At AlphaMind, we have a philosophy and ambition to help people develop critical tools, skills and behaviours that will allow traders to operate at the peak of their performance in volatile, uncertain and complex markets-based environments.

In this article, AlphaMind’s Steven Goldstein shares what he called his ‘Golden Trading Guidelines’. This list of guidelines and principles evolved over his 25-year trading career. The guidelines help Steven to navigate his journey through the complex challenges through up by trading and markets. By periodically referring to, viewing and checking himself against his guidelines, he ensured that:

-

He kept on the right path to trading success.

-

He would get back on course when he strayed too far from good practice.

-

He could see out the inevitable times when market conditions turned less favourable.

This list was personal to him. Now that he works as a performance coach with traders, Steven believes everyone should construct their own list of guidelines. We like to distinguish between guidelines and rules. Rules can be useful, particularly when risk management is involved, however guidelines create a framework for the behaviours which help build a good trading practice.

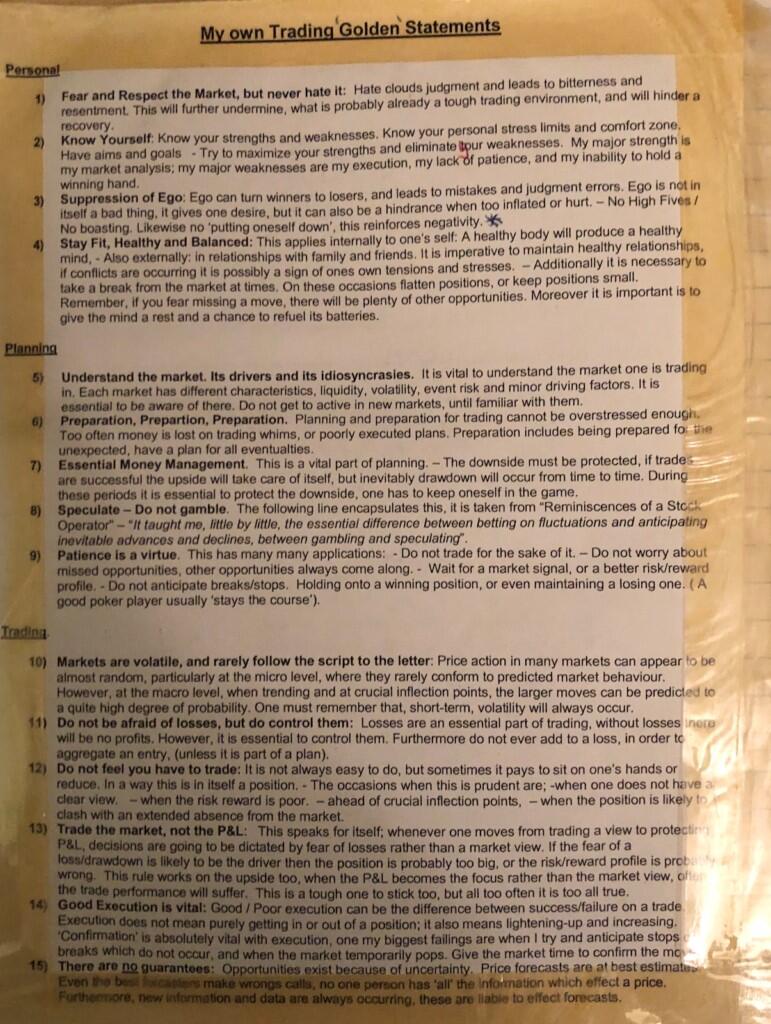

The list Steven constructed was not constant but always evolving. The one we show today was from his last list constructed back in 2007. If it was today, rather than when this one, Steven is sure there may a few additions and some modifications.

If you are going to construct your own list, Steven suggests ensuring you follow these 3 simple principles:

-

‘Keep it Simple’; making it too complex makes it hard to follow.

-

‘Less is More’; avoid more than 20 guidelines, somewhere between 10 to 15 should be enough.

-

‘Make it Personal’; by all means feel free to copy some of these, or maybe Dennis Gartman’s well publicised lists, but do evolve and adapt them to your own circumstances and style.

Here are Steven’s "Golden Trading Guidelines” which he placed at the front of his Trading Journal.

Personal guidelines

1. Fear And Respect The Market But Never Hate It: Hate clouds judgment and leads to bitterness and resentment.

2. Know Yourself: Know Your Strengths And Weaknesses: Know your personal stress limits and comfort zone. Have aims and goals.

3. Suppression of Ego: Ego can turn winners to losers and leads to mistakes and judgment errors. Ego is not in itself a bad thing, it gives one desire, but it can also be a hindrance when too inflated or hurt.

4. Stay Fit, Healthy and Balanced: This applies internally to oneself: A healthy body will produce a healthy mind.

Planning guidelines

1. Understand The Market, Its Drivers and Its Idiosyncrasies: It is vital to understand the market one is trading in. Each market has different characteristics, liquidity, volatility, event risk, and minor driving factors.

2. Preparation, Preparation, Preparation: Planning and preparation for trading cannot be overstressed enough. Too often money is lost on trading whims or poorly executed plans.

3. Essential Money Management: This is a vital part of planning. - The downside must be protected, if trades are successful the upside will take care of itself, but inevitably drawdown will occur from time to time.

4. Speculate, Do Not Gamble: The following line encapsulates this, it is taken from ‘Reminiscences of a Stock Operator’ – “It taught me little by little, the essential difference between betting on fluctuations and anticipating inevitable advances and declines, between gambling and speculating.”

5. Patience Is A Virtue: This has many applications: Do not trade for the sake of it. Do not worry about missed opportunities, other opportunities always come along.

Trading guidelines

1. Markets Are Volatile and Rarely Follow The Script To The Letter: Price action in many markets can appear to be almost random, particularly at the micro level where they rarely conform to predicted market behaviour. However, at the macro level, when trending and at crucial infection points, the larger moves can be predicted with a degree of probability.

2. Do Not Be Afraid of Losses But Do Control Them: Losses are an essential part of trading, without losses there will be no profits. However, it is essential to control them.

3. Do Not Feel You Have to Trade: It is not always easy to do, but sometimes it pays to sit on one's hands or reduce.

4. Trade The Market Not Your P&L: This speaks for itself: Whenever one moves from a trading view to protecting P&L, decisions are going to be dictated by fear of losses rather than a market view.

5. Good Execution Is Vital: Good/poor execution can be the difference between success/failure on a trade. Execution does not mean purely getting in or out of a position, it also means lightning up and increasing.

6. There Are No Guarantees: Opportunities exist because of uncertainty. Price forecasts are at best estimates.

Photo of this list taken from Steven’s 2007 Trading journal:

AlphaMind do not offer trading or investment advice and do not take responsibility for any investment or trading actions or decisions taken by clients or any observers of our material in any form of media, either now or in future.

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

EUR/USD eases to near 1.1900 in Tuesday's European trading hours, snapping the two-day winning streak. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD stays in the red below 1.3700 on renewed USD demand

GBP/USD trades on a weaker note below 1.3700 in the European session on Tuesday. The pair faces challenges due to renewed US Dollar demand, UK political risks and rising expectations of a March Bank of England rate cut. The immediate focus is now on the US Retail Sales data.

Gold sticks to modest losses above $5,000 ahead of US data

Gold sticks to modest intraday losses through the first half of the European session, though it holds comfortably above the $5,000 psychological mark and the daily swing low. The outcome of Japan's snap election on Sunday removes political uncertainty, which along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood. This turns out to be a key factor exerting downward pressure on the safe-haven precious metal.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Follow the money, what USD/JPY in Tokyo is really telling you

Over the past two Tokyo sessions, this has not been a rate story. Not even close. Interest rate differentials have been spectators, not drivers. What has moved USD/JPY in local hours has been flow and flow alone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.