For retail traders, finding an edge can be challenging. The pace is fast, the data is vast, and decisions must be precise. This is where machine learning (ML)—a subset of artificial intelligence (AI)—is making a significant impact. Through powerful data-driven insights, ML helps traders identify patterns, manage risks, and adapt strategies in real-time.

Machine learning works by analyzing large sets of data, learning from it, and identifying trends that can guide trading decisions. By recognizing patterns that aren’t always visible through traditional analysis, ML enables traders to spot opportunities and stay agile in volatile markets.

Predictive insights and pattern recognition

In CFD trading, historical data can often reveal patterns that might help predict future price movements. Machine learning models can analyze past price movements, processing years of data in minutes.

For example, an ML algorithm trained on years of forex price data might identify conditions under which certain currency pairs typically rise or fall. By providing these insights, ML gives traders a data-backed basis for their trading decisions, helping them act on emerging opportunities sooner.

Algorithmic and quantitative trading

Machine learning enables algorithmic trading, which automates trades based on predefined criteria. These algorithms are often powered by ML models that have been trained to recognize profitable trading patterns.

For retail CFD traders, this means setting up strategies that execute automatically when specific conditions are met, such as breakouts in commodity prices. Machine learning-based algorithms don’t just execute; they can also adapt over time, refining strategies to respond to changing market conditions.

Understanding market sentiment

Sentiment analysis—powered by machine learning—can be a powerful tool for CFD traders. By analyzing news, social media, and financial reports, ML models gauge market sentiment, giving traders a sense of the overall mood in the market.

For instance, if negative sentiment is building around a commodity or a currency pair, ML algorithms can flag this, providing traders with early signals about potential market moves. This insight helps traders to adapt strategies based on the current mood or trend, aligning trades with broader market sentiment.

Enhanced risk management

Risk management is essential in leveraged trading, and ML can help retail traders monitor and manage exposure more effectively. Machine learning algorithms analyze multiple factors that affect prices—such as macroeconomic indicators, credit spreads, and interest rates—to assess risk levels.

By detecting heightened volatility or identifying market conditions that signal increased risk, ML-powered tools allow traders to adjust their strategies, reducing position sizes or tightening stop-loss orders as needed.

Real-time adaptation and anomaly detection

CFD markets are known for their rapid changes, and machine learning models can adapt quickly to these shifts. Unlike static trading systems, ML models are continuously updated with new data, learning and adapting as markets evolve.

For example, if a geopolitical event causes sudden price swings in oil, ML algorithms can adjust accordingly, updating predictions and strategies in real-time. This adaptability is key for retail traders who need to stay responsive to shifting conditions.

Additionally, machine learning excels at anomaly detection, which is critical in CFD trading. Anomalies—unexpected patterns in the data—could indicate unusual market activity, like sudden spikes in forex pairs or unexpected drops in a commodity index. ML algorithms can identify these patterns and flag them for traders, helping them avoid unexpected losses or capitalize on short-term opportunities.

Machine learning techniques in CFD trading

Machine learning offers several techniques that can benefit retail CFD traders:

-

Supervised Learning: Trained on historical data, supervised learning models predict future price movements. For example, they may forecast when a forex pair is likely to enter a bullish phase based on past conditions.

-

Unsupervised Learning: This approach finds hidden patterns in data, uncovering new trading opportunities.

-

Reinforcement Learning: Through trial and error, the model learns from its past trades, adapting strategies to improve over time—a useful approach for creating adaptive trading models.

Levelling the playing field for retail traders

Machine learning offers retail CFD traders the ability to use insights and tools previously available only to institutional investors. By integrating ML into their trading processes, traders can make faster, data-informed decisions and execute strategies with greater precision. With applications ranging from predictive analysis and sentiment tracking to risk management and adaptive strategies, ML gives retail traders a sharper competitive edge.

In a field as dynamic as CFD trading, machine learning is transforming how traders approach the markets. It provides a depth of analysis and speed of execution that enhances traditional strategies, making it easier for traders to identify opportunities, manage risks, and respond to market changes effectively. As machine learning continues to evolve, its role in CFD trading will only become more integral—offering retail traders the insights they need to navigate complex markets with confidence.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

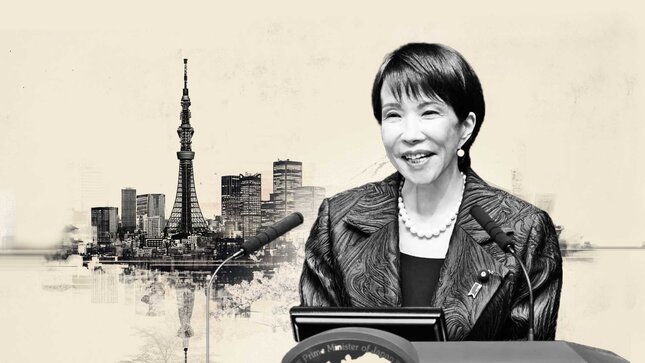

Japan's Takaichi secures historic victory in snap election

In Japan, Prime Minister Sanae Takaichi's coalition secured a supermajority in the lower house, winning 328 out of 465 seats following a rare winter snap election. This provides her with a strong mandate to advance her legislative agenda.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.