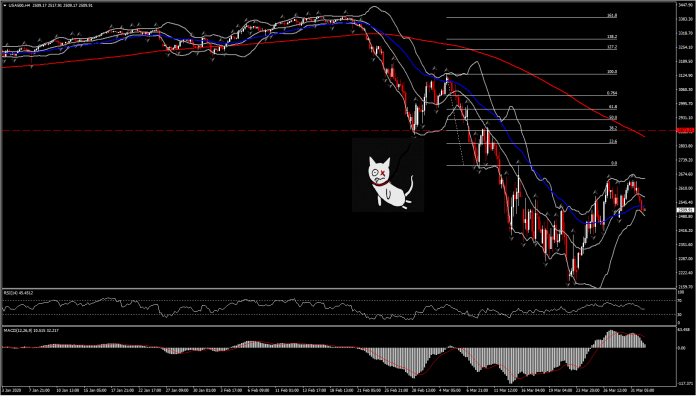

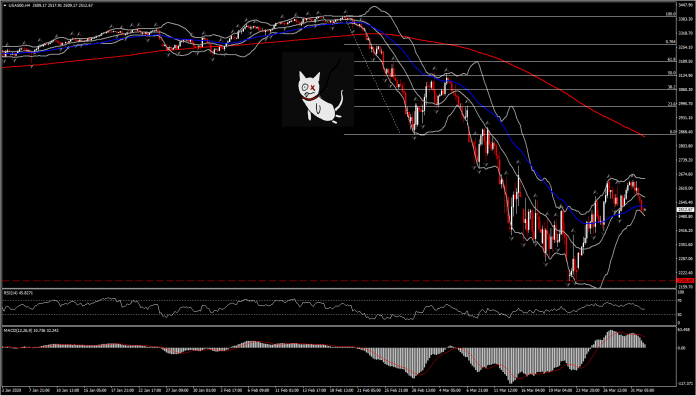

Theoretically, any rebound after a sharp long-lived decline, with less than 38.2% losses’ retracement, suggests that this is a shallow retracement and therefore is simply a dead cat bounce. This shallow rebound presents market assumption that there isn’t enough confidence in any rebound. There are always exceptions though, with a dead cat bounce confirmed on March 5, which reached 50% retracement before entering a free fall market again.

Hence when a dead cat bounce has been identified, it is crucial to monitor the market and to look for a breakout of the latest low level. Such a breakout would suggest the continuation of the downtrend. A confirmed close of the session below the latest low could also be the entry level for a short position with a tight stop loss, which could provide a high risk and reward profile. That said, stop loss should be placed at a sufficient level based on asset volatility and on the level of rebound. It is important to confirm the dead cat bounce before entering the market and to place stop losses above the peak of the dead cat bounce rather than at the peak, given that a higher high would be needed to negate the bearish view.

Editors’ Picks

AUD/USD meets initial resistance around 0.7100

A decent rebound in the US Dollar is behind the AUD/USD’s daily pullback on Tuesday. In fact, the pair comes under modest downside pressure soon after hitting fresh yearly peaks in levels just shy of 0.7100 the figure on Monday. Moving forward, investors are expected to closely follow the release of Chinese inflation data on Wednesday.

EUR/USD looks offered below 1.1900

EUR/USD keeps its bearish tone unchanged ahead of the opening bell in Asia, returning to the sub-1.1900 region following a firmer tone in the US Dollar. Indeed, the pair reverses two consecutive daily gains amid steady caution ahead of Wednesday’s key US Nonfarm Payrolls release.

Gold the battle of wills continues with bulls not ready to give up

Gold remains on the defensive and approaches the key $5,000 region per troy ounce on Tuesday, giving back part of its recent two day. The precious metal’s pullback unfolds against a firmer tone in the US Dollar, declining US Treasury yields and steady caution ahead of upcoming key US data releases.

Bitcoin's downtrend caused by ETF redemptions and AI rotation: Wintermute

Bitcoin's (BTC) fall from grace since the October 10 leverage flush has been spearheaded by sustained ETF outflows and a rotation into the AI narrative, according to Wintermute.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.