Talking about successful traders is sometimes boring. Everyone talks about Jesse Livermore or George Soros, while there are a lot of less known traders out there that have…

-

…still profited from the market

-

…still made a career out of it.

-

…are probably still great traders, but…

Why nobody is talking about them?

That is the reason why I have decided to write an article about one of them. Here it is…

How I Made $2,000,000 in the Stock Market

That is the title of a book written by Nicolas Darvas- one of the less known traders of our time. I wanted to contribute to more traders learning about him and his trading philosophy. Feel free to share this article with more traders, so they know about him!

That is the major reason why I I took the time to create and share an article about his life, trading and how he turned $25,000 into over $2 Million….

The Less Known

Nicolas Darvas is a Hungarian by birth. He studied economics in Budapest before emigrating to the United States when the Soviet Union took over Hungary. He fled through Turkey with only 50 pounds sterling and a forged exit visa.

This was in 1943. By 1953 he was already appearing in the show of Judy Garland and Bob Hope as dancers.

A very dynamic and professional by nature, Darvas was using every spare moment to learn more about trading. It all began in 1952 when a nightclub in Toronto offered Darvas to pay him $3,000 worth of stock instead of his normal cash payment.

In two months this initial equity has turned into $8,000.

While on a tour, Darvas was still reading trading books up to 8 hours a day. He is claimed to have read over 200 books on the market during off hours.

200! Try to remember the last 10 books you read on trading and try to imagine that multiplied by 20!

Impressive!

What I Have Learnt After Reading His Book

So much wisdom is collected in those pages. I do highly recommend that you find this book and read it as soon as you can. Here is a LINK, but you can also do your own research if you want a different version of the book.

The second point of this article is also to share with you some of the thoughts that have really made a great impression on me. They are worth re-reading and sharing with other avid traders.

There is so much gold in those pages. You just need to find the time and go through them. Below, I will share some of the more important passages from the book that have helped me become a better trader.

I do really hope they will help you become better traders, too. If not, they will at least introduce you to one of the greatest traders in our time that is almost forgotten.

Enjoy and share with others- that is how you can help popularise this Master Trader!

On Insiders

“By the time I found out about the insiders’ transactions, it was always too late. Besides, I often found that insiders were human too. Like other investors, they often bought too late or too soon. I made another discovery. They might know all about their company but they did not know about the attitude of the market in which their stock was sold.”

From here, Darvas concluded that advisory services should not be followed. He also learnt another very important lesson from bad experience: Ignore brokers’ advice.

Darvas also said something that Jesse Livermore is known for- Ignore Wall Street sayings, no matter how ancient and revered.

He was also an avid long-term trader. In his daily journal he wrote down that he’d rather hold on to one rising stock for a longer period than juggle with a dozen stocks for a short period at a time.

The Silent Partner

I am on page 47 of the book. Here I found another great piece:

“[…] In the same way, I decided that if a usually inactive stock suddenly became active I would consider this unusual, and if it also advanced in price I would buy it. I would assume that somewhere behind out-of-the-ordinary movement there was a group who had some good information. By buying the stock I would become their silent partner.”

Here you can see how Darvas thought. In exploring other trader’s thoughts, it is utterly crucial to try to dig deeper into them.

Nicolas Darvas was certainly a trader who thought outside the box. He was acting in a way that just a handful of traders would have agreed with. That is what makes him so great and what everyone should be striving for!

Doing the opposite of what the other market participants are doing, could be recipe for success… as long as you know what the majority of traders are doing.

Trading in Boxes

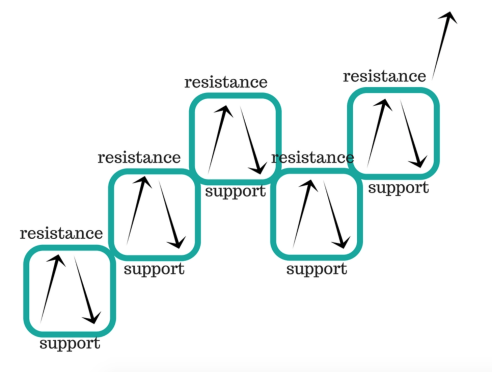

What Nicolas Darvas is best known for is his trading style or trading in boxes. He would find what nowadays is described as support and resistance and trade off these levels.

The way he saw the markets were in boxes as illustrated above. In his own words:

“When the boxes of a stock in which I was interested stood, like a pyramid, on top of each other, and my stock was in the highest box, I started to watch it. It could bounce between the top and the bottom of the box and I was perfectly satisfied. Once I had decided on the dimensions of the box, the stock could do what it liked, but only within that frame. In fact, if it did not bounce up and down inside that box I was worried.”

“No bouncing, no movement, meant it was not a lively stock”

“And if it were not a lively stock I was not interested in it because that meant it would probably not rise dramatically.”

“I found that sometimes a stock stayed for weeks in one box. I did not care how long it stayed in its box as long as it did- and did not fall below the lower frame figure.”

Darvas was really looking at support and resistance levels and obviously did very well. There are a lot more details in those pages describing his process of buying and selling a stock. That is why I highly do recommend that you get yourself his book.

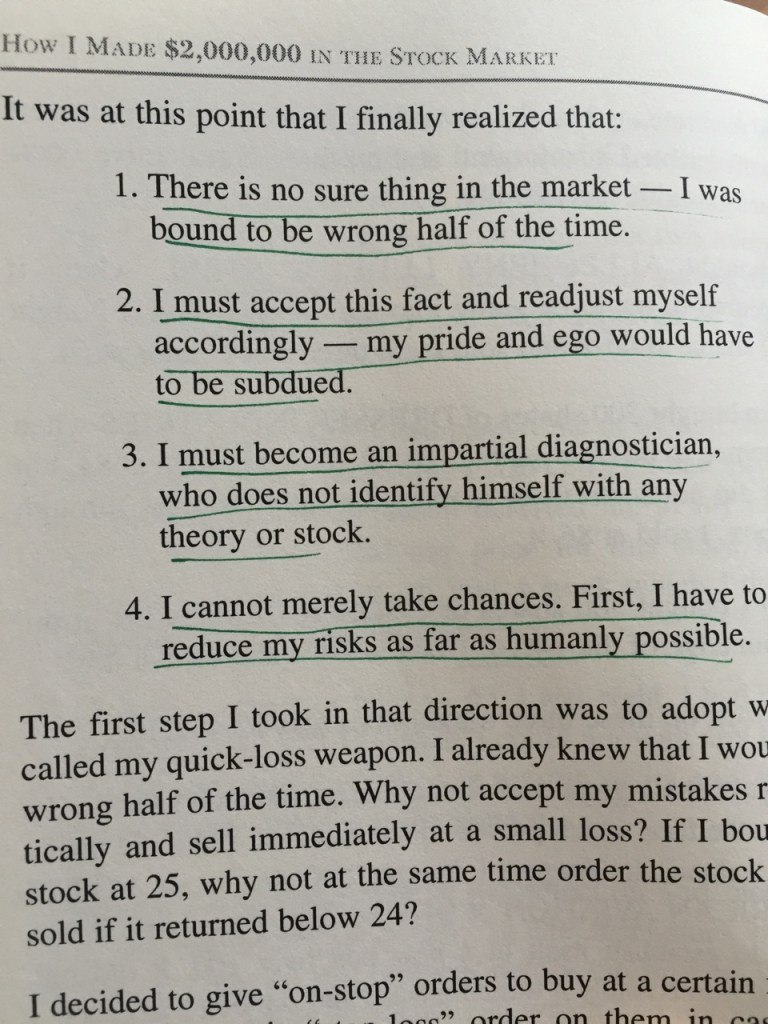

4 Major Principles

The following four principles were essential for Darvas. He sticked to them as hard as humanly possible. These thoughts and principles were born at a turning point in his career.

He explained how important it is to stick to your rules when he had a losing streak. That is why he wrote them down and kept them in front of his eyes at all times.

The following lines are taken directly from the book:

The major conclusion from these thoughts and what Darvas learnt is that a stock can ALWAYS go further down. He learnt that there is no such thing as “cannot” in the market.

Write it Down

The more experienced Darvas was becoming, the more new principles he was learning. He was always writing down his thoughts and reasons for buying/selling a certain stock. In his own words:

“Whenever I bought a stock, I wrote down my reason for doing so. I did the same when I sold it. Whenever a trader ended with a loss, I wrote down the reason I thought caused it. Then I tried not to repeat the same mistake.”

The more he was writing, the more he was starting to see that stocks have characters just like people. In his opinion this was perfectly logical since stocks reflected the character of the people who bought and sold them.

Companies

Some of the companies Darvars is famous for having bought are:

-

Lorillard

-

Diners’ Club

-

E.L. Bruce

-

Molybdenum

-

Haveg Industries

-

Thiokol

-

Anaconda

Conclusion

To sum it all up, Darvas was a man of many interests. Not only he was a gifted dancer and showman, but he was also one of the greatest traders that I have read about. His trading style was simple, yet efficient and his words are the words of a wise man.

It is not easy to write about traders like himself. I have shared just a particle of his trading knowledge. If you really want to get the essence, you should really get the Book- How I Made $2,000,000 in the Stock Market

After a great year of trading, I am giving away a real trading account funded with 1,000USD to one of you. I hope it will be of great help to one of you that is just starting and does not have the chance to invest 1,000USD of his/her own money towards trading. You can participate HERE and try to win this $1,000 live funded trading account.

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.