A quality among all consistently successful traders is avoiding mistakes.

Mistakes can be expensive and emotionally damaging.

No matter how long you’ve been trading in the financial markets, you’re bound to experience lapses in discipline. To help lessen the impact, here are five common trading mistakes beginner traders, and sometimes experienced traders, make and solutions to avoid them:

1. Lack of a Trading Plan

“Failing to plan is planning to fail”This modern-day proverb is widely attributed to Alan Lakein, the writer of several self-help books on time management from the 1970s onwards.

Many traders fail because they do not have a plan. This is a common mistake novice trader often make and may help explain why so many fail to reach their goals in this business. These are rules of engagement and should be clearly defined for each move made in the markets.

A trading plan is a road map – a systematic approach designed to keep you trading from an objective standpoint. It should cover everything you need to trade, such as risk management, money management, defined entry and risk parameters, trading time frames, trading platforms, technical analysis or fundamental analysis and which currency pairs to focus on, etc.Solution: Spend time creating and testing a trading plan. It is the only way to gain the confidence to trade successfully and objectively. Also, try keeping a trading journal which is a detailed diary of events that helps acknowledge strengths and weaknesses. Recording trades also teaches consistency and discipline. This allows you to review previous trades from an objective standpoint, and assess what could be improved on for future trades. It’s time well spent.

2. Not Using a Protective Stop-Loss Order

Employing the use of a protective stop-loss order is an integral part of successful trading in the forex markets; it’s vital for risk management.

Most traders overlook the fact they can lose on any given trade, and become complacent by not setting a protective stop-loss order. This is a mistake and considered high risk.

If you accept the possibility of loss, nevertheless, you would not trade without the use of a protective stop-loss order.

Not controlling risk is a mistake you’ll not want to make too often.

Solution:

Learn to accept losing trades and use protective stop-loss orders. Without it, you’re exposed to exaggerated losses, leading to a potential margin call. This can take months to recover from psychologically, with some even throwing in the towel.

3. Not Capping Losses

Letting losing trades run is a mistake much newer, and also some experienced traders make.

No-one likes being wrong but coupled with losing money, and we’re often bombarded with a whirlwind of emotion most of us are not accustomed to on a regular basis.

Traders search for reasons to justify staying in a losing trade, despite signs (your trading strategy) suggesting liquidation. It’s emotionally exhausting. Perhaps the hesitation to accept a losing trade stems from admitting defeat.

It’s always better to lose 2% than 10%. The emotional damage caused by a large loss can take months to recover from.

Solution:

The key is to set defined protective stop-loss levels and not deviate. You make this decision prior to pulling the trigger; therefore, you’re not as emotionally charged as you will often be during a trade.

4. Lack of Trading Education

Would you perform heart surgery without a five-year degree in medicine and core surgical training in a hospital? Trading is just like any other career. Unless you educate yourself, to start trading with live funds (real money) is going to be disastrous for your trading account. There’s a myriad of trading educators littered across the internet – some knowledgeable, some not so.

Solution:

Check out our dedicated education section. We have eBooks, video tutorials, and trading knowledge available. This provides a great foundation to develop as a trader. In addition, we have several daily and weekly reports here and here, covering several financial instruments you may find useful.

5. Analysis Paralysis

Analysis paralysis affects many traders and is best defined as information overload, usually caused by a weak trading plan – without defined rules, or lack of. It could also be the case in which a trader lacks the discipline to follow a well-defined trading plan, affecting the ability to engage with the market from an objective standpoint.

Analysis paralysis ultimately causes traders to miss entry and exit signals, and affects trading decisions consequently having a considerable effect on profits.

Solution:

Avoid diverting from a definite trading plan. Experienced traders only take signals prompted by tested trading strategies.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

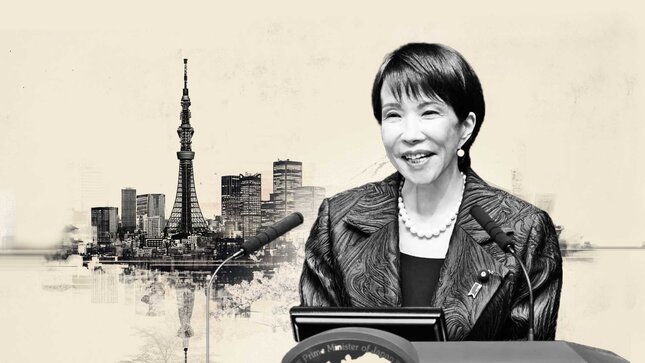

Japan's Takaichi secures historic victory in snap election

In Japan, Prime Minister Sanae Takaichi's coalition secured a supermajority in the lower house, winning 328 out of 465 seats following a rare winter snap election. This provides her with a strong mandate to advance her legislative agenda.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.