The expectation of the end of the pandemic in the medium-term horizon leads the stock indexes of the world's major stock exchanges either to the pre-health crisis price levels or to new highs.

However, although stocks and indices are moving higher, the economic collapse, given the damage caused by the pandemic and despite the positive expectations for the end of the health crisis, creates uncertainty. As a result, investors will increasingly focus on the stocks and values of countries that, as the upward trend continues their prices will expand higher than their competitors, while in the event of a downturn they will record the smallest losses.

There is a large set of variables that lead to the selection of these stocks and values of countries that have the characteristic to behave better in upward trends, while they have defensive behaviour in cases of falling prices.

One of the most critical of these variables concerns the research of corporate stocks and the values of countries that are considered Leaders.

Indeed, leading companies and countries behave better than others in times of upheaval, while in volatile times and recession they become a safe haven for investors, and therefore, although they suffer losses, they move defensively offering relative protection.

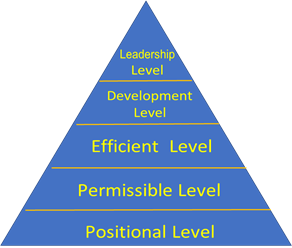

To find the countries, companies and products that climb the ranking pyramid to reach the leadership level, it is necessary to explore the five different levels at which it is judged whether a country, company, or product can really be considered a Leader.

These five levels are as follows:

-

Positional Level

-

Permissible Level

-

Efficient Level

-

Development Level

-

Leadership Level

1. Positional level. A company, a product or a country is at the “Positional Level” when people follow them not because they are satisfied but because there are no alternatives. At this level, people spend, invest, and support the least on these companies, products, and countries.

2. Permission level. A company, a product, a country reaches the “Permission Level” when people follow them because they want to, having established a strong relationship with them. This is because a country, a company, or a product meets the needs and desires of the people. This level is achieved when for long time leaders listen, observe, and learn from the people associated with them.

3. Productive level. A country, a company or a product reaches the "Productive Level" as people support them because they trust their efficiency and their innovative approach. So, people are motivated by the attraction of creativity and momentum that is created.

4. Development level. A company, a product, or a country reaches the "Development level" when people through a country, a company, or a product, develop themselves or their activities while increasing the capacity of the field in which they operate.

5. Pinnacle level. The “Pinnacle level” is the highest level in the leadership pyramid since people follow a country, a company, or a product because of its existence. For what they have already offered and continue to offer to people, community, and humanity.

Obviously, the fifth level is the optimal level that everyone wants to reach. At this level, countries, companies, and products are leaders not because of their power, but because of their ability to empower others to become the next leaders in their field.

Former US President Ronald Reagan confirms this with his words: “The greatest leader is not necessarily the one who does the greatest things. He is the one that gets the people to do the greatest things.”

Leading countries, companies and products are the ones that grow faster and often lead and act in a strong environment. By investing in such countries, companies and products, you invest in those who make a difference, that is, in the leaders who positively influence people, the economy and the market, while offering an environment of stability and consistency.

Thus, it is more than obvious that an investment will be more positive and more protective when it reflects the concept of the highest level of leadership.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD recedes to daily lows near 1.1850

EUR/USD keeps its bearish momentum well in place, slipping back to the area of 1.1850 to hit daily lows on Monday. The pair’s continuation of the leg lower comes amid decent gains in the US Dollar in a context of scarce volatility and thin trade conditions due to the inactivity in the US markets.

GBP/USD resumes the downtrend, back to the low-1.3600s

GBP/USD rapidly leaves behind Friday’s decent advance, refocusing on the downside and retreating to the 1.3630 region at the beginning of the week. In the meantime, the British Pound is expected to remain under the microscope ahead of the release of the key UK labour market report on Tuesday.

Gold looks inconclusive around $5,000

Gold partially fades Friday’s strong recovery, orbiting around the key $5,000 region per troy ounce in a context of humble gains in the Greenback on Monday. Additing to the vacillating mood, trade conditions remain thin amid the observance of the Presidents Day holiday in the US.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.