Forex binary options trading has garnered significant attention in the investment world. It presents an interesting amalgamation of traditional forex trading and the simplicity of binary options. This approach allows investors to speculate on the price movements of currency pairs by predicting whether the price will rise or fall within a predetermined time frame. In this article, experts from Binaryoptions.com present the basics of forex binary options to help you get started.

The mechanism of Forex binary options

The essence of forex binary options trading revolves around a straightforward binary proposition: speculating whether the price of a currency pair will be higher or lower than a predetermined level at a specific time. Traders buy an option reflecting their forecast, taking an affirmative outlook if they believe the price will surpass the set level or a negative stance if they expect it to fall short.

Upon the option's expiration, traders are awarded a fixed monetary return if their projection aligns with the market's trajectory. Conversely, their initial investment is lost if their prediction proves inaccurate. This unambiguous win-or-lose paradigm contrasts with traditional trading instruments, where potential profits and losses fluctuate dynamically.

The primary appeal of forex binary options lies in their simplicity and predefined risk. Unlike traditional forex, where profits and losses can fluctuate greatly, binary options offer more control. Traders know exactly how much they stand to gain or lose right from the start. This feature makes it a popular choice for beginners or those looking for controlled risk exposure.

While this fixed risk and reward structure is enticing, it's crucial to approach this activity with a balanced view. The forex market is notoriously volatile, and predicting currency movements can be challenging. This inherent risk means traders must be strategic and informed in their decisions. It’s a domain where thorough market analysis and a well-thought-out strategy are indispensable.

Strategy: The key to success

Successful forex binary options trading hinges on effective strategies. Percival Knight, author and editor at Binaryoptions.com, recommends the following strategies:

-

Trend following: This strategy involves identifying and following the market’s direction or trend. Traders look for consecutive higher highs or lower lows and make their moves based on the strength of the prevailing trend. It's particularly useful in markets with strong, directional movements.

-

News and event-driven: Economic events and news can have significant impacts on currency values. Traders using this strategy base their decisions on anticipated market reactions to news events like economic reports, elections, or central bank announcements.

-

Technical analysis: This strategy relies on analyzing statistical trends gathered from trading activity. Traders use various indicators, like moving averages, Bollinger bands, and relative strength indices, to predict future price movements and make informed decisions.

-

Range trading: In this approach, traders identify stable high and low points, or ‘ranges,’ within market fluctuations. Trades are placed based on the likelihood of a currency pair’s price staying within these bounds.

-

Hedging: Some traders use this method to offset potential losses by placing multiple trades on different outcomes. While complex, it can be effective in uncertain market conditions.

Each of these strategies offers unique advantages and can be tailored to align with individual styles and market conditions. However, traders need to understand that no strategy guarantees success — they should be complemented with thorough market research and continuous learning. The type of strategy you choose can even be influenced by the specific platform you use. For example, if you are interested in trying out Olymp Trade, here is a list of Olymp Trade trading strategies.

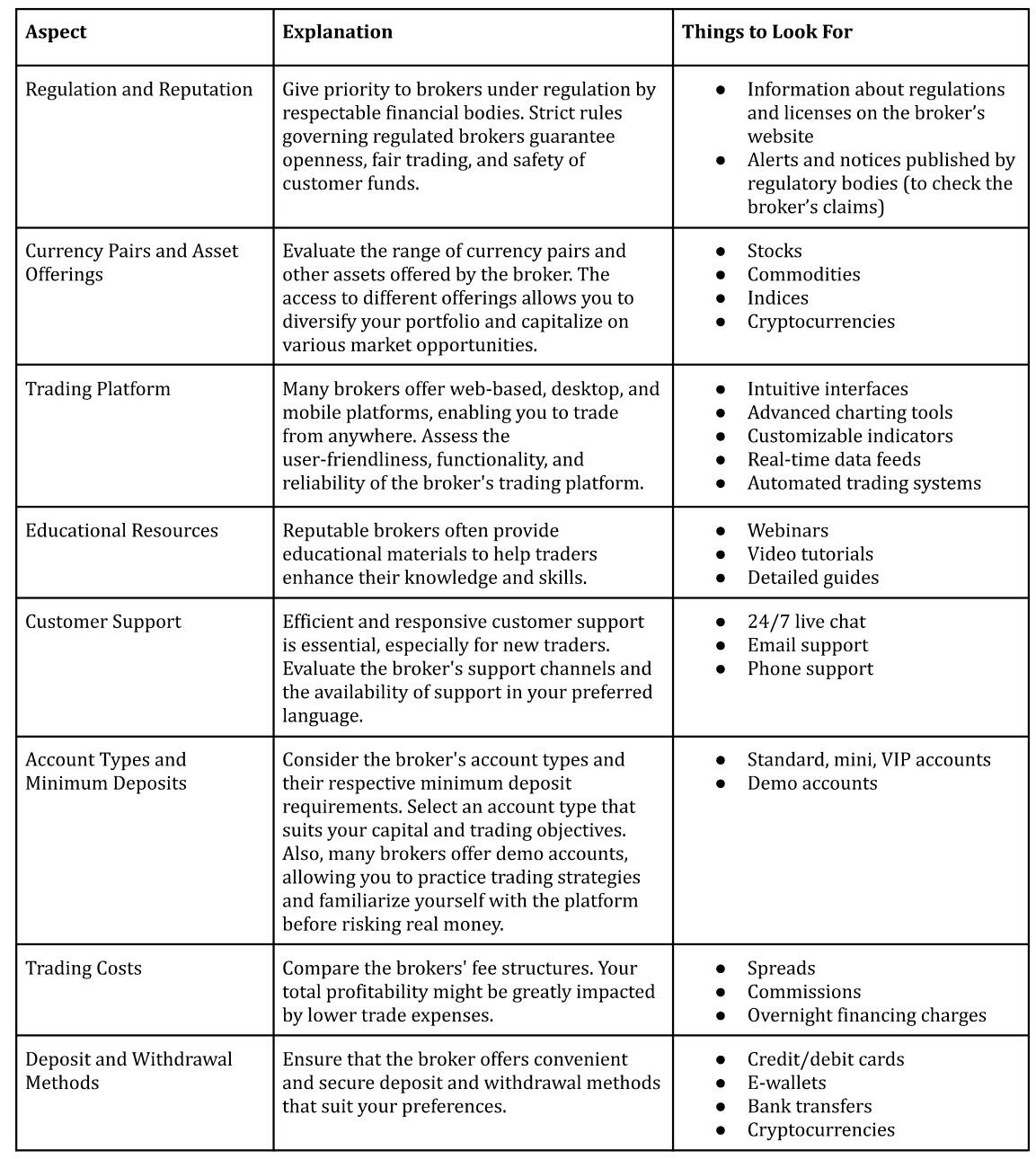

The role of broker platforms

Selecting the right broker platform is a critical decision for forex binary options traders. A reliable and user-friendly platform can significantly enhance your performance and profit. Here are some key factors to consider when choosing a broker platform:

Remember, the choice of a broker platform can significantly impact your trading experience and success. Conducting thorough research, reading reviews, and considering your specific trading needs can help you find the best fit.

Technology and tools: Enhancing trading efficiency

Advancements in technology have revolutionized forex binary options, providing traders with a wide range of tools and resources to enhance their efficiency and decision-making processes. Here are some key technologies and tools that traders should consider:

-

Technical analysis tools: Technical analysis is a crucial component of forex binary options trading. Utilize tools such as moving averages, oscillators (e.g., Stochastic, Relative Strength Index), trend lines, and candlestick patterns to identify potential opportunities.

-

Economic calendars: Stay informed about upcoming economic events and news releases that can impact currency prices. Economic calendars, available on most trading platforms and websites, provide detailed schedules of market-moving events.

-

News and market analysis: Access real-time news feeds, market analysis, and expert commentary to stay up-to-date with the latest market developments and sentiments.

-

Automated trading systems (Expert advisors/robots): For traders who prefer a hands-off approach, automated trading systems can execute trades based on predefined rules and strategies. However, it's essential to thoroughly test and understand the logic behind these systems before deploying them.

-

Risk management tools: Effective risk management is crucial in forex binary options trading. Utilize tools like stop-loss orders, position sizing calculators, and trade journaling to manage risk and maintain disciplined trading practices.

-

Mobile trading apps: With the rise of mobile technology, many brokers offer mobile apps that allow traders to access their accounts, monitor positions, and execute trades on the go.

-

Virtual Private Networks (VPNs): When trading from public or unsecured networks, VPNs can help protect your personal and financial information by encrypting your internet connection.

-

Trading journals and analytics: Maintaining a detailed trading journal and analyzing your performance using analytics tools can help you identify strengths, weaknesses, and areas for improvement in your strategies.

-

Educational resources: Leverage online courses, webinars, and video tutorials provided by brokers, trading educators, and industry experts to continuously enhance your knowledge and skills.

It's essential to remember that while technology can be a powerful ally, it should not be a substitute for thorough market analysis, risk management, and a well-defined strategy. Traders should strive to strike a balance between leveraging technological tools and developing their own skills and expertise.

Legal and regulatory landscape

The legal and regulatory environment surrounding forex binary options is an important consideration. Some people view binary options as a gambling-like activity and different countries have varying regulations, with some even banning binary options altogether. Traders need to be aware of the regulations in their region and ensure that they are trading legally and ethically.

Final considerations

For anyone interested in forex binary options, education is key. Understanding the intricacies of the forex market, how binary options work, and effective strategies is crucial. Continuous learning through resources such as webinars, courses, and market analysis can significantly enhance trading skills.

In addition, an often overlooked aspect of trading is the management of emotions and expectations. The high-risk, high-reward nature of binary options can lead to emotional decisions, which are typically detrimental. Setting realistic goals and adhering to a disciplined plan can mitigate these risks.

Lastly, as with any form of trading, effective risk management is crucial. If you want to start trading forex binary options, consider setting limits on the amount invested per trade and having a clear exit strategy to minimize potential losses.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

BinaryOptions.com will not be held liable for the loss of money or any damage caused from relying on the information on this site. The information and strategies contained on this website are the opinions of the author only. Binary options trading involves high risk and is not suitable for all investors

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates

Unimpressive European Central Bank left monetary policy unchanged for the fifth consecutive meeting. The United States first-tier employment and inflation data is scheduled for the second week of February. EUR/USD battles to remain afloat above 1.1800, sellers moving to the sidelines.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.