by Jeff Greenblatt

The trading community is relentless in its pursuit to find out how and why the market turns. Bull and bear markets surge relentlessly along their path until one day they reverse course and set sail in an entirely new direction, never looking back. Markets march to their own drummer with a language all their own.

Certainly, fundamental valuations play their part in determining where we might be in the cycle. A price/earnings ratio can tell us whether the market, or particular stock, is cheap or expensive at a specific point in time, but it has zero capability of telling us when the turn will come.

To solve this riddle, many turn to technical analysis. Technical analysis is the study of price patterns and the visual representation of emotion in the market. Examples of key technical tools are moving averages, trendlines and Andrew’s pitchfork. While these are important indicators, markets can and will overshoot their technical target, and the study of patterns can give us only a rough idea of when and where a market might turn.

So if fundamental and traditional technical analysis can’t nail the turn consistently, what can?

One class of analysis methods that works over time involves the studies of W.D. Gann. These techniques have proven instrumental in pinpointing and explaining market tops and bottoms. While it’s not always clear why a time and price symmetry identified a market turn, such symmetries do indeed exist. Gann, a well-known analyst from the first half of the 20th century, considered the squaring of price and time his most important discovery. He called it range and time squared.

In short, when the duration of a move squares with the extent of a move, price trends tend to change. On that high level, it’s simple. However, the proper application can be tricky. In “W.D. Gann’s master forecasting methods,” (February 2011) we examined several aspects of Gann analysis. Here, we’ll delve deeper into time and price studies.

Discovering detail

Markets are enigmas, and this attribute demands a great deal of flexibility when working with price and time studies. For example, a common manipulation is the decimal point — a Dow range of 7,728 points can square with a rally 77 weeks down the road. A 21-year, 1,108-point range in a market could identify a turn 1,108 weeks later — as it did with the 1987 stock market crash. However, as complex as this appears, markets can get even more complicated. But as it is with the study of pivots, the Gann calculations themselves are decidedly simple.

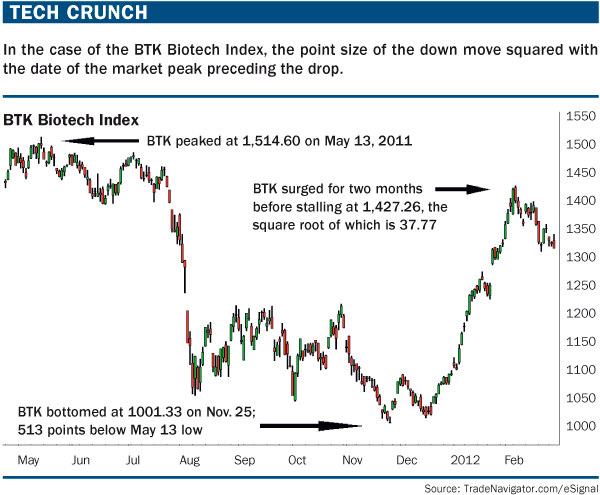

Take, for instance, the 2011 bear market in the BTK Biotech Index (see “Tech crunch,” below). The peak of this market was on May 13, 2011, with a price of 1514.60. The bottom came in on Nov. 25, at 1,001.33. The exact range is 513.27 points. What was the date of the high? It was May 13, or 5-13. The market had a range that was equal to the date of the origin of the pattern. This is just another example of how Gann’s principle of time and price balance out.

What should be understood about this mystery is it does not materialize every day. However, when it does, it usually leads to a powerful trend, as it did in the case of BTK. Going back to our ’87 crash example, consider the stock index price rise that followed the bottom.

Another progression in the study of price and time work is the square root. In the case of the BTK, the first important pullback in the bull move off the Nov. 25 low came at 1,427.26. On the surface, that means absolutely nothing. However, when we take the square root of that figure, we get 37.77, which Fibonacci enthusiasts will recognize as the derivative of 377.

The simple square root, which we all learned in grade school, is an integral hinge on which the markets turn, but because it’s hidden just under the surface, it’s not immediately apparent. Consider the Dow sequence from the March 2009 bottom to the May 2011 high. The high on May 2 was 12,876, after a bottom on March 6, 2009. The 12,876 numeral doesn’t seem so important by itself until we take the square root, 113.47, and discover the market peaked in the 113th week of the rally. That May high also was the day after the United States military killed Osama Bin Laden. The media was expecting a nice rally off the news; however, that was the day markets peaked for the year. Other markets had their own calculations, but this was how the Dow contributed to the peak and led to a grinding 108-day correction, which ended in October.

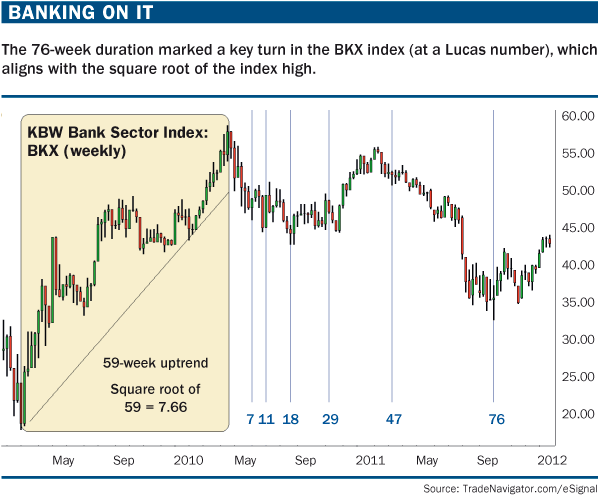

The all-important BKX also bottomed in early October, and the dog of 2011 has been one of the outstanding market leaders of 2012 (see “Banking on it,” below). How did this happen? One assumption might be that time heals all wounds and that enough time had elapsed from the financial crisis so the investing community finally became interested.

However, the banks peaked at 58.81 in their 59th week of the rally. The square root of 58.81 is 7.66. The peak on April 21, 2010, to the low of Oct. 4, 2011, is exactly 75.85 weeks, and by the plus-or-minus-one rule of market timing, it is close enough to 76. Once again, Gann came through as investors and traders have enjoyed the best rally since the move off the bottom — even if they aren’t exactly sure why it happened. Notice that 76 also is a Lucas time series number and how several interim tops and bottoms match other Lucas numbers.

Analysis payoff

As hard as this analytical sleuthing appears, the rewards are worth the effort. All the trader needs is to find one key calculation on an important chart and leverage it out to the overall market. If BKX or BTK has a great reading, the entire market usually will respond. The square-root method is the next progression of analysis when simple price and time methods don’t uncover the symmetry.

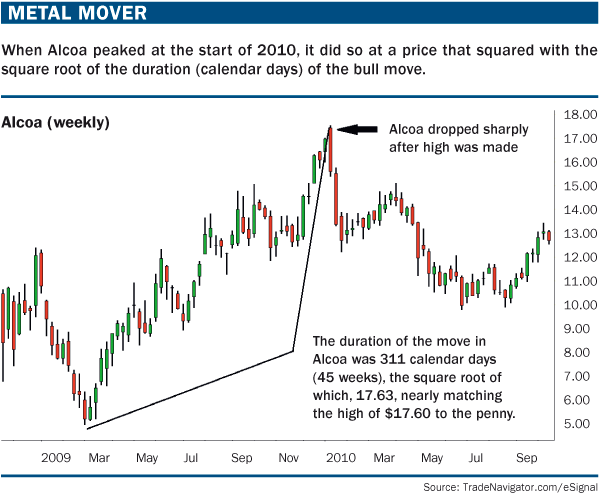

Patterns can be found in stocks, as well. One of the better examples is the first rally leg in the new bull market for Alcoa (see “Metal mover,” below). Alcoa bottomed on March 6, 2009 at $4.97 and peaked on Jan. 11, 2010 at $17.60, 311 calendar days after the bottom. The square root of 311 gives us 17.63, only 3¢ off. It sold off for the next seven months. In the world of Gann, exact precision materializes many times, but close is good enough.

There are no coincidences. Gann and several generations of traders have used time and price analysis combined with square roots successfully. Some consider Gann to be the Holy Grail of trading. It’s not. What must be understood is that until there is a pivot — price action — there is nothing. You can spend a lot of time figuring out where a market is going to turn based on certain symmetries. It’s best to have a rough idea without spending too much time looking for a move that is not there.

For instance, because the SPX bottomed at 666, it doesn’t take much effort to look at 66 days or weeks, nor does it require much effort to figure out the square root is 25.8. In that way, the trader can be loosely aware that at 26 weeks, or 258 days, a turn might occur. But if not, there’s no harm — trades should not be placed in anticipation of Gann moves prior to price confirmation. On the other hand, this methodology becomes valuable when an important price pivot has materialized.

Also, this isn’t a trading method where you look for entries simply because a square root lines up. There is a macro and micro picture. One of the biggest stories in financial markets in 2011 was the expectation of so many equity euro bears that Greece would lead to the next Lehman moment. It never happened because too many traders allowed themselves to be ruled by their emotions and did not really understand the importance of cycles.

Before attempting trade entry, you need an edge that gives you confidence that you are on the right side of the market. Once that is established, you can use your own rules and discipline to find good entries. Gann will help and square roots certainly are an important piece of the puzzle.

Finally, consider the bear market low for the SPX at 666.79. It has an exact square root of 25.82. Go back 258.3 months, and we have the August 1987 peak before the crash on Aug. 25. This may finally explain the March 2009 bottom because the 1,108-point Dow range produced the NDX bottom on Nov. 21, 2008.

Take the same Dow bottom at 6469, and we get a square root of 80.43. The retest of the Great Depression low is recognized by market historians as the second most important low of the 20th century on April 28, 1942. That pivot is 802.3 months removed from the 2009 bottom, which is close enough to consider.

There is a checklist of conditions for discovering time and price squares:

Check the trading or calendar day count.

Look at the high, low and range to see if there is any symmetry. If something materializes, that will be good enough.

Keep an eye out for the requisite price pivots. If no signals emerge, take it one level deeper and work with the square roots.

Once the reversal materializes, you leverage in the trading instrument that flows with your data.

As you perform your due diligence, you might find something else, such as a specific date matching up with the range. Opportunities are out there. There might be something vitally important sitting just below the surface of your price charts. Gann time and price analysis and square roots can get you there.

Editors’ Picks

EUR/USD holds firm above 1.1900 as US NFP looms

EUR/USD holds its upbeat momentum above 1.1900 in the European trading hours on Wednesday, helped by a broadly weaker US Dollar. Markets could turn cautious later in the day as the delayed US employment report for January will takes center stage.

USD/JPY remains heavy around 153.00 on firmer Japanese Yen

USD/JPY is sustaining its three-day rout at around 153.00 in the European session on Wednesday, awaiting the closely-watched US NFP report. Rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance bolster the Japanese Yen, weighing on the pair amid intervention fears.

Gold sticks to gains near $5,050 as focus shifts to US NFP

Gold holds moderate gains near the $5,050 level in the European session on Wednesday, reversing a part of the previous day's modest losses amid dovish US Federal Reserve-inspired US Dollar weakness. This, in turn, is seen as a key factor acting as a tailwind for the non-yielding yellow metal ahead of the critical US NFP release.

US Nonfarm Payrolls expected to show modest job gains in January

The United States Bureau of Labor Statistics will release the delayed Nonfarm Payrolls data for January on Wednesday at 13:30 GMT. Investors expect NFP to rise by 70K following the 50K increase recorded in December.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.